As we pre-paid for one of our trips in 2018, it’s no surprise that the past month’s expenditure surged past $5,000 again. In a month of celebration, catch-ups and gift-giving, we spent about $5,300.

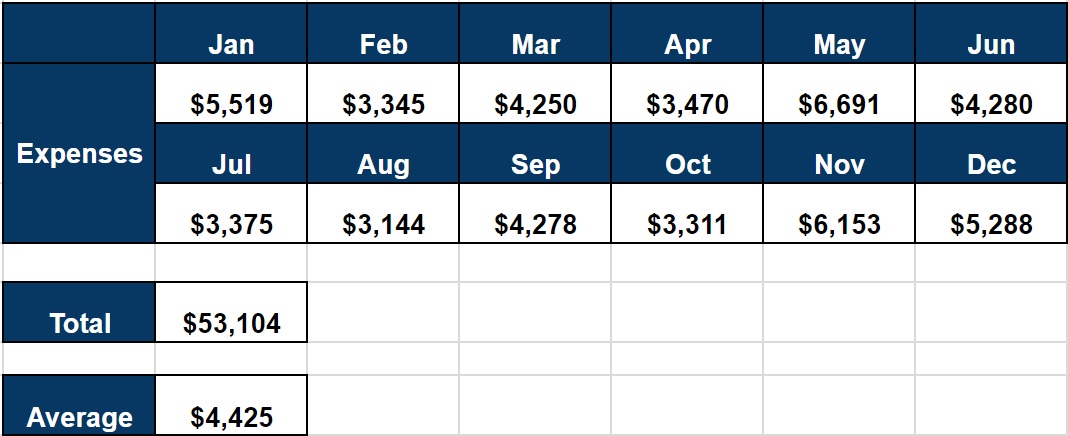

With December’s entry, the yearly expenditure came in at $53,000 and on average, we spent about $4,400 a month. This is an amount slightly on the higher side as I was quite confident we could keep to $50,000 at the start of the year.

It’s really alright though since we were still able to clock a very decent saving rate on our income. Moreover, there has been really no conscious attempt to control or rein in the expenses over the past year.

I will probably summarise the entire year’s expenditure and post some thoughts of them in an upcoming post.

Eating Out: $630

Hawker ($168) – There were about 18 entries so it’s quite clear we are not cooking as often as we should be.

Fast Food ($43.80) – 1 entry each at Wing Stop, Burger Up and Mac. We met up with some friends recently who have not ate Mac for years. I am really pondering ver whether we should do a blanket ban on fast food for at least a few months.

Restaurants ($418.20) – 10 entries and we spent about $40 for each visit. What’s interesting is they were all at different places and about 4 were meet-ups with friends to catch up. There were also two occasions when I went to for low to mid-tier buffets and truth be told, I didn’t really enjoy those meals. I think I have come to the stage where I can no longer enjoy gouging myself silly on buffet spreads.

Groceries: $137.65

Supermarket ($50.45) – 4 trips to NTUC Finest.

Wet Market ($87.20) – Just 2 trips to the Kovan market as lessons started resuming and there were some weeks when we didn’t have free mornings. One highlight was that we invited a friend over and cooked some salmon for lunch.

Beverages & Snacks: $91.70

Snacks ($79.60) – Two Bing Su, two Godiva icecream (1-for-1) and a impromptu durian purchase in the middle of the month.

Beverages ($12.10) – Two cups of Koi and some sugar cane at a hawker centre.

Utilities: $215.10

Electricity, Gas & Water ($117.90) – Electricity usage was about 380kWh for this month. 38KWh of gas and 7.8 Cu M of water meant the bill added up to $117.90.

Cellphones ($97.20) – $51.55 for me and $45.65 for the Mrs for our mobile services. Mine comes with upsized data to 7GB.

Transport: $100

1 EZ Reload transaction for each of us. This is one area I might not track so closely as I begin to use Grab Shuttle Plus services in Punggol and get involved in bike-sharing services. There’s temptation to lump all of them in as fixed transport costs at $100 a month.

Departmental: $682.40

Clothes ($323.60) – I am responsible for most of these as I bought a jacket and some long pants to renew the wardrobe during the year-end sales.

Personal Items ($30.80) – I changed my Casio watch strap and the Mrs bought a lip balm and some shower wash.

Books & Stationery ($328) – Assessment books and storybooks from the Popular Bookfest at Suntec.

Miscellaneous: $1,770

Gifts ($420) – A wedding lunch and the bro-in-law’s ROM reception.

Travel ($1,350) – We bought air tickets to Phuket and booked a 5 night stay at this fancy Amatara Wellness Resort during May. We like to make arrangements for a trip right after coming back from a vacation. This maximises the utility since we can then spend the next few months looking forward to the beach holiday.

Great work sticking roughly in line with your target on expenses while over performing on savings and investments!

Cheers to 2018!

Hi JF,

Thanks for your comment and encouragement!

53k for 2 pax is pretty impressive with vacation expenses included. I am looking forward to your next post!

Hi KPO,

It might take some time and effort to piece everything together so you probably have to wait till the middle of this month.

This year, i think my family spent around the same amount or slighly more.

If include opportunity cost, it will be beyond my imagination.

Hi Frugal Daddy,

With a new family member, spending slightly more is to be expected.

Hmm, how to include opportunity cost in our expenses?

I was unemployed and forgo my bonuses. But it is a spiritually worthwhile period that dont make financial sense