I am celebrating my 31st birthday in a couple of days’ time and I will be getting my best present ever.

More of the Mrs’ time.

Freeing Up More Time Together

Yes, the Mrs will be leaving her job very soon. Probably still two more months of notice to go and after that, there is a strong likelihood that she would be enjoying a 15 hour work week from July till the end of the year.

With a heavier workload since the start of the year, I have been recommending more and more students to the Mrs and I think she should manage to transition rather well to becoming a tutor just like me.

Soon, both of us can spend our weekday mornings and early afternoons together.

We watched La La Land recently (spoiler alert) and at the end of the movie, I was quite caught out when the Mrs uttered “A couple has to spend time together to stay together”.

The Mrs probably does not “enjoy” all the aspects of a tutor as much as me since I am so much more introverted than her. But still, she was willing to make the leap so that we could spend more time together. Really kudos to her.

A Slower Accumulation Rate

In recent months, as I experience more success in my work, our combined monthly income has comfortably breached the $10k mark again. So obviously, the Mrs’ decision to leave her current workplace will have some ramifications on our finances.

And no, I am really, really, REALLY not complaining. Nor anywhere near that.

After all, I am approaching the 3rd anniversary of my decision to leave my comfortable and well-paying job and a quick tabulation shows that I have only earned about $100k over the entire past 3 years. If I had stayed, the odds are that I would have earned closer to three times that amount for the same period. That’s huge opportunity costs that we are talking about.

I have been led to believe that most wives would have given their husbands hell given the above situation. However, the Mrs had been extremely accommodating and supportive throughout the period. At the same time, she has knuckled down, worked even harder and actually earned close to $200k over the three years, almost double the amount of mine. And even though she has been the main breadwinner, I never felt I was ever “talked down” to.

It’s also obvious that me doing 90% of the housework doesn’t come close to compensating. So really, the Mrs is the real heroine behind our $400k portfolio, although I always appear to be the one one enjoying the adulation. =p

Therefore from now on, the tables will turn and I will definitely bring home more of the bacon. I am not absolutely certain that I can exceed $200k for the next 3 years but at the very least, I am confident I should be able to earn the bulk of the $240k that we are targeting together as a couple.

If we can earn $80k a year and assuming an expenditure of about $50k, we can still save about $30k or 35% of our income. That’s still a decent % although it would no doubt slow down our accumulation rate as compared to the past.

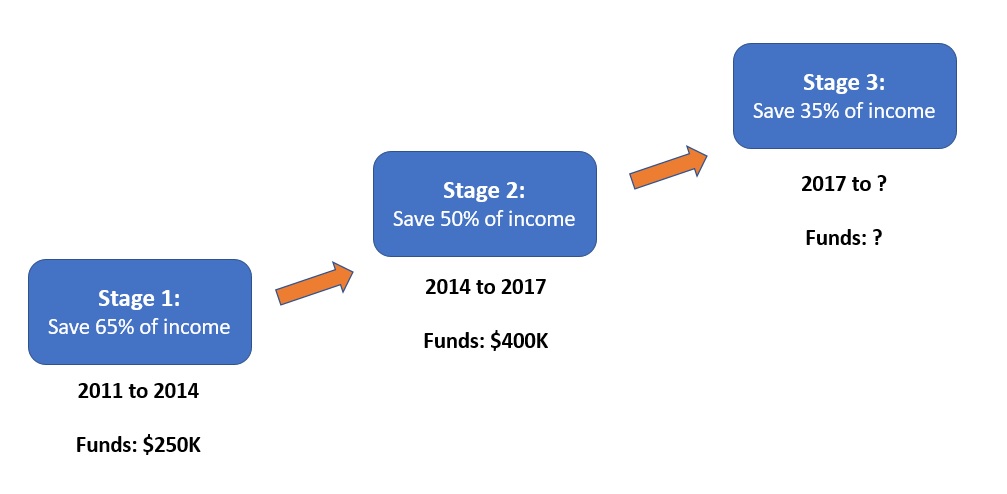

As seen from the above, we have maintained pretty good (or extreme) saving rates in the past. From the half-empty point of view, “if only we sustained those 65% and 50% rates longer so we could reach FI earlier”.

However, I am more inclined towards the bottle is half-full point of view, “We have accumulated enough to take stock after every 3 years, enjoy some of our fruits and slow down our pace to smell the roses.”

Let’s hope we can enjoy this slower pace fully and maintain a 35% saving rate for the best part of the next decade.

Wish us luck!

Hi 15hww

I’m really happy for you and your wife approach to finding own time own target plan to life. I think it’s probably one of your biggest milestone just to be able to take down this path and not to mention how successful it has been so far.

Definitely kudos and looking forward to seeing more two of you 😉

Hi B,

You are right that it has been successful so far. Three years ago, if you tell me this will be the situation three years down the road, I think I would be quite delighted.

I guess you will see less of the Mrs around your work area after June. =p

Hi 15HWW,

Congrats…soon will be husband-and-wife team liao. See you around..

Oh, La La Land is awesome, pity that it didn’t get the Oscar for the best movie..

Hi Richard,

Actually, after watching La La Land, I felt it was a bit overrated. No doubt it was refreshing and I really enjoyed the initial few scenes but I felt a bit let down/disappointed in the middle of the show and towards the end. Maybe it’s just me…

I am really excited for you! It’s great. It’s probably another couple of years before Dave and I will be taking a step back from our current jobs and it’s good to have a motivation 🙂

Hi Kate,

Thanks for your kinds words and well wishes.

I am also happy for Dave and you and of course Ally too! She will be delighted to have more time with her parents very soon.

Your plans should give your good motivation to save up more and continue with the minimalist lifestyle.

Going to factor in having children?

Hi SGFT,

Haven’t heard from you on your blog for some time. =)

I won’t deny that we are keen on having children. It’s a bit difficult to plan since the whole thing isn’t entirely up to us.

And maybe freeing up more time would make it more conducive to bring up children.

Life is not all about numbers; how much you save,or percentage of accumulation etc.

Congrats on your and Mrs move. Live your dreams.

Hi Fred,

Yes, you are right.

Although we can’t totally ignore it, how we live our life should not be entirely governed by numbers too.

15 HWW,

Cool!

Its always good to have diversity – be it alternative lifestyles or career choices!

“I have enough” has taken precedence over “$X amounts in Y years”…

I’ll have fun watching your journey to see when you’ll ditch your clutches or training wheels 😉

Welcome into the Grey!

And have fun!

Hi SMOL,

Thanks for your encouraging words!

You are right that I still need my training wheels. =p

It will be apparent when you see me do up a post on $X amount in Y years soon. Lol.

You are an inspiration to be able to retire at 31, when my calculations led to retire in 16 yr later at age 50 🙂

Hi Ks,

Um… Definitely not retiring at 31. Probably not even semi-retire. Maybe 41 is a possibility for us. Haha.

All the best in your journey!

I have been a follower of your blog for a while. I like the way you keep the issues discussed at a personal level, which appeals to commoner like me. By the way, your posts have been my top favourite reads on the internet that I shared in my weekly post. I welcome you to visit my blog and give me comment to improve. I just started. Hope you will continue with your great work and continue to inspire others.

By the way, most favorite read two weeks in a row

Hi Warriortan,

Thanks for your kind words. A lot to live up to.

I will definitely pop by your blog for a read soon!