I have a confession to make.

The past few months, I had been less methodical in the recording of my expenses. There had been moments when I had to backdate for more than a few days. Thus, the tracking errors could be bigger than that of maybe… the STI ETF? (oops). Nonetheless, the big items and of course, restaurant meals, would never be omitted.

Mentally, I have been less stringent on money flowing out of my pockets. Could it be because of the bear market? After all, saving a few tens of dollars there does seem pointless when your portfolio could plunge by thousands within a day?

Nowadays, when I rein in, especially with regards to food, it’s more likely because of the guilt from overeating or the sugar/salt overload. With regards to material stuff, interestingly, there’s really little temptation except for the big items like cars/houses.

Eating Out: $1066.50

Hawker ($294.10) – Since we are cutting down on carbohydrates, i.e. less rice and noodles, it’s not a surprise that food cost is going up. Instead of 3 dishes and a rice, the Mrs is ordering 4 dishes the Cai Peng stall for her lunch.

Fast Food ($18.60) – 2 Mac & 1 Long John meal. I am hoping this cutback will last much longer as I become more and more conscious of my diet.

Restaurants ($753.80) – A meal at Lawry’s to celebrate the Mrs’ birthday, a treat from us @Tunglok for my father-in-law’s birthdays and more splurges at Waterway Point. It’s nice to have a nice meal there in the afternoon when the crowds are much more manageable.

Groceries: $57.50

Supermarket ($57.50) – We haven’t bought rice for eons and finally bought a 5kg pack and shared with with out in-laws. For the past two Mondays, I cooked some porridge for my lunch and dinner and it’s a good start! I just have to cut down on buying ice-cream and snacking at Gelare.

Beverages & Snacks: $204.20

Beverages ($12) – A few cups of Koi green tea.

Snacks ($192.20) – The amount is crazy here because I included some of the CNY goodies I got from JB a few weeks ago.

Utilities: $159.80

Electricity, Gas & Water ($82.80) – Electricity usage decreased with 238kWh used. It seems that electricity tariffs are coming down slowly with the lower oil prices. 16KWh of gas and 7.6 Cu M of water make up the rest of the utility bill.

Cellphones ($77) – $45 for the Mrs and $32 for me.

Transport: $50

0 EZ Reload transaction for me and two for the Mrs. I hardly have to take the bus or mrt these days.

Departmental: $877

Clothing ($97) – Some pieces of new T-shirts for me. They cost just $7 for a piece when I bought them from Padini in JB. A couple of new tops for the Mrs too!

Electronics ($780) – You might be surprised but we have been relying on the old and trusty broom and dustpan for the past 3 years! I wonder if that helps to explain our lower utility bills. But since we find our place a little dusty, we got a Miele vacuum recently together with a Novita air purifier, in anticipation of the annual haze.

Miscellaneous: $50

Others ($50) – Some altar offerings for my Mum and an outing with other financial bloggers @Hooters.

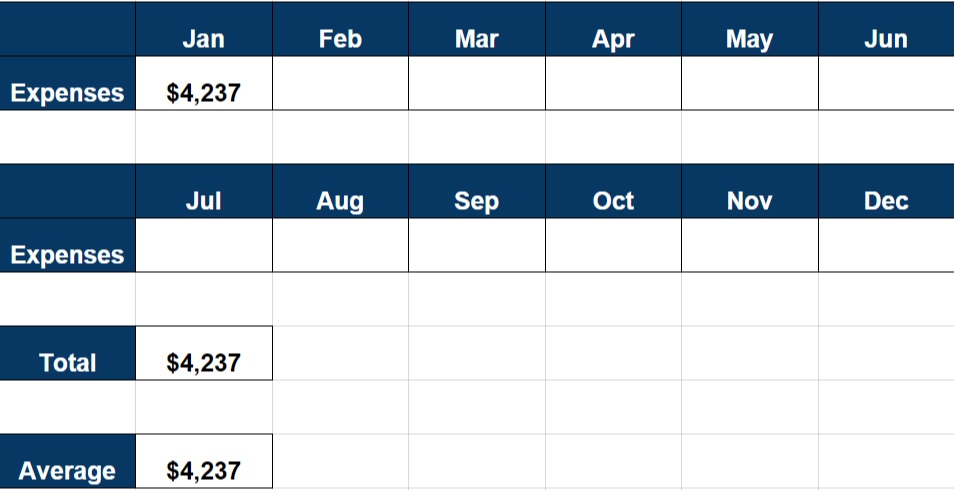

Total: $2,465

Overall Total: $4,237 (included fixed expenses of $1,822)

Hi 15hww

That’s an increase right there but a close look at it there are many one off item like the vacuum cleaner and such.

Interesting to note that less carbo means higher expenses because thats what i am experiencing as well for my lunch 😉

Hi B,

We are still saving more money! Paying a little more to eat healthier stuff will cost us less in the long run, no?

u use cash to pay for your mortgage loan? why don’t you consider using cpf oa?

Hi z,

We are actually using the funds in our CPF OA to service our mortgage. Since I am currently self-employed, it makes sense to include that as part of expenses since the OA will be exhausted if I don’t do any voluntary top-ups.

Hi! Thanks for inspiring me to document my expenses update online just like you!

Will continue to stalk your blog every week 😛 May you earn more and spend less, haha!

Hi cherry,

Ah, my pleasure and honour!

I will be popping by your blog and saying hello to you there soon!