Mrs 15 HWW has a very close-knit extended family as she spent most of her childhood in her aunt’s place (both parents were working). Together with her three older cousins, they formed close bonds under the roof of a 3-room Bedok flat.

During those days, her uncle worked as a taxi driver and her aunt, a housewife. With three children in tow, it wasn’t easy to make ends meet in those days, let alone save for retirement. Furthermore, due to their vocations, their CPF contributions, if any, was negligible.

Their story isn’t unique. With a fully paid up HDB asset, they are like most lower-income elderly in Singapore. Asset-rich, cash-poor.

Since all the children have already moved out, there have been suggestions to cash-out on this asset to enhance their retirement lifestyle. Like buying a cheaper and smaller 3-room BTO to live closer to one of their children and her family. But never once was the Lease Buyback Scheme (LBS) mooted, even though they qualified for it.

And as announced in the National Day Rally, this “not-so-popular” scheme has been extended to the elderly owners of 4-room flats. They could also now sell part of their remaining lease back to the Government to supplement their retirement income.

But I sincerely doubt this change can improve the popularity of this scheme. Here’s why:

====================

An Illustration Of How The Scheme Works

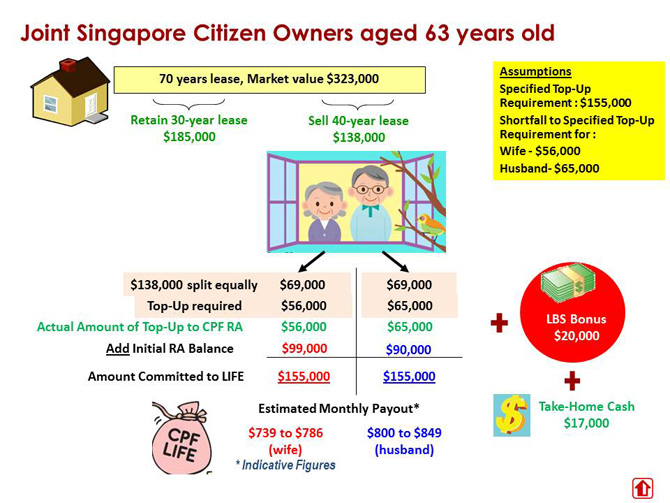

Basically, this 63 year old couple (let’s call them Mr and Mrs Lim) owns a 3-room flat with a market value of $323,000, with CPF RA balances of $99,000 and $90,000 respectively.

Basically, this 63 year old couple (let’s call them Mr and Mrs Lim) owns a 3-room flat with a market value of $323,000, with CPF RA balances of $99,000 and $90,000 respectively.

If Mr and Mrs Lim participate in the Lease Buyback Scheme, they would sell a 40-year lease back to the government for $138,000. This $138,000 would first be used to top up their RA balances to the prevailing Minimum Sum ($155,000). Since there would be an excess of $17,000 and they qualify for the LBS Bonus, they can take-home $37,000 of cash.

So in exchange for 40 years of lease, they each receive about $400 increase in their CPF LIFE payouts and a $37,000 lump sum payout. The HDB flat would be worth $0 and returned to HDB after 30 years or whenever both of them pass away, whichever is latter.

How Worthwhile Is the LBS?

Let’s assume Mr and Mrs Lim have two children. These two children sort of take over the role of the government and provide a $37,000 cash gift to their parents and an additional allowance of $400 each to the parents.

Over the next 30 years, this sum would amount to about $325,000 ($37,000 + $800 x 12 x 30). If the children could have invested this sum and return an annual return of 5%, this would amount to over $800,000. But if the flat had not depreciated and in fact appreciated by about 5% a year, the flat would fetch a price of $1.2 million in 2044.

Since most Singaporeans are capable of making such calculations in their head and might even use a higher return for property (recency bias), children who can afford to support their parents would choose to do so from the numbers perspective.

The numbers would be even more favourable to the children if the parents have the option of purchasing another 3-room BTO since they might be able to cash out an additional sum and it would also eliminate the risk of depreciation of the property with 70 years of lease left (as compared to 40 for the matrimonial flat).

Emotional Barriers And Lack Of Flexibility

The Straits Times actually had an article that covered this today.

The LBS option is pretty unpalatable to most of the elderly as most of them would want to leave a significant bequest to their children. Even if LBS is financially slightly more superior (the children are good investors etc), there would be more “face” and “pride” for the children to support their parents in their old age and for the parents to leave behind the HDB flat as an asset when they pass on.

Furthermore, there’s little flexibility in LBS. The proceeds have to be used to top up the CPF RA and buy a CPF LIFE annuity. And even if Mr and Mrs Lim won a lottery in the next year, they can’t buy the lease back from the government. They have effectively become renters to their own flat and this puts control of their flat out of their own hands. A stark contrast compared to other options like renting out a room or subletting their flat.

====================

Even though the participation rate isn’t high, I would still laud the government for extending this scheme to more of the elderly. This scheme would definitely appeal to those without children or who have weaker bequest motives. And especially those that feel they could live past 120. But since it’s irreversible and a big decision, best to take it up after having considered all other alternatives.

And it’s obvious that Mrs 15 HWW’s uncle and aunt will not be taking up this scheme, which really can’t be considered a negative thing. =)

Thanks for the detailed explanation and example!

I was confused with this new scheme but didn’t bother to research it out since I thought that it was another scrap scheme.

After reading your explanation here, it does mean to serve the needs for elderlies. But again, there is no one-size-fits-all disposition especially with Singapore’s overwhelming mix of citizens with different income gap and perception on finance matters too.

Either way, keep up your sophisticated writing on this resourceful site! 🙂

Regards,

The Independent Abecedarian

Hi The IA,

Thanks for your kind comment and glad you enjoyed the write-up on this scheme. I initially dismissed the scheme as a lousy one too but the more I read and researched on it, the more useful it seemed.

It’s a rip off period.

Pay market value and no less.

In this case, if an elderly couple sign up for the LBS, and one spouse say the husband, passes on leaving the other one ( still alive), will the remaining person/owner be able to put in the name of one of her kids as a co-owner?

or will it be stagnated, leaving no room for any child to add in their name to become the sole-owner of the flat receive the remaining value in cash on the demise of the 2nd applicant?

Thanks for responding…

Hi Mrs Chong,

This is what I read on the HDB website for the LBS if someone passes away:

“In this situation, your spouse or child who is living in the flat will be given the option to:

Live in the flat for the balance of the lease period; or

Return the flat to us

If your lease is terminated prematurely, we will reimburse the remaining value of the lease to your beneficiaries, based on a straight-line depreciation.

The unused portion of your premium*, if any, will be refunded to your CPF accounts when you pass away. The monies will then be distributed to your nominees. If you have not made a nomination, the monies will be distributed to your family members according to Singapore’s intestacy law.”

If you are unsure, best to check with the authorities before making a decision.