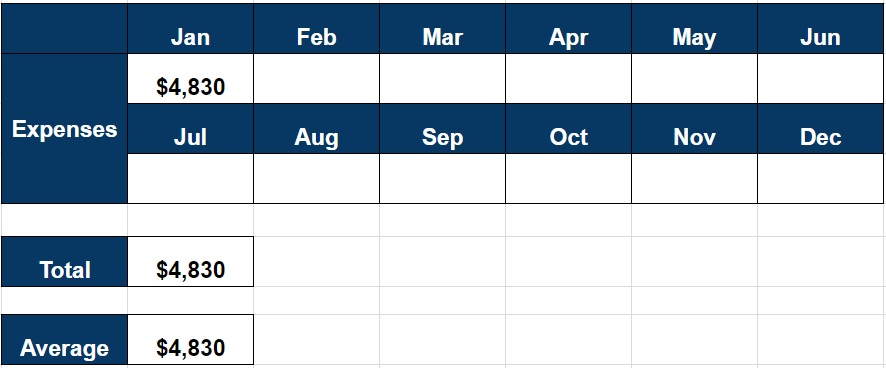

This is probably another frivolous spending month. We spent more than $4,800 in January and besides a bigger than usual restaurant allocation, there were quite a few one-offs like a trip to the dentist and aircon servicing.

Well, the higher expenditure is nothing surprising since the Mrs’ birthday falls on January and we are also getting ready for CNY. Moreover, we also celebrated our 10th dating anniversary! Omg, I feel so old.

Since this is a new year, I have made some changes to this expenses reporting front. Besides adding some photos to make it more interesting, it will also be a better store of memories. There is also a new category called work where all work-related expenses will be parked under. This will allow me to have a better grasp of our core spending.

Eating Out: $1096.20

Hawker ($231.10) – With the school calendar starting, work is almost at full gear and there are days when it’s inevitable we have to eat out. There are about 23 entries so it’s quite clear we are not cooking as often as we should be.

Hawker fare can be quite expensive when you eat out at places like Zai Shun Curry Fish Head as we made a trip to Jurong East.

Fast Food ($22.80) – 2 entries at Mac together and another 1 at KFC for the Mrs.

Restaurants ($842.30) – This is extremely high as there were three meals that cost more than $100. A semi-buffet at St Regis, a crab feast with the extended family and another meal at Japanese restaurant Rakuichi.

I enjoyed the place and the spread and it’s likely that we will come back again. The Amex 50% discount helps make the cost much more palatable for us.

Other than that, there were the usual restaurant meals at places like Dian Xiao Er.

One of the most worth it set lunches out there. We have it at least once a month.

Groceries: $313.40

Supermarket ($170) – 7 trips to NTUC Finest @Waterway Point as we start stocking up packet drinks and frozen food which are especially cheap as we approach CNY.

Wet Market ($143.40) – 4 trips to the Kovan market on weekday mornings.

This is also where we have our favourite wanton noodles.

Beverages & Snacks: $101.91

The nuts from SnackFirst and some Chinese New Year goodies bought from across the Causeway.

Utilities: $112.43

Electricity, Gas & Water ($15.23) – Electricity usage was only about 210kWh for this month as we reduced aircon usage during the cold spell. 38KWh of gas and 7.4 Cu M of water meant the bill added up to $80.23. The U Save GST voucher reduced the bill by $65.

Cellphones ($97.20) – $51.55 for me and $45.65 for the Mrs for our mobile services. Mine comes with upsized data to 7GB.

Transport: $50

1 EZ Reload transaction for the Mrs.

The average public transport cost for each of us is about $50 a month and since there’s little variation and a small amount, it’s likely this will be part of fixed costs by the middle of 2018.

Departmental: $409

Clothes ($241) – Each of us bought a pair of Skechers and a new towel. The Mrs also bought a top and bottom for CNY.

Personal Items ($126) – My Casio finally gave way and I got a new replacement. We also got some supplies from Watson’s.

The Casio W-735H. It costs about $46 which is ~100% more expensive than my previous watch. This is lifestyle inflation creeping up on us.

Electronics ($42) – We got a new charger and a wire as the previous one was spoilt.

Work: $428

Books and Notes ($183) – Assessment books and papers/notes purchased online.

Gifts ($150) – CNY goodies for the students and parents. A parent/close friend remarked that we enjoy gifting. I guess that’s true!

Electronics ($95) – A new ink toner for the printer. We print lots of stuff for our students.

Miscellaneous: $657.80

Gifts ($84) – It’s the FIL’s birthday and we had a meal at Hai Di Lao. The bill was split between us and my BIL.

Medical ($299) – A trip to the dentist for the both of us. My bill came up to quite a bit as two fillings have to be performed. I really think my dentist is raking in the money.

Others ($274.80) – This includes the gym pass at SAFRA Punggol and the servicing of our aircons.

Yes, the aircon started dripping water. And servicing aircons are not cheap. It’s probably a technical skill that pays decently well now and in the future.

Total: $3,168.74

Overall Total: $4,829.74 (included fixed expenses of $1,661)

Haha even with a car, I spend so much less than you!

You’ve got to control expensive trips to restaurants. I dont know why people like dian xiao er. To me its just high-class economical rice and my mum’s cooking.

My record is a $80 crab buffet with my family. I do not intend to ever break it. It was both regrettable and enjoyable.

I dont go for buffets anymore as I cannot eat as much nowadays. Also eating too much is not good for health.

I only buy clothes once every few years : wear until they spoil

Hi Henry,

Wow, your Mum must be quite a great cook!

You are right about buffets and we also rarely eat that nowadays. Semi-buffets are more attractive due to the quality and the variety of food.

I guess you prefer to spend on a car whereas we prefer to spend it on food. Everyone has their “poison”.

I love posts with pictures of food in it, to that end – I love the new layout and visual appeal 😀 Oh that wan tan noodles..sluurp 😀

Since I returned to work mid December, I have been itching to eat out more and it is amazing how the cost adds up. Just my meals outside without considering Mr.C’s had added up to ~$460 in January. There was a durian splurge in there somewhere as well haha!

I have also recently discovered the joys of Chope and Quandoo, for which I’m just writing a post on as it is another avenue to make some ‘cash-back’ for money you would spend anyway. Do you use either?

Hi Ms K,

Thanks for the compliments. I was inspired after reading Rootofgood (A US blogger).

I realised his expenditure updates are much more interesting than mine and a big reason was the pictures appended.

Oh, I haven’t heard of Quandoo. Will check that out. The Mrs has tried Chope a couple of times already!

consider contract aircon servcing once a quarter. 20/unit. i suspect long term cheaper than fixing leaking aircon 😀

Hi Tutor&Investor,

I think in the end, they didn’t really “fix” it. A normal servicing solved the problem. Once a quarter is really frequent.

We are trying to make it a point to service the aircon once every half a year.

Just curious, why do you spend on notes and books and give to your students for free?

shouldn’t this be the parents’ expenditure and responsibility?

You spend quite a fair bit on your students… is this the norm in the tuition industry?

Hi Alucard,

I have no idea whether it’s a norm in the industry.

But I dislike the idea of having to “claim” from the parents whenever I have to buy additional materials for my students. I prefer to see it as my responsibility.