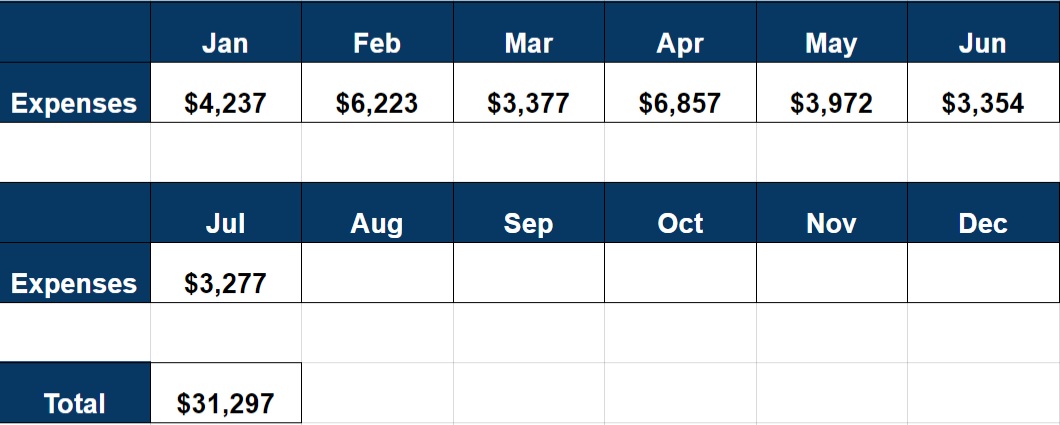

With a new set of fixed expenses, the monthly expenses will be coming down and July’s the lowest for this year.

For the month of July, we spent less than $3,300 and our average for the year reduced to $4,470 for each month. Next month’s expenses are likely to be rather low too as my peak season draws. I no longer have a 25 hour work week and even my recent mornings are being taken up by an international student. Yesterday, I only had a half an hour dinner break and packed a burrito for it.

Nonetheless, these busy months will be compensated by the lull time in November and December. I probably have to earn more now to justify a short overseas trip during that period. =p

Eating Out: $838.20

Hawker ($337.10) – There’s a hike in this department as we consciously cut down on carbohydrates. For eg, I will sometimes order cai peng without rice and order 4 dishes instead of 3.

Fast Food ($47.30) – A couple of Long John Silvers and two Mac meals for us! The Mrs is a big fan of curly fries.

Restaurants ($453.80) – We bought some Tampopo vouchers and dined with the Mrs’ family there twice. We also had crabs at Tunglok recently and there was a trip to JB in the middle of the month!

Groceries: $54

Supermarket ($54) – Two trips to NTUC. No tubs of ice-cream from Haagen Daaz or Ben & Jerry’s this month!

Beverages & Snacks: $95.40

Snacks ($84.80) – Bumped up by a durian purchase that set me back by more than $40. Also bought some popcorn for my student’s birthday!

Drinks ($10.60) – Very much controlled as we had only one cup of Koi each.

Utilities: $186.85

Electricity, Gas & Water ($90.30) – Electricity usage was higher at 291kWh for this month. 17KWh of gas and 725 Cu M of water make up the rest of the utility bill. With the increase in electricity tariffs and the increasingly hot weather, I really do think $100 is not a matter of if but when.

Cellphones ($96.55) – $51.55 for me and $45 for the Mrs for this piece of essential service.

Transport: $150

1 EZ Reload transaction for me and 2 for the Mrs.

Miscellaneous: $268

Gifts ($120) – A church wedding lunch just the last week

Clothing ($54) – We got some new basics from Uniqlo and I bought some freaking cheap T-shirts in JB.

Work ($54) – Books from Popular, especially for my P6 kids as they enter the final stretch before their PSLE.

Entertainment ($40) – Karaoke and a Chinese Orchestra concert which I had to accompany the Mrs. She actually played the flute in Secondary and JC.

Total: $1,592.45

Overall Total: $3,277.45 (included fixed expenses of $1,685)

Wow! Such detail record on all the expenses ,, yap! Is really important to record one’s cash flow ,,, to ensure that we are not ending up with negative personal cash flow that will affect our wealth accumulation ! Bravo ! Cheers …

Hi STE,

Yeah, I guess it’s pretty detailed and recording expenses is an ingrained habit by now. Honestly, it’s not that difficult using this system of discretionary and fixed expenses.

You certainly spend a lot of restaurants. 😉

Hi MSR,

Without a car, kids (yet) and no heavy mortgages to service, I guess we can “indulge” in our food a bit more? =p

i noticed that you do not buy much from ntuc and prefer to eat out at hawker. as u know hawker food is very unhealthy though yummy. do you eat any fruits or clean food (vegetables salad without dressing) at all? its good to track expenses and be thrifty but health is important.

Hi Richard,

Sometimes, my mother-in-law will buy groceries for us. For example, last week, she bought a whole salmon and I enjoyed it for dinner twice last week. So our groceries could be under-stated.

The amounts I spend at NTUC more or less goes to fruits and vegetables. My breakfast is an apple and snacks are mostly frozen blueberries.

It’s interesting that another person actually commented that we are spending alot on our food. I guess I have to admit that we should cook more often but I am really “quite lazy” in this aspect.