Introducing The New DBS Multiplier Account

In early October, a friend alerted me to the revamp of the DBS Multiplier Account. She had received an email which mentioned that DBS will be adjusting the interest upwards to 3.5% come 1 November 2017.

I was quite privileged to be invited to a pre-launch briefing by DBS in late October and I was blown away by the attractiveness of the new DBS Multiplier Account.

Why I Think It’s A Great Savings Account

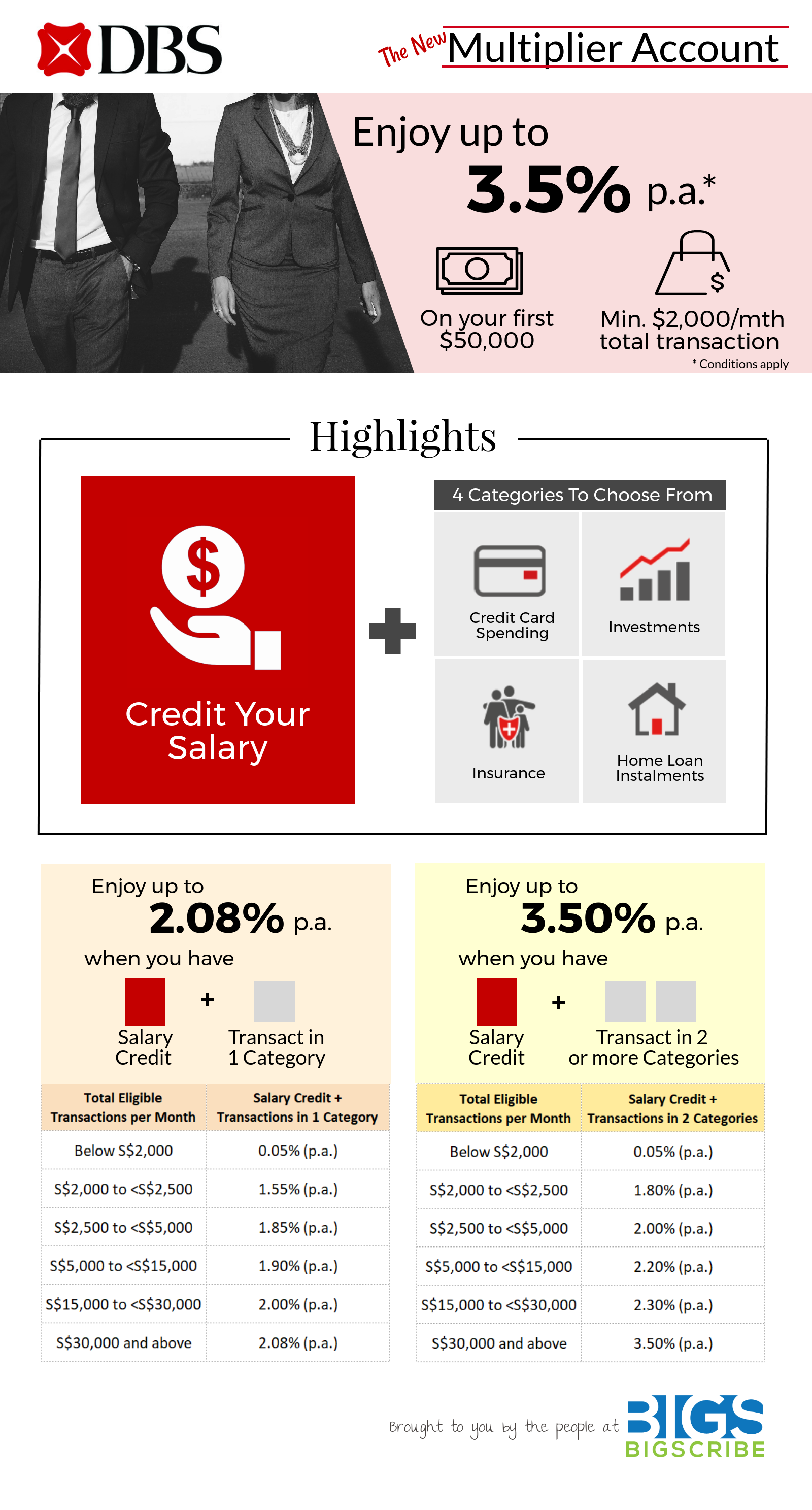

Just a Salary Credit + 1 Category would allow you to enjoy up to 2.08% of annual interest on the first $50,000 balance.

