A new year, a new beginning and a new format for the monthly portfolio updates.

As many readers have known, the 15HWW Permanent Portfolio is live and it will definitely be a part of future updates, along with my other investment strategies.

January has been a rather good month for local equities as the STI Index breaches the 3,000 mark once again. Let’s see if this can be maintained and if the total value of $380,000 for our overall portfolio signals a good start for the rest of the year to follow.

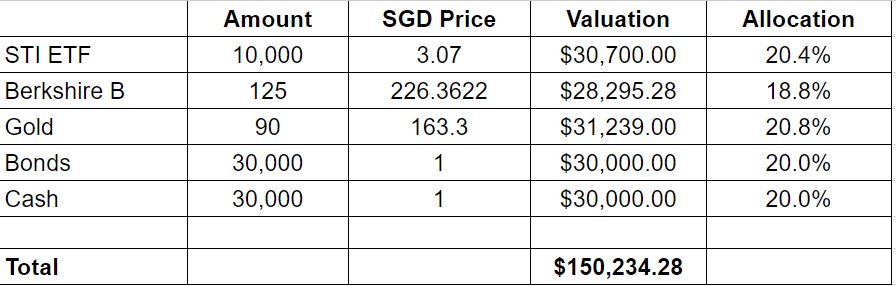

1. 15HWW Permanent Portfolio

Even though this portfolio begins with a value of around $150,000, it was actually built over the whole of 2016 at a cost lower than $140,000 in total.

The price of Berk B is finally coming down slightly, along with the exchange rate. But the rise in price of gold and the STI ETF makes up for it, enabling this permanent portfolio to start off on a positive footing.

USD-SGD Rate: 1.42

UOB 50 Gram PAMP Gold Price: $2,757 x 6 = $16,542

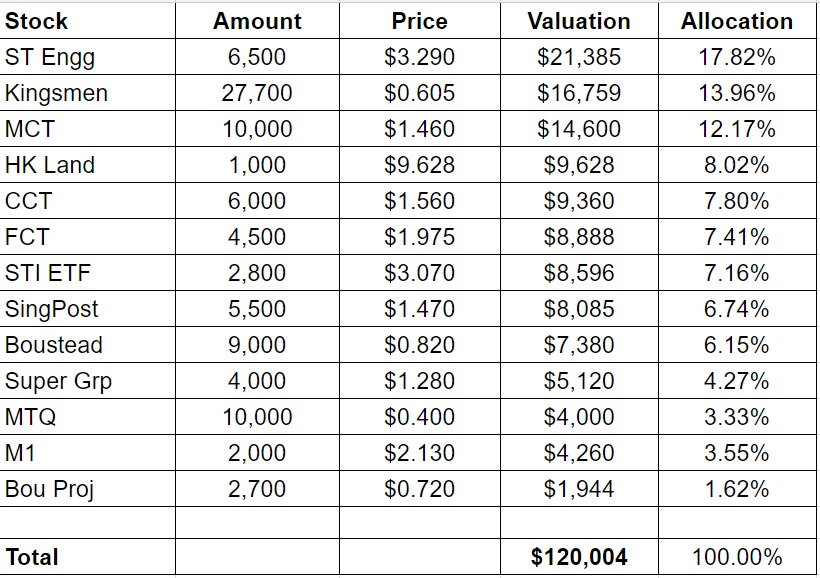

2. Personal Picks

Slightly more than a week ago, I sold off 3000 shares of Semb Corp @$3.07. After accounting for this sale, this portfolio is still up by $5,000 over these 3 weeks.

A rising tide lifts all boats, including this.

XIRR: 6.98% (Nov 2010 to Jan 2017)

3. BFP Picks

For obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few indicators as shown below.

There is still a lot of room to grow since I only started this portfolio half a year ago.

Portfolio Value: $37,946

Number of local stocks: 2

Number of foreign stocks: 3

XIRR: 7.07% (Sep 2016 to Jan 2017)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed into the markets.

Value: $72,000

I’m liking this new format for the monthly portfolio updates. Clean and organized by Permanent Portfolio, Personal Picks, BFP Picks and Warchest. Can see you are slowly reallocating from Personal Picks to Permanent Portfolio and it’s working out well for you. I might explore BFP in more detail if you are actually building a portfolio based on its methodology and recommendations.

Hi Finance Smiths,

Regarding BFP’s portfolio, I am actually taking some of their picks at face value. i.e. little research on my part.

I will be monitoring the XIRR and updating it so it will be a good indicator of how my mirroring is doing.

Can I ask what “BFP Picks” are?

Hi Ben,

BFP stands for Big Fat Purse. I am a subscriber of their services.

Been reading your posts. Nice update. But just curious, what is BFP?

Might have missed it if you have posted before…

BIG FAT PURSE! (;

Hi JASS,

BFP stands for Big Fat Purse. I am a subscriber of their services.