I have an investment record of about 5-6 years.

For someone who is 30 years young, that’s considered pretty long. But to most “investors” out there, it’s too short a period to judge whether I am a good investor. Some of them would say you need to have at least 10 years of track record or go through at least a cycle or two of bulls and bears.

It’s then when you can judge if you really outperformed the market and should continue to manage your own portfolio rather than outsource to an ETF that tracks an index.

However, I feel such views could prove disastrous for a new investor.

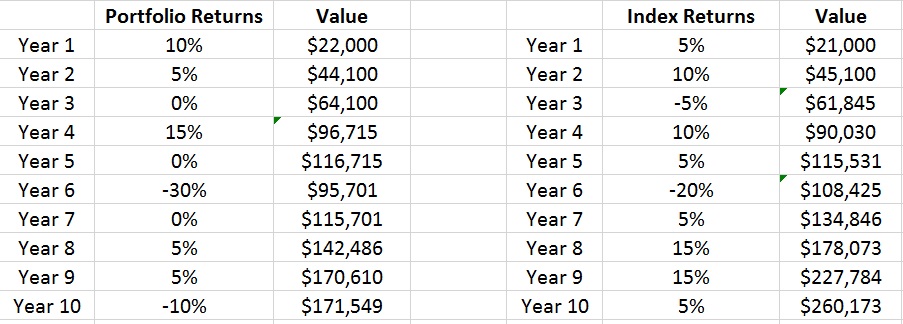

Suppose he starts investing at 30 and pump $20,000 every year into specific stocks and this is his performance over the ten years.

Basically, at Year 4, he would be ahead of the index and that could give misguided confidence to that new and young investor. However, by Year 10, he would have trailed by $90,000, which is close to half of his invested capital. At least for me, that is a huge amount of money.

The opposite could also apply. Suppose the left side is the index and the right side is now the portfolio return. The person started out picking stocks and at Year 4, he might have trailed the index. Disappointed, he gives up and outsource his investments to an ETF.

If he had continued to have belief in himself, he would have been $90,000 ahead at the end of the 10 years.

$90,000 might not be a very big sum to some but looking at the table above, some investors might even feel that 10 years is too short a time. However, as the invested sum increases, any lag in returns would be amplified even more.

So, when should a new investor stick to his convictions or cut his losses?

I will be honest and admit that I also have no clue. Some financial bloggers have been outperforming for many years and it’s a no-brainer for them. They really do seem to have an edge. And it helps a lot that most of them enjoy the process of picking or even trading stocks.

However, if you are new and unsure like me, I would recommend a double-pronged approach which I had mentioned 4 years ago.

And then try to monitor closely and see which approach you would prefer. And there’s nothing wrong if you continue both strategies forever too.

Since no one will ever know if your under/outperformance will be a trend or if mean reversion would occur.

10 Years to know the market?

I have dabbled in shares for almost 37 years now and still know no better. I can even do another 37 years and still know no better. Too lazy to learn like many others, just punt!

Hi Fred,

I sincerely hope the punting has been good to you so far!

I sort of started with a lopsided double-pronged approach. 90% indexes and 10% for whatever I want, which includes everything from Apple (long ago) to Telcos, and REITs etc.

Worst case scenario, my 10% would crash and burn (oops), but I liked that my “play money” kept me interested in learning more about the various options that are available. Don’t we all would like to believe that we are better than average?

Hi Kevin,

Ah. Since you mentioned it’s lop-sided at the start, are we approaching something like 50/50 here?

Interesting to see that it’s a 100/0 approach for your wife’s portfolio!

When some of my peers realized; they chopped their fingers and become good savers.

Hi Uncle8888,

Ah… Then where did they put their savings to? Property?

Property?

If one made a big mistake; he/she is going to work for a long time for free.

I do dual path too. Is more like “Hedging” as I am no Warren Buffett. In fact I dabble in safe bonds and some percentage in FD as well.

Hi Cory,

Like you mentioned, hedging could be the optimal strategy for most of us.

I keep 90% in low cost, passive index funds but allow 10% for individual stocks just in case the old stock picking itch should return. Right now I would not know what to buy, but when dividend yields increase when stocks are on sale I might pick some blue chips.

Hi Singvestor,

That sounds like a sound strategy! I hope you execute it well too!