There are 4 categories to choose from and honestly, I really think it’s not difficult to qualify at least 2 Categories to enjoy up to 3.5% of annual interest on the first $50,000 balance.

As a testament to the DBS Multiplier Account’s flexibility, for the credit card category, one could transact from ANY DBS/POSB credit cards available in the market.

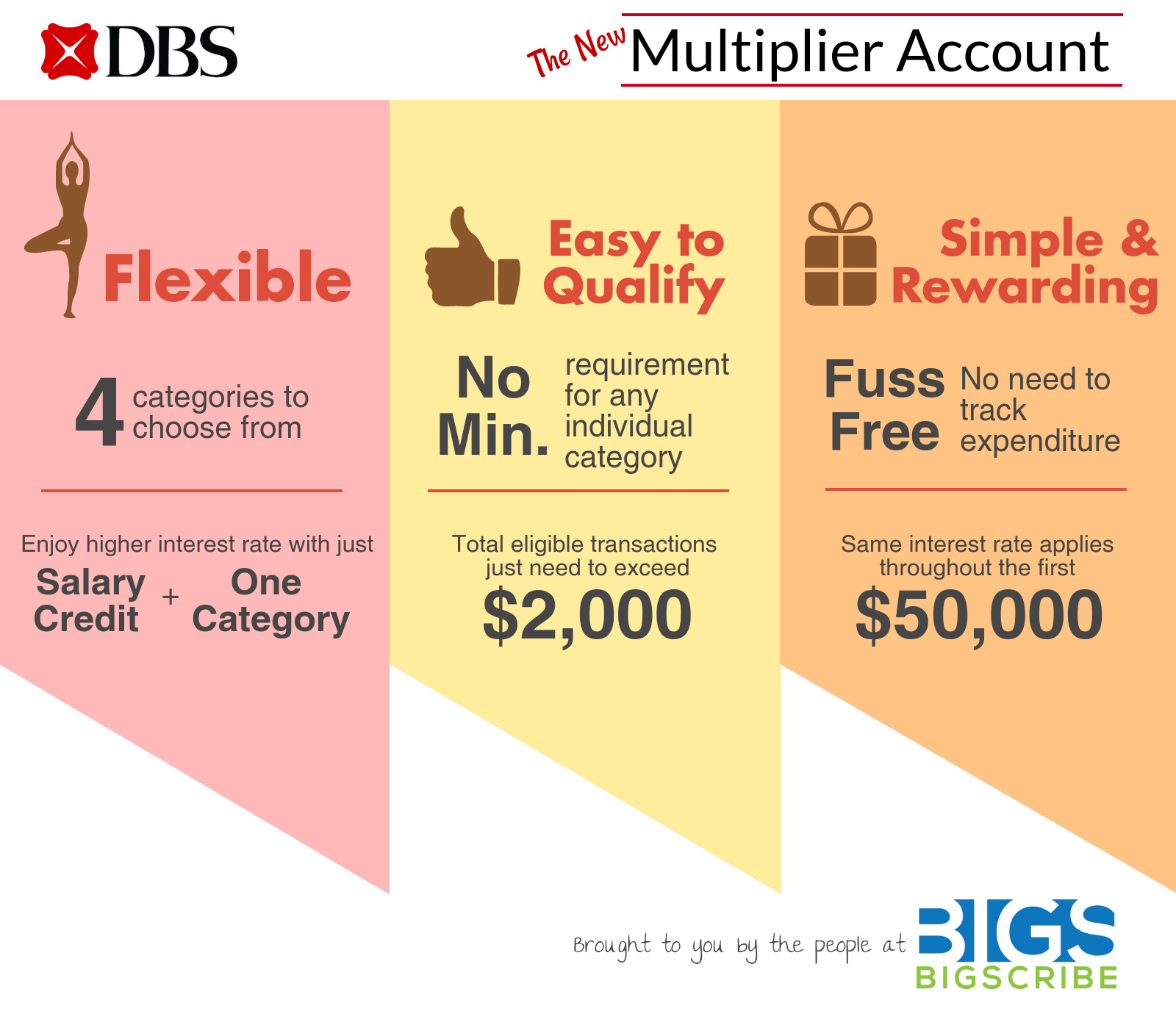

It’s so Easy to Qualify

There is no minimum amount required for any individual category.

$2,000 minimum salary credit? Nope.

$500 minimum credit card spending? Nope.

You can earn significantly higher interest once the total eligible transactions exceed $2,000!

It’s so Simple and Rewarding

With no minimum credit card spending, there is no need to track expenditure or overspend just to meet a criteria. It’s fuss-free!

There is also no need to keep your saving balances above a certain amount to enjoy the higher interest rates. The same interest rate applies throughout the first $50,000 of your saving balances.

Products like the POSB Invest-Saver also encourage easy entry into the Investment Category.

Young Millennials (Like My Brother) Rejoice!

