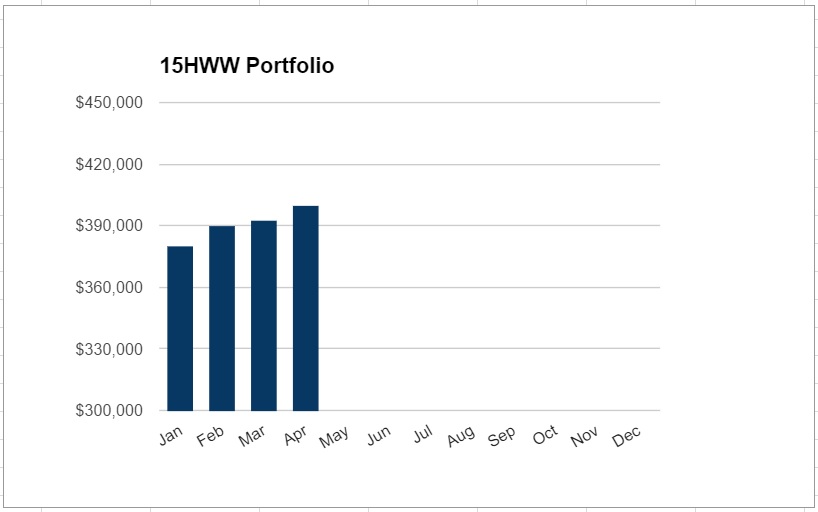

This could be considered a pretty good month for the portfolio. Firstly, even though the STI retreated slightly, there were gains even after excluding the capital injection from savings. Secondly, the total value of the portfolio finally managed to breach the $400,000 mark.

It was quite a pretty active month as there were quite a few purchases and sales and inactivity is likely the theme for the next month as lessons are already piling with the mid year exams coming.

The annualised returns look pretty good for both the Permanent Portfolio and the DWI Picks but since these two categories are less than a year old, I really would not pay much attention to them.

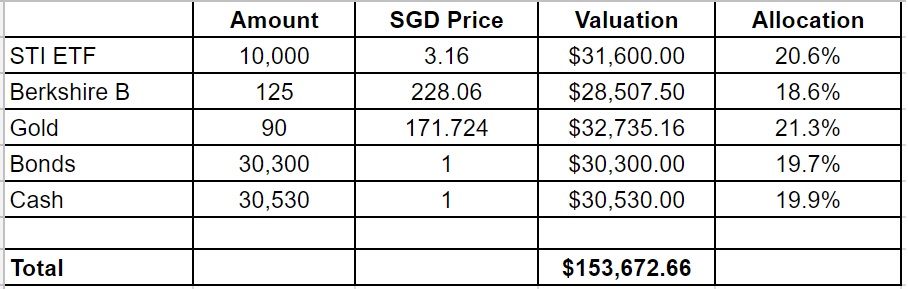

1. 15HWW Permanent Portfolio

The soaring gold prices managed to offset the declining prices of Berkshire B. I have also included the dividend from STI ETF earlier in the quarter and parked them under cash. The likelihood of a need for rebalancing still seems remote at this point in time.

I would be absolutely delighted if this portfolio can achieve a 8% return in the long run. 5-6% is probably more likely.

USD-SGD Rate: 1.40

UOB 50 Gram PAMP Gold Price: $2,880 x 6 = $17,280

Annualised Returns: 8.6% (Jan 2017 to Apr 2017)

