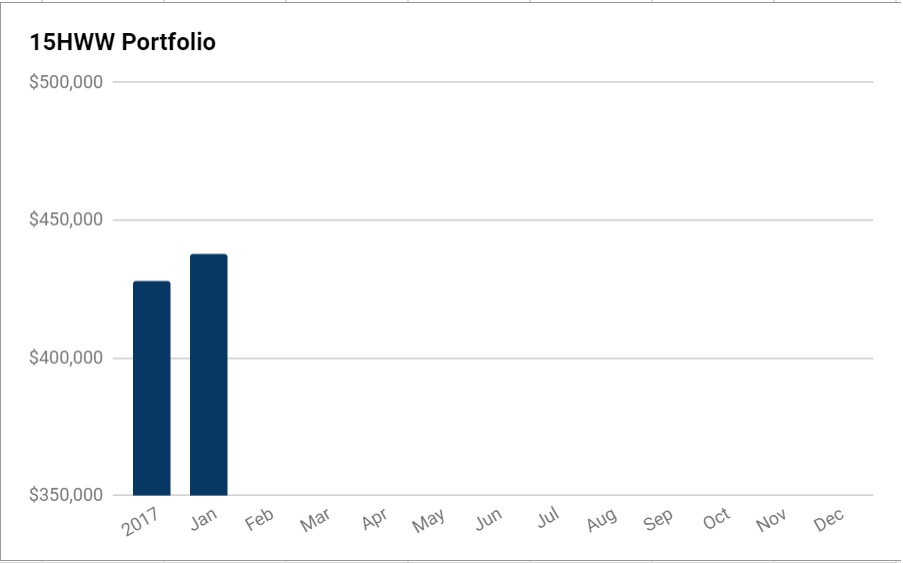

Similar to 2017, it’s a terrific start to the year for the markets.

Month-on-month, the portfolio managed to increase by $10,000 and the value of the portfolio is now at $438,000.

With work gearing up, we managed to inject $2,000 to the portfolio. This also means that the organic gains total $8,000 this month. In fact, all three sub-portfolios registered gains!

Even though my stocks are still under-performing the index, I am definitely not complaining. Let’s see how long this bullish sentiment lasts.

Overall Portfolio (Value: $438,000)

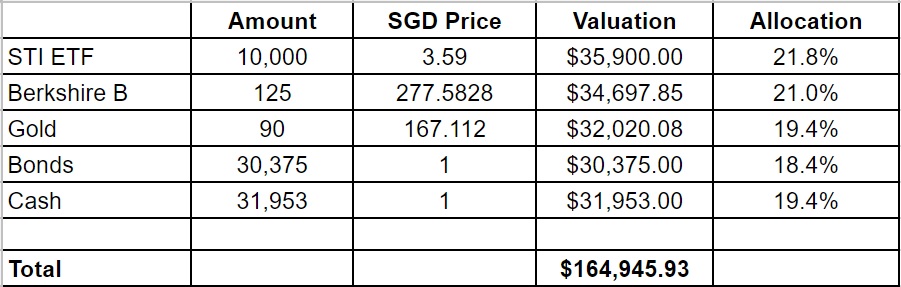

1. 15HWW Permanent Portfolio

It’s quite incredible that all three of STI ETF, Berk B and Gold are up this month!

However the rise of Berk B and Gold prices in the past year is tampered by the appreciation of the SGD against the US dollar. One year ago, the USD-SGD rate was at 1.42 and it’s now depreciated to 1.32. That’s a 7% difference!

Otherwise, the return of this sub-portfolio would be even higher than the already impressive 9.5% p.a.

USD-SGD Rate: 1.32

UOB 50 Gram PAMP Gold Price: $2,830 x 6 = $16,980

Annualised Return: 9.5% p.a. (Jan 2017 to Jan 2018)

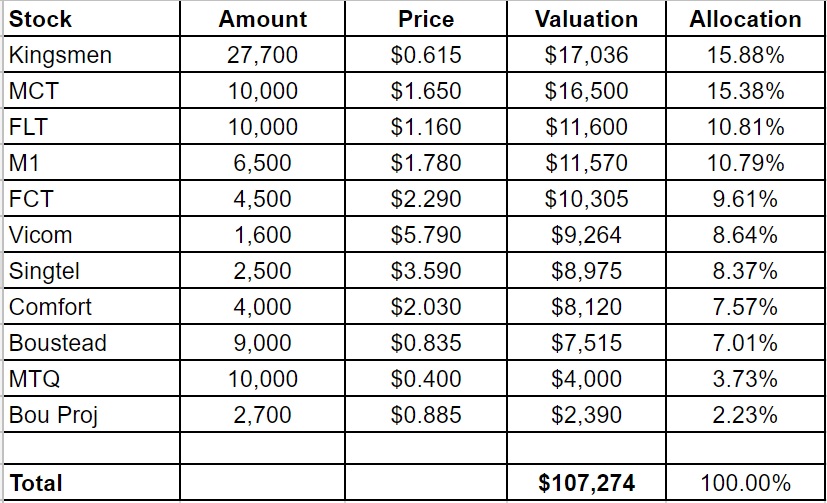

2. Personal Picks

Kingsmen and the REITs did well this month and the sub-portfolio registered a 2% gain from last month.

Annualised Return: 7.0% p.a. (Nov 2010 to Jan 2018)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few comments and indicators below.

The sub-portfolio, did ok this month and managed to increase by 1.5% in tandem with the overall market.

Sub-portfolio Value: $75,570

Number of local stocks: 6

Number of international stocks: 4

Annualised Return: 5.3% p.a. (Sep 2016 to Jan 2018)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

This month, there is an additional injection of $2,000 from the savings of our income.

Warchest Value: $90,000

Hi, for annualized returns- do you include dividends as well?

Hi June,

Yes, I have included dividends, coupons and interest in the returns.

Good summary! Your post helped me a lot in constructing my own portfolio.

Have you considered buying Daily Leverage Certificate on STI or HSI Index to ride on the rising wave?

Hi Ryan,

At this point in time, I am still quite conservative and prefer not to utilise leverage in my investments.

why permanent has Cash, warchest also Cash ?

Hi Nicholas,

The sub-portfolios are kept quite separate. The warchest is meant more for additions to the Personal Picks and DWI sub-portfolios if the market corrects. Whereas the Permanent Portfolio part will be auto-rebalanced once the threshold/rules apply.

did you regret buying into DWI stocks?

Global indices rose by 10-20% worldwide. Why not consider them?

Also very few people beat the market, so why not just join them? Save time and increase ROI.

Also why not buy overseas stocks such as China’s BAT and US’s high-growth?

I find local stocks less and less attractive.

Hi TMC,

I wouldn’t classify it as a “regret” so fast since it’s impossible to ALWAYS be outperforming an index.

It’s mainly a tool to diversify and interestingly, it’s closing the gap on the indices in the past couple of weeks.

As for those high-growth tech stocks, my take is now is probably not a good time to go into them.