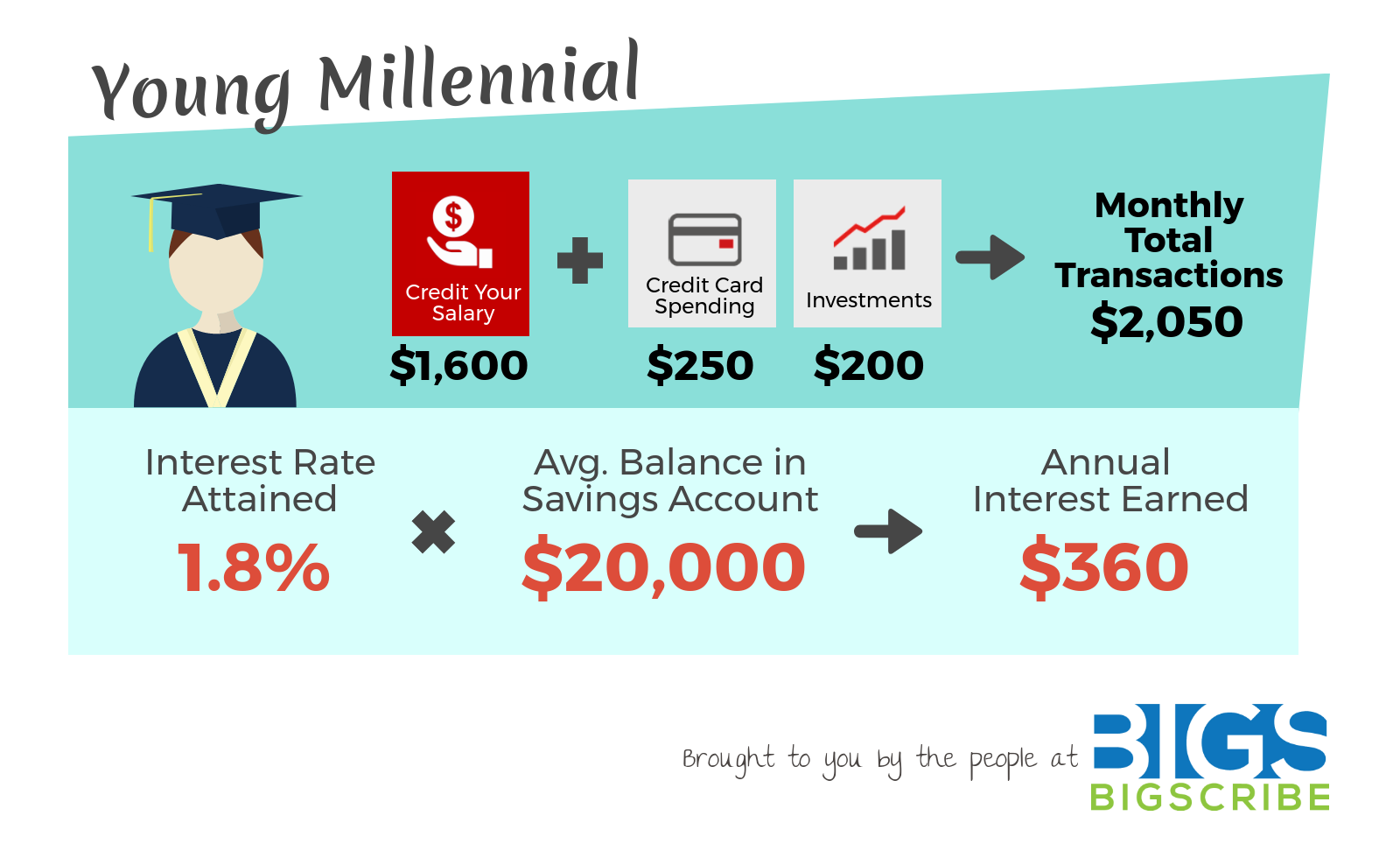

My younger brother (YB) is aged 23 and living under the same roof with us. YB has an Accountancy Diploma and is currently pursuing his ACCA certification.

He only started working full-time about a year ago and is drawing a gross salary of $2,000 at an SME. After deducting his CPF contributions, he has a salary credit of $1,600.

Since he’s a frugal millennial with no dependents, he does not really spend much and on average, clocks about $250 on his credit card on transport, dining and entertainment. He can continue using The DBS Live Fresh Student Card which he received during his Polytechnic days. It is a great credit card for him and can also be used for EZ-Link transactions.

And upon my encouragement several years ago, he started his investment journey, setting aside $200 every month and investing it in the STI ETF with POSB Invest-Saver.

However, unlike the Mrs and I, he has not been able to take advantage of higher interest saving accounts. Since his salary credit is below $2,000 and his credit card expenditure is below $500, he could not qualify for any of them in the market.

But the game-changing New DBS Multiplier Account is a godsend for folks like my Brother.

Since he has about $20,000 of balances in his savings account, from now, he can earn $360 of annual interest. It is an amount not to be sniffed at and can definitely help offset some of his ACCA course fees.

