In less than two weeks’ time, it would mark 7 years dabbling in the stock market for me. Besides these monthly updates, it has been some time since I wrote exclusively about investments and I shall be preparing a series of posts just for this milestone. Yup, peak period for my work is over and I have more free time these days.

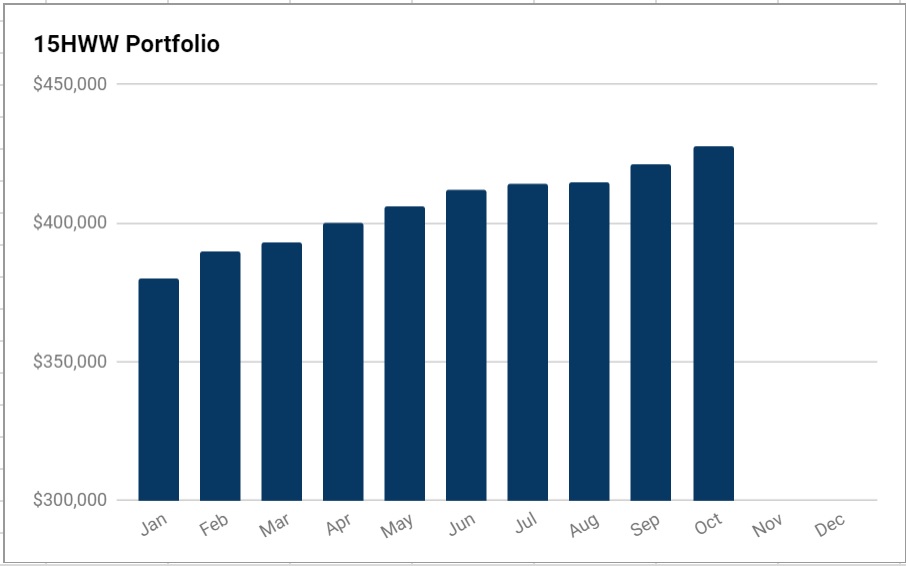

Month-on-month, the portfolio rose pretty significantly by $7,000 to reach $428,000 and it’s amazing that the 15HWW Permanent Portfolio is nearing $160,000 in value. This is supposed to be a defensive portfolio but over the past two years, the gains have exceeded $15,000.

Some dividends came in to boost cash levels and there was a buy and sell transaction this month for the Personal Picks sub-portfolio and the DWI Picks sub-portfolio respectively. I am quite happy stacking up cash at this point in time as I anticipate a correction in the markets.

Overall Portfolio (Value: $428,000)

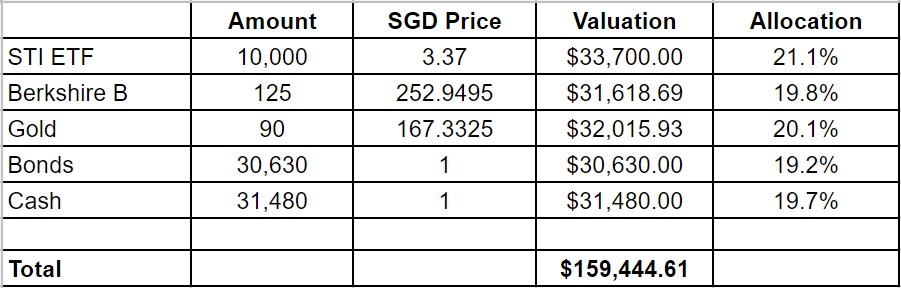

1. 15HWW Permanent Portfolio

The USD appreciated against the SGD earlier in the month, but gave up its gains in the past week, so the exchange rate remained at 1.35.

With the STI ETF, and Berk B doing pretty well during the past month, this sub-portfolio added $2,000 in value and the annualised return is really quite impressive at 8.0%.

USD-SGD Rate: 1.35

UOB 50 Gram PAMP Gold Price: $2,826 x 6 = $16,956

Annualised Return: 8.0% (Jan 2017 to Oct 2017)

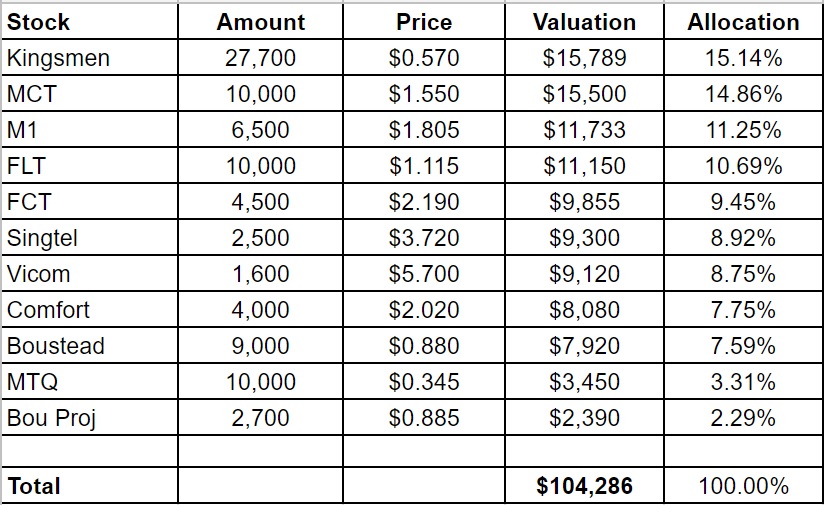

2. Personal Picks

The value of this sub-portfolio actually is up by $9,000+ but most of it is due to the addition of 1,600 of Vicom @$5.7. I am not expecting stellar returns from this sleeper stock and it should provide a stable 5-6% returns in the long run inclusive of dividends. Annualised Return: 6.7% (Nov 2010 to Oct 2017)

Annualised Return: 6.7% (Nov 2010 to Oct 2017)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few indicators as shown below.

To be fair to Dr Wealth, I am probably under performing their portfolio as I finally appreciate the fact that it’s quite impossible to do a full mirroring at the same prices in the long run. Rather unfortunately, I also did not manage to purchase some of their recent picks which ran up pretty fast.

The DWI portfolio made a sale which I duly copied and this meant the first completed trade in this sub-portfolio actually booked a loss. Hoping for better to come.

Portfolio Value: $81,155

Number of local stocks: 6

Number of international stocks: 4

Annualised Return: 7.5% (Sep 2016 to Oct 2017)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed into the markets.

Besides the dividends, we managed to pump in another $2,000+ from our income this month.

Warchest Value: $83,000

Hi 15hww

Solid gains there during the month. Seems the portfolio is back on track this month after a blip last month.

Nice addition to Vicom as well.

Hi B,

Think when I first bought Vicom 5-6 years ago, there was still quite a bit of growth left. Now it’s definitely much more mature and the upside has declined.

The portfolio has done ok in recent months, in line with the markets. Nothing special there. Just riding the wave. Let’s see if I will be caught naked when the tide goes out.

Good job!!

I think everyone’s enjoying the bull market while it lasts heheh!

Is there a difference between cash in your permanent portfolio versus cash in your warchest?

Hi Sinkie,

Yes, hope you are doing well in the markets too.

The cash in the permanent portfolio and war chest is kept separate. Otherwise, I will just be double counting more than $30,000 in cash.

Hi 15HWW

I managed my personal portfolio on a spreadsheet, and compute a very raw returns. Could you share how you work out a more meaningful/accurate annualised returns over 1 or 5 years?

(Btw I also quit my job and derive income from tutoring and investing 🙂

Hi Zeegareth,

I think basically, I just use the xirr function on excel/google sheet and keep track of all investment transactions, including dividend payouts. That should work out fine.