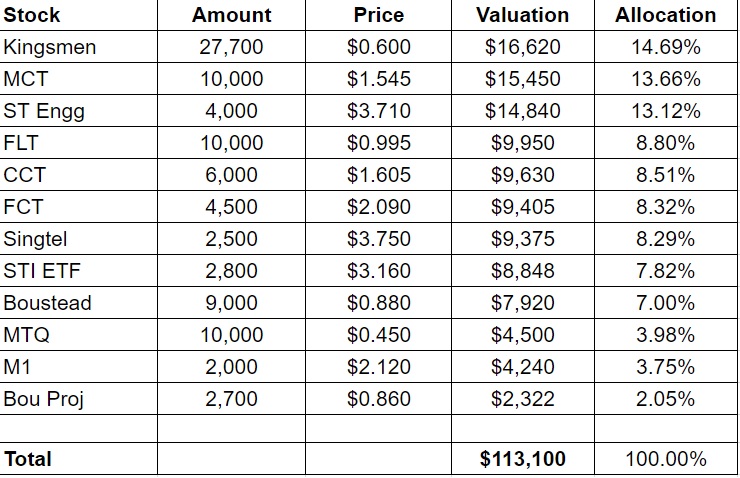

2. Personal Picks

I accepted the offer of $1.30 for my entire stake of Super shares which translated to a sale of $5,200. I probably just about broke even on this trade after accounting for the dividends the past couple of years.

I also bought back Singtel @$3.80 a few days ago. I had sold it close to two years ago at a price of about $4. On hindsight, it was a terrible decision then as I channelled the proceeds into M1 at a price of around $3.50.

Interestingly, the REITs in my portfolio have appeared pretty resilient and defensive in the recent weeks, which helps to explain the improvement in the annualised returns to 6.9%.

Annualised Returns: 6.9% (Nov 2010 to Apr 2017)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few indicators as shown below.

I managed to add a local stock to the portfolio to increase it further. And with one of the stocks making a ~20% return in one month, the annualised return managed to skyrocket to a really respectable 10.9%. But with such a short time period to date, there’s really no point getting too excited about the numbers.

Portfolio Value: $63,959

Number of local stocks: 4

Number of foreign stocks: 4

Annualised Return: 10.9% (Sep 2016 to Apr 2017)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed into the markets. The two buys this month managed to reduce the warchest by $8,000 and some of these funds are now also parked in Citibank Maxigain account. We managed to open an account at the start of April.

Warchest Value: $70,000

I just had a chat this morning with a friend who also happens to be a parent of two of my students. During one of our previous conversations, I had revealed that I write about personal finance. It was just a passing comment so I was really surprised when she asked me today if I was the writer behind this blog.

And when she asked me some questions about some of my writing and views, it was then that I realised that my writing isn’t really that friendly to the layman. For instance, I had to clarify on what xirr meant.

Since this is an update I do on a monthly basis, I have decided to make some tweaks above to make things a little more readable and relatable.

Congrats 15hww on breaking the $400k magical mark 🙂 And good layout too i like it.

Hi B,

Thanks! Your portfolio is doing great too! Much to learn from you.

Very well diversify portfolio ! I like the way you split your portfolio into Permanent and Personal Picks .. 🙂

Cheers

Hi STE,

Yes, have to diversify away my potential incompetence… lol

Congrats on your portfolio reaching the $400k level! I find your layout to be neat, clean and easy to ready. Something I’m trying to do with mine as well!:)

Hi FS,

Yours is also a joy to read! Hope you have some luck both in starting a family and getting a new and bigger place in the neighbourhood. I like that neighbourhood too!

Hi like to ask why you decided on DR Wealth insiders… you heard of good reviews about them?

Thanks

I’m thinking of subscribing to dr wealth as well, just like your opinion. Thanks

Hi Bernard,

I happen to know the founders pretty well and I do trust them. So far, I am pretty satisfied although I have not been with them for a long time (<1 year).

If you are thinking of subscribing to them, I would advise that you talk to them or even attend their VIMC course.

Currency is in SGD or USD ?

Hi Mike,

For those stuff that are normally denominated in USD, like Berk B and Gold, I have converted them to SGD.

Hi, i recently started reading your blog and am curious to know, is your portfolio a combination of both yours and Mrs 15hww’s funds?

Hi Vic,

It comprises both of our funds. I manage it as one single portfolio.