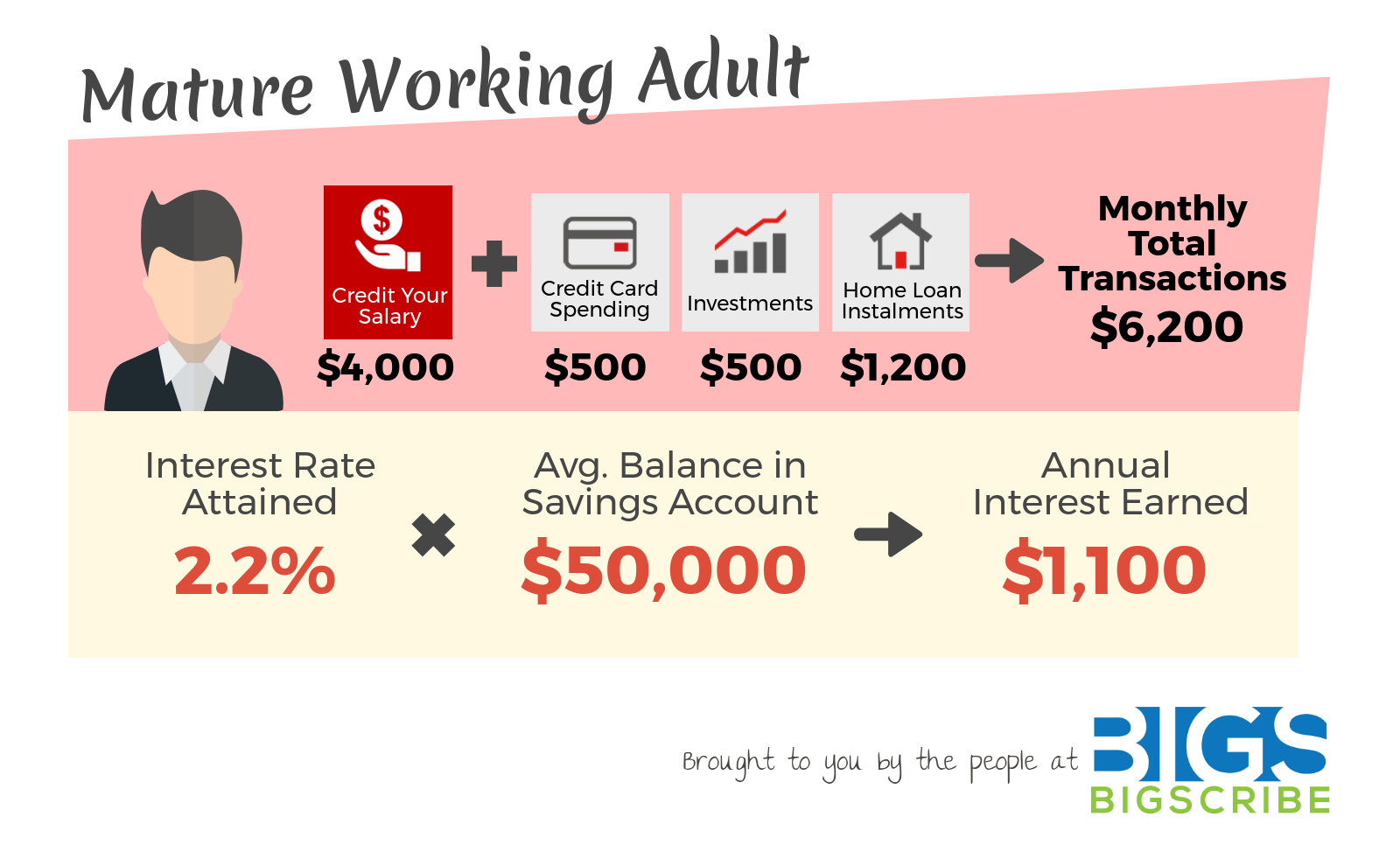

Grow With DBS Multiplier

The DBS Multiplier Account also offers long-term value to millennials like my brother. As financial commitments increase and we pursue more aspirations, we can earn both higher rates of interests and higher amounts of interest with the DBS Multiplier Account.

Changes in our life include:

- Increases in Income

- Buying a house and taking on a Home Loan

- Forming a family and purchasing Insurance for protection

- Increases in Investments

- Increases in Saving Balances

Conclusion

The DBS Multiplier Account caters to our need for flexibility as we begin to learn how to manage our finances. It’s simple, easy to understand and most of us can qualify for it once we step out into the workforce.

It’s a hassle-free account that retains liquidity yet provides higher interest.

So sign up for the DBS Multiplier Account today!

This article is written in partnership with DBS Bank. I only believe in promoting products and services that I would use myself, and when I believe they are of value to my readers too. The views in this article are strictly mine.

wow, i am impressed. the DBS website is not even updated. but you have all the info in your blog already!

this is indeed good for people with lower income, with no min sal.

just that the highest hoop of 3.5% is quite hard to achieve though.

just noticed the last tier from 2.3 to 3.5 is a huge jump too!

Hi FC,

I guess it’s whether the 1.8% to 2.3% interest is appealing enough.

I agree for the 3.5% tier, it’s either you ‘can’ or ‘cannot’ hit it. Not much point trying. 😂

Good share! Just that I am not sure how many of us can actually hit the last tier lol. And for those who can probably won’t be too bothered to open an account like this?

Hi RT,

You are right. For someone with more than 20k income, the 3.5% interest on $50k is really akin to a drop in the ocean.

