There wasn’t many opportunities to spend alot of money in October as both of us were very busy with lessons during the exam period. We just spent slightly above $3,300 this month. And as always, we don’t really hold back on eating out.

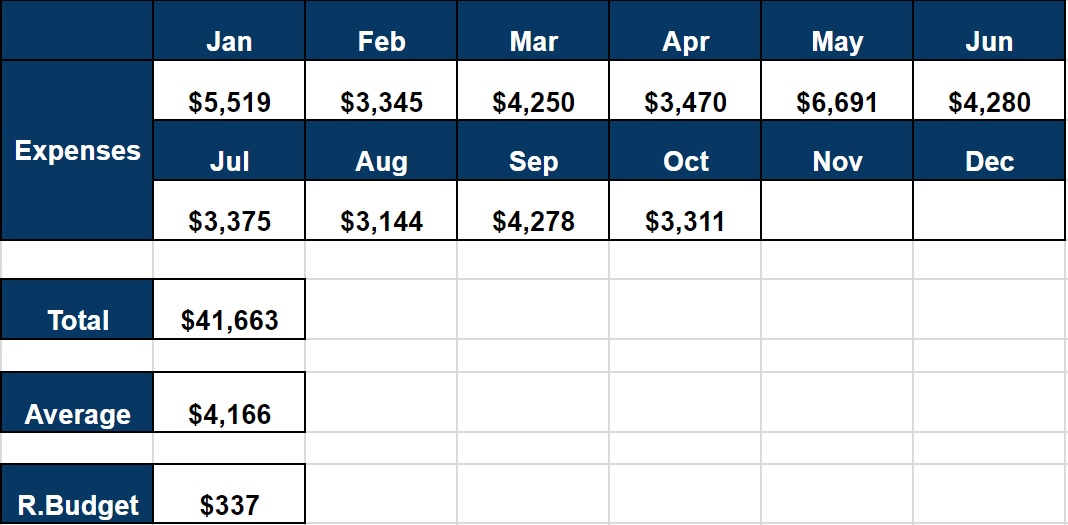

We have just about used up the year’s budget. On hindsight, that was too lofty a goal and perhaps we should just congratulate ourselves if we can stick to $50,000 every year and be shielded from lifestyle inflation. Thus far, our average expense per month is about $4,166.

The next two months are likely to be spendier months as will be taking a break from work. Moreover, we will also be away for a one week vacation in Nov and Dec is the month of X’mas celebrations with friends and family.

Eating Out: $651.95

Hawker ($132.30) – 17 entries which also means we dine at hawkers/food centres/food courts once every other day. And we spend about $8 each time.

Fast Food ($42.30) – 2 Mac meals at SAFRA Punggol where we get to enjoy a complimentary Sundae when we order a meal. Quite shiok once in a while. And another meal at Wing Stop.

Restaurants ($477.35) – 15 entries which also means we dine at restaurants once every other day. And we spend about $32 each visit to a restaurant. A $500 monthly budget for this chief indulgence of ours seem to be fine for now.

Groceries: $214

Supermarket ($76.50) – Fewer visits to the supermarkets as we are trying to clear the fridge before our vacation.

Wet Market ($137.50) – 3 trips to the Kovan market and I need to start getting alternatives to Halibuts as the Mrs doesn’t like its fishy taste. Probably salmon, prawns and squid will rotate and take its place.

Beverages & Snacks: $32.80

Snacks ($17.40) – A trip to Gelare and a small tiramisu cake for the Mrs when she had a craving for it.

Beverages ($15.40) – A total of 4 cups of Koi green tea.

Utilities: $213.77

Electricity, Gas & Water ($116.57) – Electricity usage moderated to about 370kWh for this month. 38KWh of gas and 7.5 Cu M of water meant the bill added up to $116.57. With an additional aircon in the living room, our average utility bill has increased from $90 to $120.

Cellphones ($97.20) – $51.55 for me and $45.65 for the Mrs for our mobile services. Mine comes with upsized data to 7GB.

Transport: $100

1 EZ Reload transaction for each of us.

Departmental: $237.40

Clothes ($3.90) – Just a bag from Decathlon.

Books & Stationery ($233.50) – We purchased a new drum and some ink cartridges for our printer and one book for one of our student’s birthday.

Miscellaneous: $200

Gifts ($200) – A celebration of an auntie’s birthday. This includes a buffet meal and a small ang bao from the Mrs.

Total: $1,649.92

Overall Total: $3,310.92 (included fixed expenses of $1,661)

how do you manage to keep your house loan at only $900/mth?

how much is the original flat cost?

I’d like to share how I minimise my expenses at http://my-radical-thoughts.blogspot.com/2017/09/my-expenses.html

How do you keep track of your expenses ?

Hi Sam,

I use an app on the phone to do it.