Dear OCBC 360,

It pains me to write this break-up letter.

I have actually developed real feelings for you during the past 3 years. Over this period, even though you have decided to gradually give fewer in this relationship (from 3.05% on April 2014 ⇒ 2.25% on May 2015 ⇒ 1.85% on April 2017), I have continued to stick with you. Even when so many others (here, here and here) have told me to move on, I have waited till this point. You were definitely not a fling to me.

But it appears now that our relationship is truly broken. From this month onwards, because there is no salary being credited to you, you have decided to provide just 0.65% even though I am spending so much $$$ and time with you. That amount is totally unacceptable and it’s really best for both of us to move on.

Yeah, it’s time to look for a new love.

No hard feelings, OCBC 360. I have given you some pretty glorious reviews over the past few years. But what makes your account tick right now is really the extra 1.2% of bonus interest given to a salary credit (>$2,000). Without that, the effective interest rate becomes pathetic.

In all honesty, I am quite tired of “jumping through hoops” to qualify for a higher interest. This probably explained why we stuck with OCBC 360 for so long, even after the latest revision in interest rates earlier this year.

But hey, even without a salary, we still have to spend money, pay bills and perform some banking transactions and my rational left-brain insists not to leave money at the table. No-frills accounts simply cannot yield a higher interest and there’s some bananas given out when we “jump through hoops”. Yes, I want those bananas.

And so, a quick research on the internet provided me with this conclusion:

For self-employed/entrepreneurs/retirees/those with incomes below $2,000, the UOB One Account could be your best bet.

