So the details of the 1st tranche of the Singapore Savings Bonds were announced yesterday. Basically, if you hold the bonds for the full duration of 10 years, you would receive a promising 2.63% average annual return.

I wrote a post on this product about half a year ago, when the concept was first introduced by SMS Josephine Teo. And in light of Lee Kuan Yew’s passing then, I actually alluded SSBs to being Ah Gong’s present to conservative investors.

Coincidentally, the announcement made yesterday coincided with nomination day for the 2015 General Elections in Singapore. I watched both the news on Channel 5 and 8 last night and the part on SSBs followed immediately after the section on GE 2015. I guess the government is really trying to tell Singaporeans that they are doing their best to help us earn a higher interest on our emergency funds.

Maybe Chee Hong Tat is also asking us to pump our savings into SSBs

====================

How The Singapore Savings Bonds Work

If you’re still quite blur about the SSBs, you can find all the information you need on this official site (in different languages some more). But since you are here already (and please don’t go), I will attempt to value-add by highlighting some of the useful tools on that site.

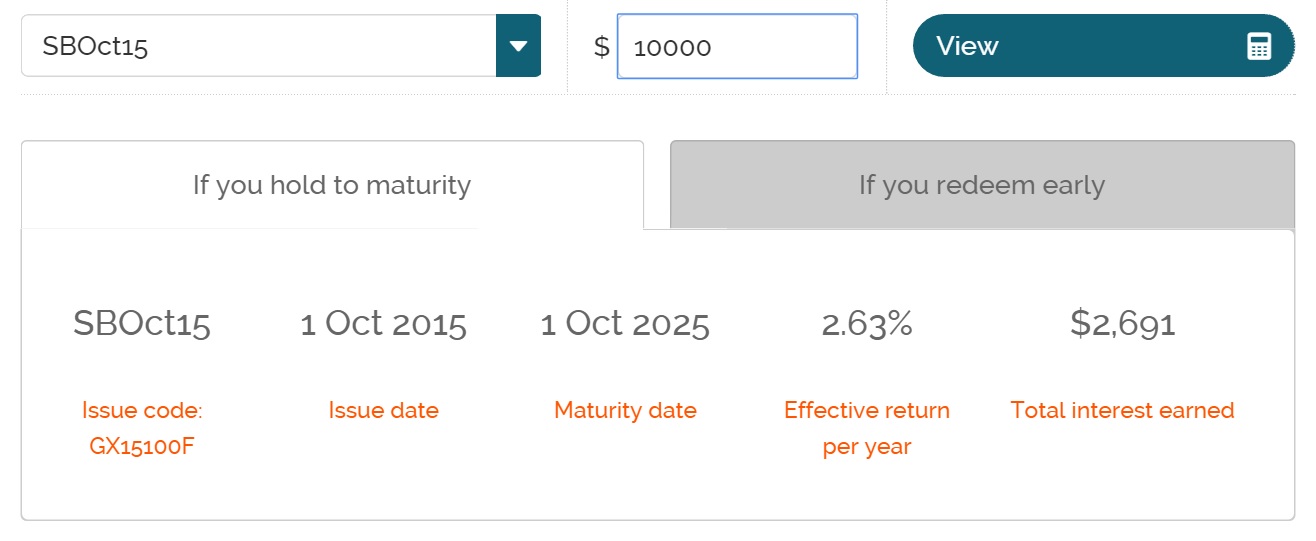

First up is this interest calculator:

Let’s say you intend to put in $10,000 for this tranche, the below is a summary of what happens when you hold the bond to maturity:

In case you’re struggling to understand how the effective rate of 2.63% is calculated, it’s done using XIRR. And yes, yours truly has verified it.

But what most people care about is the total interest earned on the bond. The below is the coupon schedule for the 10 years (most bonds give out coupons on a bi-annual basis). When you add them up, it’s $2,691. Pretty decent for an essentially risk-free product, if you ask me.

| 2016 | 2017 | 2018 | 2019 | 2020 – 2023 | 2024 | 2025 | ||||

| Apr | $48 | $54.50 | $96.50 | $146.50 | $162.50 | $165 | $185 | |||

| Oct | $48 | $54.50 | $96.50 | $146.50 | $162.50 | $165 | $185 | |||

Why Put Your Emergency Funds Into SSBs?

First, let me reiterate the key features of the Singapore Savings Bonds:

- Offers better yields than other lower-risk investments like saving deposits

- Principal guaranteed by the government

- Flexible redemption and no penalty on early redemption

And now, why SSBs are perfect for at least half of your emergency funds:

The odds of an emergency (retrenchment, unique medical condition etc) are pretty low. Just to let you have a better idea what isn’t an emergency, the sudden urge to bet $10,000 on Liverpool winning the Premier League isn’t one. So is the craving to go to Maldives for a dive.

So basically there is a good chance you might not utilise any of your emergency funds for the next 10 years.

Unlike other bonds in the market or even the tradable SGS bonds, the SSBs are principal guaranteed by the government. At any point in time, SSBs can be sold back to the government at par value. If I bought $10,000 worth of SSBs, I will always get back $10,000 worth of SSBs. An interest rate increase will not affect the price of your bonds. The predictability is a god-send for your emergency funds.

You will also be hard-pressed to find an SGD-denominated fixed deposit that can give you an effective interest rate of >2% for any reasonable duration. And seriously, even though corporate bonds like those issued by Aspial might offer a higher return of 5.25%, the risk is at least multiple times that of SSBs. I wouldn’t touch Aspial’s bonds with a ten foot long pole, much less with my emergency funds.

And (touch wood), if an emergency crops up, you can redeem the bonds by the next month. And there are no penalties involved unlike some fixed deposits. Understandably, the SSBs are probably not as liquid as a tradeable instrument or a saving deposit. However, there are few emergencies that simply don’t grant you a grace period of 2 weeks to a month to pay up.

Nonetheless, I am not asking you to use ALL your emergency funds to buy SSBs. You can allocate a remaining portion to a high interest account like OCBC 360 Account if you easily meet the three conditions. 2.2% (or even 1.7%) interest is pretty decent and this will help you to maintain daily liquidity for your emergency funds.

Lastly, it’s good to keep some of your emergency funds in the SSBs as the higher interests nearer the end of the tenure should incentivise one to be disciplined. In a prolonged bear market, you will be less tempted to cash out and use your last portion of cash to purchase equities.

Now, How To Buy It?

Refer to this page for a comprehensive guide.

To summarise, as long as you hold a CDP account, you can apply it through local banks’ ATMs.

If you prefer to apply it online through a DBS/POSB account, fellow blogger Felix has prepared a step by step guide to guide you through.

Lastly, remember that since the amount of Singapore Savings Bonds are limited for each tranche, you might not get your full allocation. Yeah, demand and supply. But you don’t have to rush since MAS promised to launch a new tranche every month for at least the next 5 years.

At the same time, do note that a $2 transaction fee will be charged by the bank for each application request. So you probably won’t want to apply just $500 every month for 20 consecutive months to achieve a $10,000 exposure. That’s really not the best way to spend $40…

What The 15HWW Household WIll Be Doing

We would like to have a $20,000 to $30,000 exposure by the middle of 2016 and Mrs 15HWW will probably be holding the bonds. Since we intend to both spread out the purchases meaningfully and limit the $2 expense, we will be applying $5,000 worth of SSBs for this first tranche.

Good luck with your purchase. In my view, in the long run, every Singaporean should have at least a small amount in these Singapore Savings Bonds.

====================