Despite the long queues at POSB ATMs, I will always have a soft spot for this heartlanders’ bank.

At least for the first 20 years of my life, this was the only bank I transacted with and it was there when I saved my first $1, $10, $100 and then $1,000.

Therefore, I am not surprised by my favourable review in the past and even right now, it continues to benefit me even when I have long stopped withdrawing money from its ATMS.

Just last month, I signed up for the POSB Cashback Bonus (it has to be done online) and to qualify for it, I started a $100 contribution to the Nikko STI ETF using POSB Invest Saver.

Basically, to qualify for the cashback, you need to fulfil at least 3 out of 5 available conditions:

- Salary Credit (0.3% cashback, $20 cap)

- Credit Card (0.3% cashback, $20 cap)

- Home Loan (3% cashback, $30 cap)

- Insurance (3% cashback, $30 cap)

- Investments (3% cashback, $30 cap)

I have to admit I belong to the lucky few that stands to benefit from this program. Because in my humble opinion, if you don’t have a mortgage loan with POSB or DBS, there’s not much point making an effort to qualify for the cashback bonus.

How I qualify:

- The POSB HDB Loan was a wonderful program when it was first launched, with a ten year guarantee that the rates would be capped at 2.5%.

- It’s easy to spend at least a few bucks on the credit cards. I use the Everyday Card as my EZ link and charge my utility and conservancy fees to it.

- The POSB Invest Saver is a pretty good saving and investment program, especially for beginning investors.

My Experience So Far:

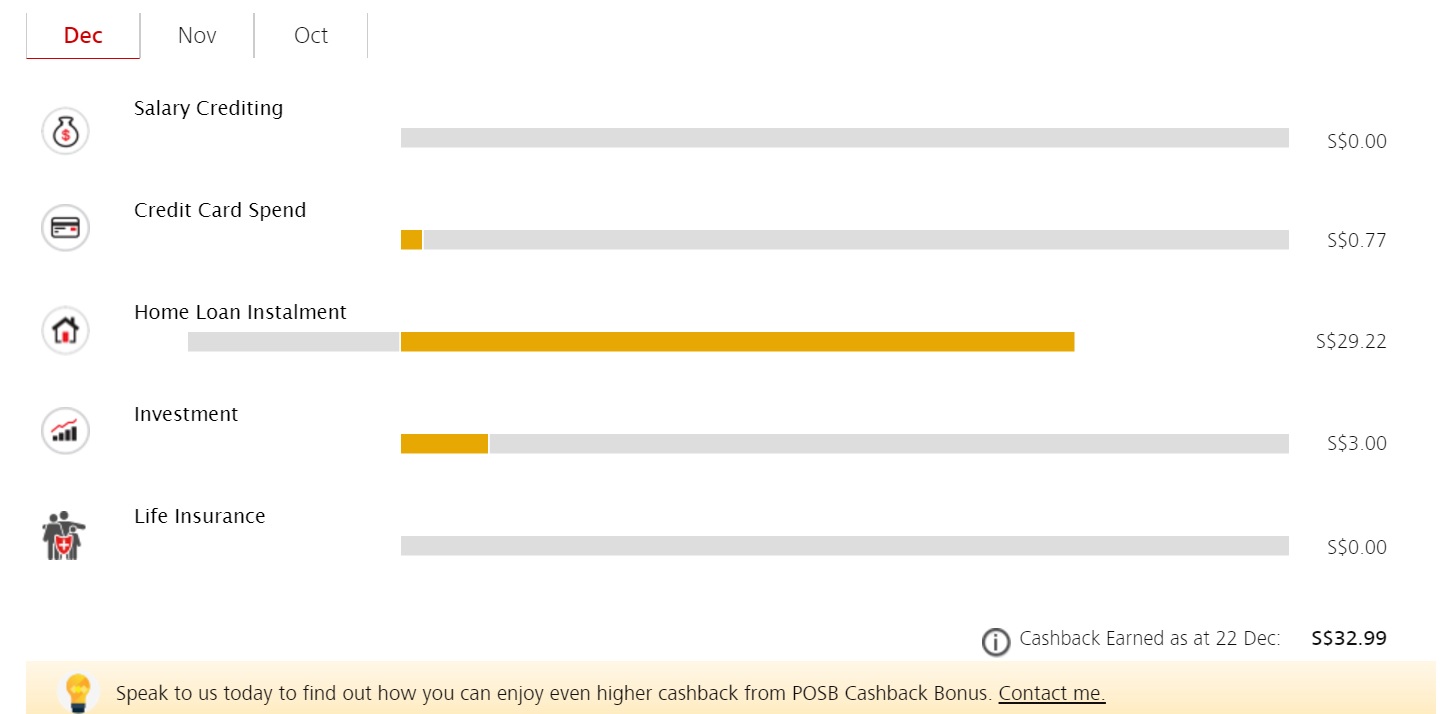

Summed up by this picture and indeed, a picture speaks a thousand words

I get a 3% cashback on my home loan which is close to $30 and then I also get a 3% cashback on my investments which more than covers the fees associated with the program.

This $33 can either cover a very decent dinner for the Mrs and me or pay for my breakfasts and lunches for a week.

Thanks POSB! You just made my Christmas a little sweeter this year.

Next?! Signing up the Mrs for this plan and if it works for her, we can look forward to another $33 in cashback.

Maybe, there is indeed more merits to delaying the repayment of the mortgage, at least for our case!

Is there is a POSB HDB loan?

Hi Verbatin,

Here’s the link:

http://www.posb.com.sg/personal/landing/loans/hdbloan/index.html?pid=sg-posb-vanity-hdbloan-loans

Thanks for sharing .

Its also the only one that u can leave 0 in the account since it’s not based on deposits

Hello there,

Thanks for sharing, and I’m certain that we could get more rebates from Ocbc as well man. Just happened to check them out. Check out their 360 program.

Hi Farath,

Thanks for the suggestion. The Mrs is using OCBC 360 and we have already maxed out her account and receives about 2.2% of cashback every month!

No worries, and once again cheers. PS: I suggest you to open a YouTube Account or join with me to create a YouTube Channel for such posts.

Hi Farath,

A Youtube channel for personal finance posts? Just curious, how does that work?

Hi there,

It’s rather simple. Instead of a blog, you could release YouTube videos explaining in a video format to Users. From this way, you could earn for your videos and also, get followers extensively.

Let me know if you need help.

Hi, I read the description for unit trust in the calculate page and it said only for new sign up. Is it true? Because I already have posb invest saver.

Thanks in advance!

Hi The Su,

I have no idea if you can qualify for it. Best to either give them a call or drop them an email.