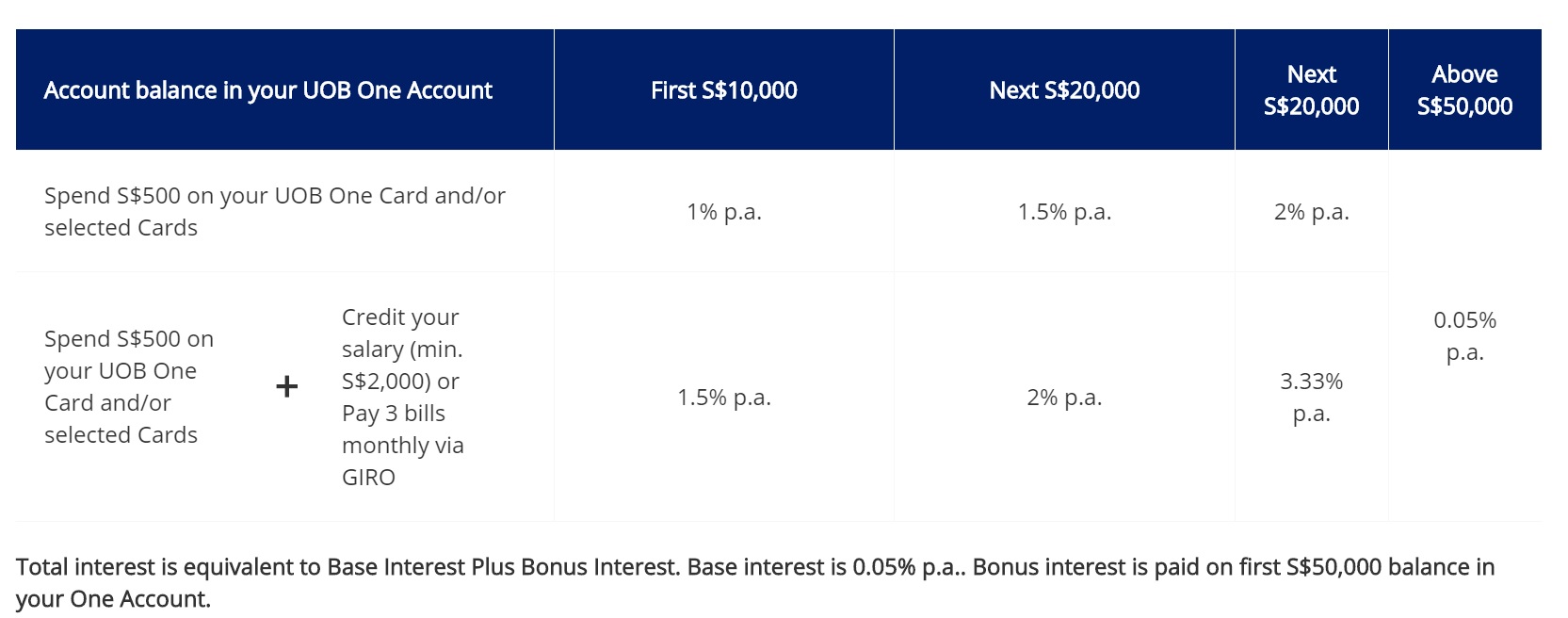

The above picture speaks a thousand words and I am just going to value-add by highlighting some important points below.

The above picture speaks a thousand words and I am just going to value-add by highlighting some important points below.

For the UOB One Account, the critical condition is to spend $500 on your UOB card. This should not be too difficult for a household. Our household averages $1,000 on this front.

- If one charges telco and broadband fees to the card, that’s easily $100-$200.

- Add in groceries at supermarkets ($100-$200) and restaurant meals ($200-$300) and there you have it.

- For others, it could be Grab or Uber rides or even departmental store purchases.

And if one doesn’t have a $2,000 salary credited to the account, the alternative of 3 monthly giro transactions would work to qualify for additional bonus interest. I personally recommend to have at least 4 as a buffer. The possibilities include:

- Income Tax

- Medisave Contribution for Self-Employed

- Other Credit Cards

- Monthly Insurance Payments

The 15HWW household has AMEX bills to pay (dining privileges), two POSB Everyday Cards (EZ-Link usage) and upcoming mandatory Medisave Contributions for self-employed. So really, I foresee no issue on this front.

If we do the above and park ≥ $50,000 in the account, over a year, we would receive at least $1,216 in interest. The effective interest rate will likely be above 2.4%!

In my opinion, pairing this account with the UOB One Card for the spending portion is the best option to max out the benefits. If one charges slightly above $500 for three consecutive months, a quarterly cash rebate of $50 is provided which should amount to a 3% cashback.

A potential hassle for most people is the tracking part, but hey, who are we talking about here?

A more likely concern for the 15HWW household and other self-employed or retirees is whether we can qualify for the UOB One card to get that additional $200 of credit card cashback.

But well, even if we had to use a debit card and forgo the cashback, it’s still not a dealbreaker. If I deduct the $200 from the account interest, the effective interest rate would still be above 2%.

But I would prefer to have the additional chocolate sauce on my ice-cream. So if any UOB credit card sales personnel/banker is reading this post, feel free to contact me and drop me an email.

I am a low-lying fruit. Otherwise, I would be making my way down to the nearest UOB branch to set up my UOB Account this Friday morning.

Dear UOB One,

I hope you would behave much better than OCBC 360. I want to make you the main ONE and establish a true banking relationship with you. No 360 or 180 degree changes down the road would be great and please do not grow complacent and start giving less to this relationship a few years (or even months!) down the road.

Let’s start dating!

Thank you for your great update. I was looking around for better savings account interest and was considering CITI Maxigain and your detail information greatly helped.

Hi Jeffrey Yan,

Citigain Maxigain is a really good account too and I have money parked there for a few months already.

I’m still looking for one that doesn’t require minimum spending … coz I spend way less than $500 for monthly credit card spend. Any half-decent options out there?

For Giro link, another item would be Property Tax. Coz Income tax will stop once you transition into the next year.

Maybe you can try paying 2 mths worth of bills instead (if you are using non-uob one card) to qualify for rebates bi-monthly.

Hi Sinkie,

I think if you prefer something more no-frills, Citi Maxigain would be a good option. After a year, the interest rate can go up to 1.8%.

Ok thanks! Will check it out!

