Background

In early 2013, when I first received the keys to my BTO flat, I had a mortgage of about $255,000. Like most first-time BTO owners, by default, I was on the HDB Concessionary Loan (HDB CL).

In early 2013, when I first received the keys to my BTO flat, I had a mortgage of about $255,000. Like most first-time BTO owners, by default, I was on the HDB Concessionary Loan (HDB CL).

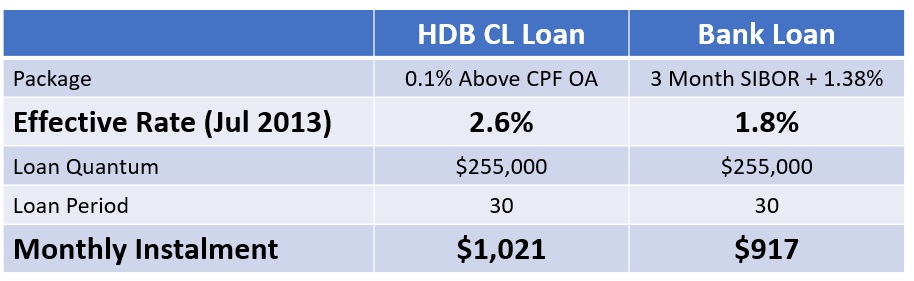

Even in 2013, there was nothing “concessionary” about the mortgage rate of 2.6%. SIBOR rates were hovering at 0.5%-0.7% then and most banks were offering home loans at rates wayyyyy below 2%. With a loan period of 30 years and at the “concessionary” mortgage rate of 2.6%, I found myself paying about $1,020 a month. (Using this calculator here.)

A few months later, I decided to abandon the HDB CL. I switched to a bank loan that came with a 2.5% interest cap for the first 10 years.

A comparison of the two loans below: Saving more than $100 a month immediately, I decided to recommend this bank loan to many of my friends.

Saving more than $100 a month immediately, I decided to recommend this bank loan to many of my friends.

The response was lukewarm at best and many brushed the suggestion off. That was when I realised that many people have biases and misconceptions against banks and bank loans.

Here’s 7 more Myths about Bank Loans:

1. Bank Loans Are Only For Private Properties

As mentioned earlier, I stay in a 5-room HDB BTO and had refinanced to a bank loan 4 years ago.

2. I Cannot Use CPF To Pay For A Bank Loan

For the bulk of the past 4 years, we have been using our CPF OA funds to pay the monthly installments of our bank loan.

3. I Must Pay More Cash When I Take A Bank Loan

This is not exactly a myth. At the point of purchase of a flat, taking a bank loan means that the first 5% of the down payment has to be strictly in cash.

However, one need not pay more cash during refinancing. For example, I was initially on the HDB CL and when I refinanced to a bank loan, there was no need for any cash top up.

4. I Have To Pay A Lot Of Fees For A Bank Loan

When you switch from a HDB CL to a bank loan, there are legal and valuation fees involved. They can easily cost $2,000. However, some banks do absorb these fees, especially during a promotion.

I personally benefited from one such promotion and I did not incur any switching fees 4 years ago.

5. I Cannot Prepay A Bank Loan

Some loans do have a commitment period and prepaying a bank loan during that period could incur a penalty.

However, there are some bank loans that do allow prepayment without any condition attached.

6. I Cannot Take A HDB Loan Again Once I Have Taken A Bank Loan

This only applies to the house I am staying in right now. Once I switch to a bank loan, I cannot go back to the HDB CL for the same flat.

But if I were to sell my flat and purchase another one, I can decide between a HDB CL or a bank loan again.

7. On A Bank Loan, I Cannot Approach My MP For Help If I Have Difficulty With My Mortgage Payments

I heard from friends who work in banks that they do get approached by MPs to help some buyers tide through a difficult period. It is also in the bank’s interest to help these buyers come up with an alternative arrangement.

This article is sponsored by DBS Bank. I only believe in promoting products and services that I would use myself, and when I believe they are of value to my readers too. The views in this article are strictly mine.

You can prepay the POSB/DBS loan without any penalties. (This is the loan with the 2.5% cap.)

Also, I think people just have inertia to either refinance or to “reconsider” taking a bank loan.

Cos it’s so “easy” just taking the default HDB loan.

Although after putting in some effort to set up the operations, servicing a bank loan is the same as servicing a HDB loan. But the effort to set it up is a bother. Saves $100/mth thou, but some ppl aren’t willing to go through the hassle.

Have a good day bro.

ERSG

Hi ERSG,

Spot on! You can only bring the horse to the well and can’t force him to drink.

You have a good week too!