Raising Of Premiums

When I heard this piece of news that meant all insurers were effectively raising the premiums of their Integrated Shield Plans (IPs), I knew that I might have to reevaluate my health care insurance strategy.

After all, according to the same report, “Claims for IPs covering treatment in private hospitals have risen by 17 per cent a year in the past few years” and in case you did not know, insurance companies are profit-making in nature (there are shareholders) and when their costs increase, they are just going to pass it on.

So I expect premiums to be raised again in a few years’ time. Most of us will probably feel the pinch when the subsidies are removed and we grow older.

Imperfect Information & Moral Hazard

Imperfect information is a really big issue in the healthcare industry. The customers know so much less than the providers. For example, most of us would find it very difficult to question a doctor’s advice.

Adding in doctors’ incentive to provide more “services” plus a buffet effect with healthcare insurance for patients, this makes for a lethal cocktail mix. It is no wonder claims have risen by an astronomical 17% a year at private hospitals, where there is likely less regard for “costs”.

My Prediction

Healthcare insurance costs will skyrocket. The more comprehensive the plan, the higher the increase.

When I talk to people, the prevailing sentiment is to get the most comprehensive plan you can afford, not need. It is often cited that a surgical procedure plus one or two week stay in the best wards in a private hospital would “earn back more than a decade of premiums paid”.

And there is mainstream acceptance that hospital insurance is a priority and one should have the “best” care when one is sick.

I also believe that in the future, the newest and most innovative procedures will not be covered by hospitalisation insurance plans. Maybe something along the line of stem cell therapy. To gain access to them, one would have to pay out of pocket.

My Strategy

I am on NTUC Income’s Enhanced IncomeShield Preferred plan which is the most comprehensive IP they provide. I also have an Assist Rider so that I would only need to pay 10% of the claimable amount. The Mrs is on the exact same plan.

An alternative plan is the Enhanced IncomeShield Basic which cover stays in government hospitals for wards B1 and below.

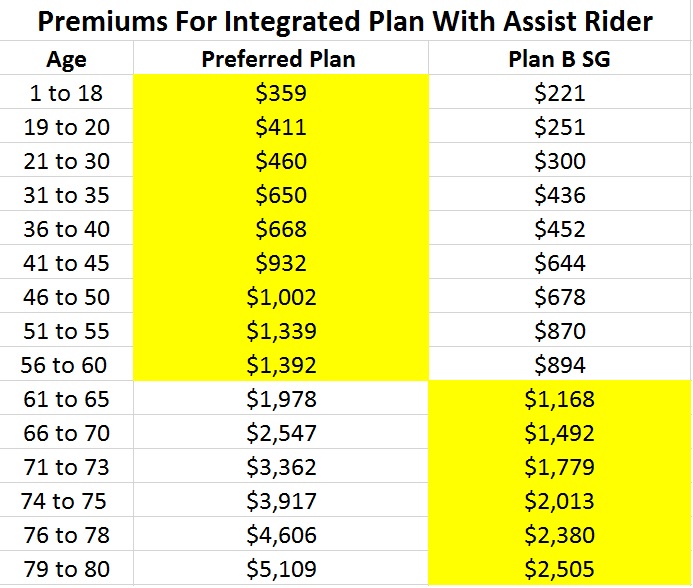

*Numbers extracted from NTUC Income website on 7th April 2017

The above compares the premiums paid for these two plans and the highlighted portion reflects my plan. (Do note that the above premiums are likely not reflective of the latest revision.)

At this point in time in our early thirties, both of us still have a lot of human capital left. It seems reasonable to pay around $100 a month ($1,200 a year) to get private care in the low probability event of being hospitalised in the next three decades. Protecting the human capital is a big priority and those are also the prime years of our life so maintaining the quality of life is also important.

However, it does seem absurd to me to be paying $2,000 or even more every year for hospitalisation insurance as we grow even older. At age 80, each of us have to pay an astronomical $5,000 a year just to be on the same Preferred Plan with an accompanying Assist Rider.

Plan B would make so much more sense at age 80, with the premiums halved to $2,500 a year.

And the scary part is that these premiums are likely to be increased at least a few times over the next few decades.

So the likelihood is that past the age of 60, we would change/downgrade to the Enhanced IncomeShield Basic or even to MediShield. At age 75, the premiums would still be a reasonable $2,000 a year and I have had no prior bad experiences in government hospitals. In fact, although my Mum only qualified for B2 wards under MediShield, she was often upgraded for free to B1 wards.

The care provided in the B1 wards was really good and my gut feel is that if I prefer and can afford care in a private hospital in my old age, it might make more financial sense to pay out of pocket instead of relying on a private hospitalisation insurance.

As someone who has worked in hospitals before, I can say that fully as-charged plans are self-sabotaging, in the sense that uncontrolled incentivized push to max out the benefits coupled with private hospitals’ & private doctors’ profit-maximizing motive causes a vicious cycle of hyperinflationary private medical costs leading to hyperinflationary private medical insurance premiums leading to further incentivisation to max out medical benefits even more. This ill effect has also affected as-charged IPs covering A-class in govt hospitals to a lesser extent.

As A-class patients in govt hospitals pay full costs and don’t have a single cent of subsidies from MOH, there is much lesser impetus to control costs / procedures / drugs prescribed by the doctors & surgeons. Doctors & processes in C-class & B2-class on the other hand are often queried on costs and standardized care plans & healthcare pathway treatments (i.e. SOPs) for various diseases & conditions are often analysed and streamline for “cost effective” care. It’s difficult for a C-class patient to demand the “latest & greatest” drugs and procedures as these are usually non-subsidisable and they are advised as such.

