Even with the North Korean tensions escalating, the market remained somewhat flat during the past month. So I was pretty delighted to eke out some decent gains for the portfolio, especially with the crediting of close to $2k worth of dividends during the past few weeks.

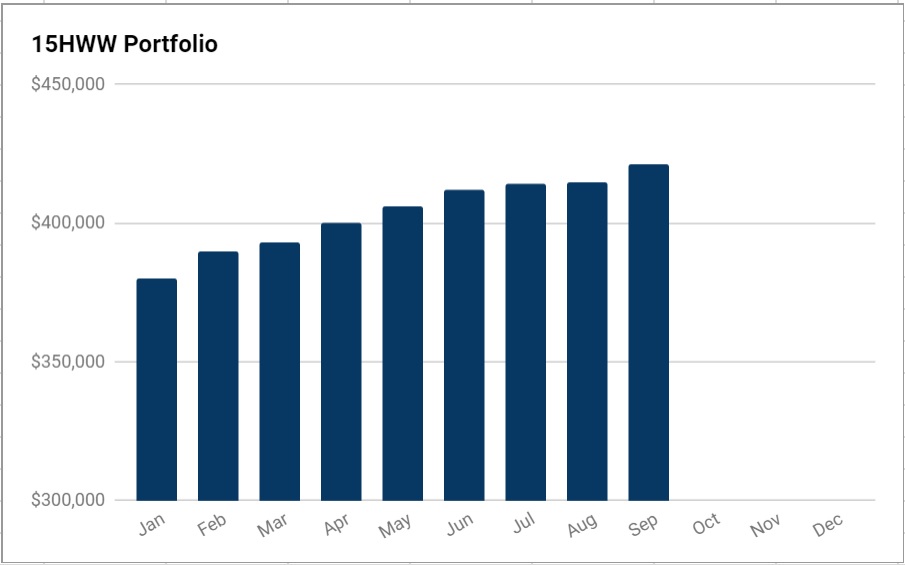

The portfolio rose pretty significantly by $6k to reach $421,000 and a big contributor was the good performance of the DWI sub-portfolio as a couple of stocks there made good gains in the past month. The annualised return of all the sub-portfolios are above 6% again.

There was no transactions this month but I am on the lookout to deploy a bit of cash into some stocks and it’s likely I will fire a couple of bullets in the next month.

Overall Portfolio (Value: $421,000)

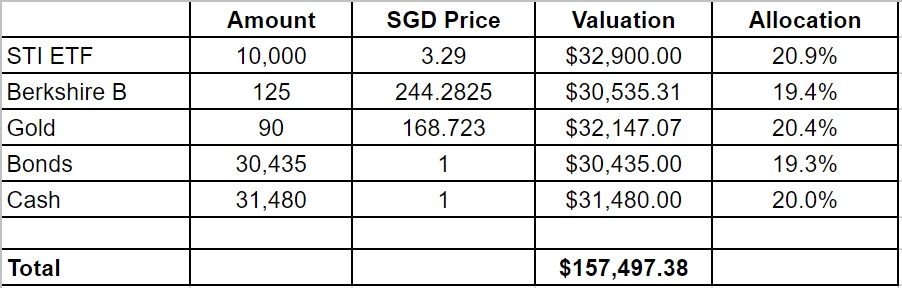

1. 15HWW Permanent Portfolio

With the SGD appreciating against the USD, it’s quite surprising that there is actually some paper gains this month for this sub-portfolio.

Gold did decently well with the political tension in the Pacific and Berkshire is also performing really well. The STI ETF also coughed out close to $500 of dividends and the returns of the Permanent Portfolio is still slightly ahead of the two other sub-portfolios.

USD-SGD Rate: 1.35

UOB 50 Gram PAMP Gold Price: $2,827 x 6 = $16,962

Annualised Returns: 7.0% (Jan 2017 to Sep 2017)

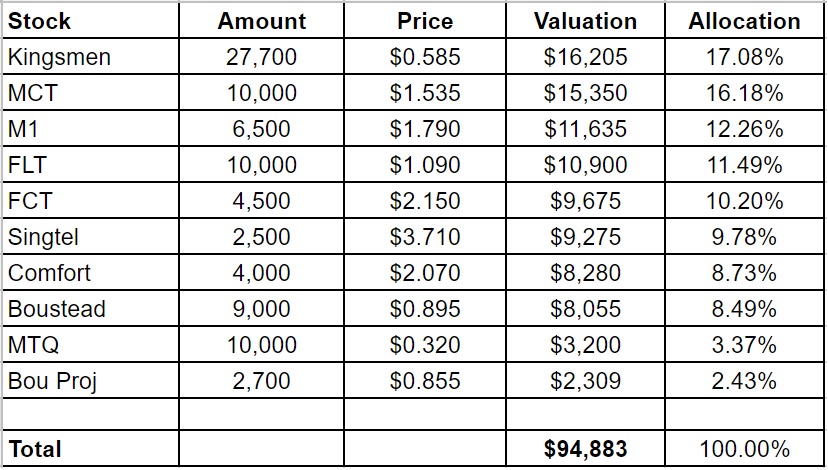

2. Personal Picks

The value of this sub-portfolio actually went down by $1.5k but most of it is offset by the dividends received in August. Dividends that will be received later this month should also help to maintain the performance of this sub-portfolio.

Annualised Returns: 6.7% (Nov 2010 to Sep 2017)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few indicators as shown below.

In just about one month, the portfolio gained 3%. The annualised return is back up to about 6.4% from 0.7% last month, which really illuminates how small caps are much more volatile compared to blue chips. It can go down as quickly as it rises since a small cap could gain or drop 10% in just a day.

Portfolio Value: $88,766

Number of local stocks: 7

Number of international stocks: 4

Annualised Return: 6.4% (Sep 2016 to Sep 2017)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed into the markets.

Besides the dividends, we managed to pump in another $2k+ from our income this month.

Warchest Value: $80,000

Nice growth in your investment portfolio! I’m interested in the section on DWI Picks since there seems to be a focus on small caps there. Higher risk for higher rewards!

Hi Finance Smiths,

I am surprised you are interested in that section and in small caps! I guess it’s true that “expected higher returns” really helps!