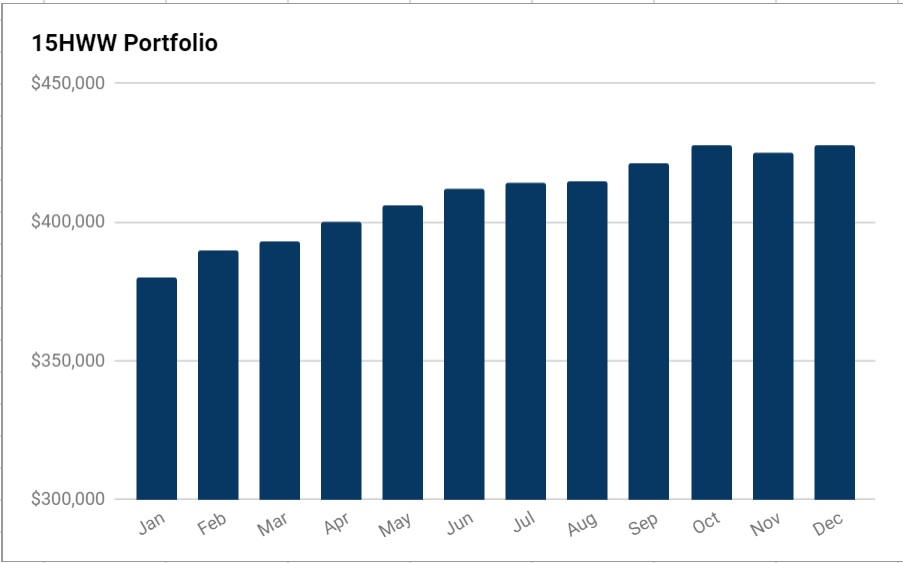

It’s a pretty decent end to the year.

Month-on-month, the portfolio managed to increase by $3,000 and the value of the portfolio is right back to where it was in October, at $428,000.

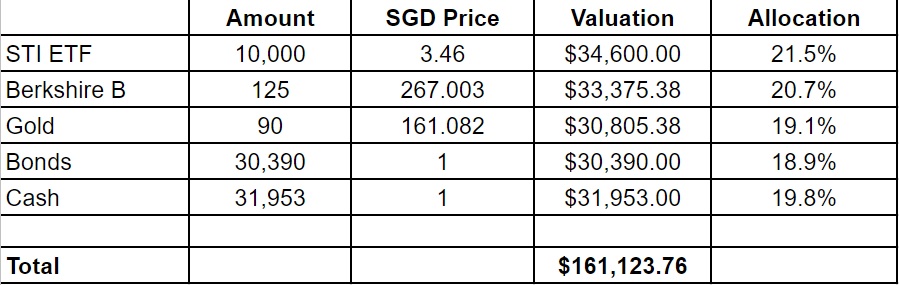

The 15HWW Permanent Portfolio continues to surprise and in fact, was responsible for most of the gains this month.

This cannot be said for the DWI sub-portfolio, which continues to underperform, continuing the trend in this second half of the year. Hopefully, its return catches up with the others in 2018.

It’s a lean income month so not surprisingly, there are no transactions at all for this month.

Overall Portfolio (Value: $428,000)

1. 15HWW Permanent Portfolio

Berkshire B has been on a tear and is up close to 10% as compared to the previous month. This more than offsets the drop for gold.

One tranche of the SSBs and the FCL bonds gave out coupons, adding a few hundred dollars to the cash position.

USD-SGD Rate: 1.35

UOB 50 Gram PAMP Gold Price: $2,718 x 6 = $16,308

Annualised Return: 7.7% (Jan 2017 to Dec 2017)

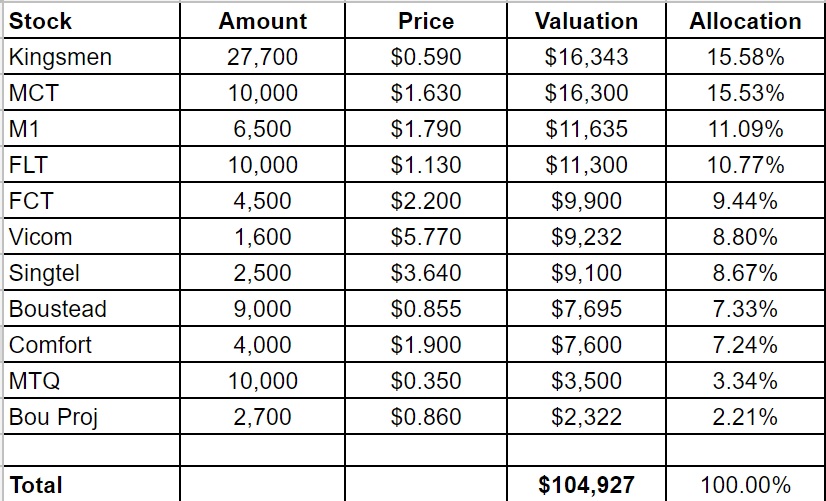

2. Personal Picks

This sub-portfolio actually did well to maintain its value, considering Singtel just went XD.

The star performer this month has to be MCT, up almost 5% from the previous month while Comfort remains abysmal.

Annualised Return: 6.7% (Nov 2010 to Dec 2017)

Annualised Return: 6.7% (Nov 2010 to Dec 2017)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few comments and indicators below.

The sub-portfolio, largely made up of small caps, is lagging way behind the indexes for this year. Does it mean it’s a good time to add? I actually think so.

I am almost definitely sticking to this strategy for at least 5 years before fully evaluating it.

Portfolio Value: $74,449

Number of local stocks: 6

Number of international stocks: 4

Annualised Return: 4.0% (Sep 2016 to Dec 2017)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed into the markets.

There is a small increase of $1,000 since we received some bumper dividends.

Warchest Value: $88,000

“I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. ”

Do you mean you paid $2K over for 2 yr access ? So far annualized return is 4% which just managed for now to cover the subscription fee?

https://drwealth.zaxaa.com/checkout/signin

Am considering by 2K seems quite high.

Good wrap up for 2017.

It’s been tougher to find undervalued investments of late (maybe I’m not looking hard enough and/or looking in the wrong places).

May we have bumper harvests in 2018!

Happy holidays!

That’s a nice healthy uptrend in your overall portfolio! Congrats on the good result! A 20% cash balance + some gold is a good buffer….that reminds me….time to get get some gold coins for when the zombies come.

Hi Mr C,

Gold coins or crypto coins? Zombies might find it harder to access those crypto coins? Lol

Hello I just can not understand the gold price in your portfolio- how is the figure of $30,805 reached ? This is singapore dollars or US dollars ?

What does the number 90 mean ? what does the number 161.082 mean ?

Hi dr denis,

You can refer to this post here.

https://www.my15hourworkweek.com/2017/01/17/the-15hww-permanent-portfolio-is-live/

Basically, it is made up of two components, physical gold bars and SPDR Gold Shares listed on SGX. 161.082 is the price of the Gold Shares in SGD.

Hope the above helps.