Have been dumping my emergency funds together with my warchest into short duration bonds for past 15 years. Yield is good at 3+% per annum. But takes 5-6 business days to get it in cash in my bank accounts. And also requires a bit of monitoring.

Good to park at least some portion of my emergency funds into something more liquid.

I have been using uob one since launch, i moved out of OCBC after the 3% was removed. I passed the 2 year anniversary without any changes to conditions or interests. As I spend about $1000/month, I maintain both BOC (before they revised the rates, then i switched to maybank) and UOB for higher interest for first 110k. Without salary credit, then CIMB 1% for first 50k is the next best. I highly recommend UOB. It’s also easy to get a credit card if you offer to earmark some of your deposits.

Hi jarwey,

Way to go! You seem to be optimising and maximising the gains from your cash and expenditure.

Yes, understand that parking a $10K fixed deposit should qualify me for the credit card. However, I prefer not to have to utilise that option. We simply don’t have that much cash!

Hi 15HWW,

Welcome to the club. We seemed in a very similar stage of going into self employment and setting up a bigger family as well. The going is gonna get tougher but I am sure you will pull through.. all the best! 🙂

Hi Jes,

Bigger family? Number 2 coming for you so fast? =p

All the best in your biz!

Hey 15HWW,

I have signed up for UOB as well and I am moving my funds out of OCBC. The $500 cc spend has always been a problem for me, but I’ve managed to sort out my spending so that I’ll hit that every month.

It’s a sad day for OCBC that it is losing its endorsement from most bloggers.

Hi 15HWW,

Welcome on board. I guess I am less brand loyal than you are! Seeing my interest rolling into my UOB One Account vindicates the decision to ditch OCBC. Hope you also have a wonderful relationship with them.

Hi Heartland Boy,

Your post was very well-written and informative! I learnt a lot from it.

Let’s hope UOB don’t pull a fast one on us within a year.

Hi GMGH,

That’s great. I think if I were single, the $500 would be an issue too, unless I help to pay some of the family bills.

I was actually wondering if anyone from OCBC would contact me but I guess they probably don’t really care. My bet is due to first mover advantage, they are probably still the bank that is sitting on the most amount of balances from such step-up accounts.

Hi 15 HWW,

I am not aware that OCBC 360 has cut their interest rate to 0.65%.

May I know where your news come from? Moving over to UOB would be the best move if that happens.

Thanks

Hi Michelle,

It’s actually still 1.85% for most people. Just that we do not qualify for the salary credit bonus interest of 1.2% anymore.

Hey for any employed person, bank of china or Standchart is still better than these local banks. BOC gives much better rates, on top of that they offer 5% cashback on their family card. I receive close to 30-40 per month when I spend around 500-600 on the card. Local banks are just too stingy, queues are wayyyy too long and just too protected by our government

Hi 15HWW

Can I confirm with you that payment for amex credit card via UOB one account would fulfill as giro payment.

Thanks

Joyce

Hi Joyce,

I think you need to make an arrangement with AMEX that you are doing a monthly giro payment on UOB One. From my understanding, a typical bill payment would not qualify as a giro payment.

Yes, I’m going through the same break up too! And I started that this week. OCBC has decided to charge annual fee and refused to waive it because I did not meet their min requirement of spending $10k in a year. I’m not sure how much I have spent but I don’t think i’m that far off since I do meet the $500 spend to qualify for additional interest in most months. It’s really a shame they’d rather lose a customer over this. Am closing my 360 together since there’s no point continuing with the savings account when all my credit cards have been cancelled due to their refusal to waive annual fees.

Similarly, I’m switching over to UOB One. UOB has been my first love but unfortunately, some (around) 10 years ago, their very good credit cards lost their lusture and became mediocore as compared to the competition which overtook them. They are doing great with their ONE card and account, I’m looking forward to continuing the banking relationship with them.

Hi Ying,

Thanks for this comment!

We have had issues waiving late fees (by 1 day) in the past with OCBC too and the relationship was always deteriorating since the first year.

If switching was not a big hassle for you, it would be the right decision. Congrats!