I believe if the hyperinflation in medical consumption, costs & insurance premiums continue, govt will step in eventually to ban 100% as-charge & to mandate minimum of 10%-15% co-payment no matter what.

Hi Ex-Nurse,

Great to see your comment as nothing beats an insider speaking out against the current system.

I find myself nodding at most of your points and it will indeed be interesting to see if the government or insurance companies would stop 100% coverage with no out-of-pocket charges.

This is a typical reaction from those have purchased IPs.

It goes: ‘Since I have purchased it, I might as well max it otherwise I will waste my premiums.’

The buffet mentality will drive premiums higher and higher. If one has to pay ala carte, this situation won’t arise. Same for subsidy, people will abuse it. It is not just the patients but the caregivers abusing them as well. Simple as that.

Hi Fred,

It’s hard to ward off that mentality.

When I occasionally find myself at buffets these days, there is still a tendency to overeat even when I consciously remind myself not to.

15HWW,

I like the wisdom of our public healthcare system.

Polyclinic charges can be heavily subsidised; but there are not free.

If free, everyone will visit polyclinic for the slightest pain or discomfort.

The same rationale will also “incentivise” health care institutions to run more expensive tests, prescribe more experimental drugs to patients – the insurance companies will pay anyway mah!

Smart move by our insurance companies. Play to the kiasu nature of Singaporeans. If no claim, will get discount.

This should arrest some of the frivolous clinic and hospital visits 😉

Hi SMOL,

When it comes to generating $$$ or saving $$$, you can trust our government to do a tremendously good job. Look at their track record!

Yes, the no claim discount will help but I have a feeling the impact will be quite negligible unless the discounts are much more substantial.

‘No Claim Get Discount” works like vehicle’s NCB. That’s a brillant idea and should be given serious thought.

Medical expenses is unpredictable.

We know we will die eventually but we do not know how much we will need to spend on medical bills before we die.

Hi Jasmin,

You are right. I think I read a statistic somewhere that >50% of our medical expenses are likely to be incurred during the two years before we pass away.

Having quite a few bad exp prompt me to go upgrade to pvt isp.

My uncle in pain have to wait 6 mnths for appointments. He end up visiting a pvt.

I treat pvt isp as a fail safe. When u can’t wait u have a safety net.

For me, it take 2 visits before I am admittedfir pneumonia. Terribly disappointed for the prolong/delay treatment. 7 days after I fell sick I got adnitted. High fever 41-42 degrees.

Under u exp something like. U wont curse n swear at the stupid doc n hospital

Hi Desmond,

Sorry to hear about your bad experience.

And I can understand your preference for private care. The crux of the question is, with rising insurance costs, would it be better to self-insure for private care (when we really need it) or still pay for insurance and consume healthcare like a buffet?

Oh BTW, 15HWW — you seem to have forgotten about the premium portion for Medishield Life. The premiums you’ve shown for the Integrated Plan is ON TOP of the portion for Medishield Life, which adds another 40%-50% to the total insurance costs.

And NTUC Income has updated their new increased prices. E.g. for the 41-45 age band, the Preferred portion has been upped from $327 to a whopping $577 (76+% !!!). Your table must be really outdated??!?

Hi Ex-Nurse,

Thanks for pointing out my mistake! Yes, I had forgotten to add the premiums for MediShield Life. That’s easily another 30%!

Guess instead of downshifting in my 60s, it might be even more prudent to reduce it from 50 onwards.

Regarding the numbers being outdated, I don’t have the latest tables and I just plucked the numbers from the NTUC Income website.

Insurance needs assessment is the worst part of our overall financial planning since we neglect it so much. My wife and I have private hospitalisation insurance plans with AIA and NTUC Income respectively. But we don’t have critical illness insurance plans, which according to a good friend working in the industry, is a gap we should address especially as we get older. It’s always at the back of our minds and the last thing to be addressed financially. Probably why we haven’t gotten around to it!

Hi, 15WHH,

I’m also on the same Income plan as you and am worrying the same thing. They will keep escalating the premiums at short intervals such that in time to come, only the multi-milllionaires will be able to afford the premiums at old age.

On 31 Mar 17, the New Paper published this:

“The premiums of Income’s Enhanced IncomeShield Preferred plan relating to private hospitals have been hiked by between 5 per cent and 15 per cent from March 1. Its Assist rider on this IP also saw a premium hike of between 10 and 30 per cent from March 1.”

However, I just received the letter for this year’s annual premium and it has increased by a whopping 34%. In addition, the Rider also increased 33%. Both increases are more than double what was published in the news less than a month ago. I emailed Income regarding this yesterday and am waiting for their reply.

AGE IP ARider

31-35 300 199

36-40 300 209

41-45 577 311

46-50 600 351

51-55 816 417

56-60 863 451

61-65 1201 637

66-70 1697 823

71-73 2447 1103

74-75 3032 1296

76-78 3614 1550

79-80 4085 1804

81-83 4283 1927

84-85 4774 2125

86-88 5343 2320

89-90 5866 2412

Hi Laurence,

I guess when the premiums become too hefty, one would just have to either be prepared to pay them, or downgrade the plan and rely a bit more on self-insurance? Moral hazard is really becoming a big issue seeing your experience. Let’s see what’s Income’s reply to you.