Quite smart of them — they literally get the whole pie for those before 2% and after 3.5%. After 2.3, before 3.5 uob one, maybank, BOC share the pie.

Hi Jarwey,

On behalf of DBS, I hope you are right. Besides comparing the interest rate, the most attractive feature of the DBS multiplier is no min on any category and there is a lot of flexibility involved.

To qualify for 2.08% with just salary crediting + 1 extra transaction the monthly amount must be more than $30000.

How many millennials can hit that kind of volume in terms of their monthly transactions… There’s not much incentive to try for the tier above $5000 imo, and at that level there are comparable or maybe even better accounts out there…

Hi Don,

That was my initial assessment too. It’s really whether the 1.8% to 2.3% interest is attractive enough if you qualify for at least two categories.

For some higher income earners, they might be able to hit the 3.5% on a consistent basis, otherwise it’s quite impossible for most.

Thanks for the article! Do you know if its possible to use the Multiplier Account with SAYE to qualify for DBS BYOB?

Hi KY,

I don’t think that is possible as they are two separate accounts/schemes.

With the introduction of the revamped DBS Multiplier, they have also closed off new applications for the BYOB account.

Hmm, I registered for BYOB but haven’t had my first salary credited yet.

I remember reading on Investment Moats where he mentioned that DBS BYOB could be use with POSB Cashback Bonus.

Considering both POSB Cashback Bonus and DBS Multiplier are Bank & Earn Programme, I was thinking if I could enjoy the 1.8% on the Multiplier account on top of 4% on BYOB.

Hi,

I blogged about possibly synergising BYOB with Multiplier account over at fighting4financialfreedom.blogspot.com. since i am alrdy crediting salary with dbs for SAYE, i though i could see how else i can benefit from the arrangement.

I opened both SAYE and Multiplier account already. Fingers crossed that i get to enjoy higher interest in both accounts.

So which one would you use in the end? In previous articles, you use ocbc 360 and uob one and posb investor savor.

Now with this new scheme? Do you want to change to dbs from your uob one? Thanks.

I just checked faq. This cannot be opened together with posb cash back. Must choose one from another. As you are a investor savor account user. And posb cash back would stop recognise after first 12 months. So would you want to switch to this? And gap the investors savor for a month or two to continue with the interest? The bad things are you need to move your balance to the new account. Which is troublesome. Posb cash back is great as you don’t need to maintain balance in the account.

Hi Considerposb,

We can’t qualify for DBS Multiplier as both the Mrs and I do not have a salary credit anymore. Otherwise, with us sitting on quite a bit of cash, we would actually enrol into both to enjoy higher interest rates on our savings.

for those with more than 150k in warchest, I think UOB One or SCB BonusSaver is better for the highest tier. the new multiplier for the 3.5% requires two categories. spending is easy but the rest of the three of which to choose one is not so easy. So we are therefore relegated to the credit salary hoop + 1 category (spending) which ends up being the same as the old multiplier. In fact, the old multiplier is easier. just deposit salary and that’s it to get the same interest. So i think DBS new multiplier is NOT an improvement over the old multiplier from the standpoint of the customers.

UOB One and SCB BS are easier as it is just GIRO. Moreover, UOB One do not even require salary credit as one of the hoops. Since most of us will only have a single salary credit, we can put salary for SCB BS and do the credit spending and 3 GIRO transactions for UOB One.

Hi,

I read the FAQ and noticed that current RSP products are not recognised for this multiplier account. Only those that are newly set up are recognised, so your brother’s transaction would only be $1850 instead.

Also they make it quite hard for you to terminate and reopen. You need to fully redeem your units and wait for 6months before setting up the RSP again.

Do correct me if im wrong!

Just use maybank SaveUp and UOB. These are the better ones … what’s so great about DBS? they never had any good savings account … are you being paid by them to advertise ? =p

see how I manage my freeflow cash http://my-radical-thoughts.blogspot.com/2017/10/my-bank-accounts.html