We saw a little bit of volatility at the start of this month. In fact, within a couple of days, our overall portfolio was down by more than $10,000 at one point in time.

This episode is a good reminder to myself that market movements are not within my control. I only have autonomy over my own actions. There’s only 3 things I can do in the stock market. Buy, sell or do nothing.

In a falling market, I prefer to narrow the choice to 2 to simplify decision-making. Either do nothing or buy some stocks.

And yes, most of the time, we did nothing. After all, we do not have a bottomless cash pile. This also meant that we did make a couple of purchases.

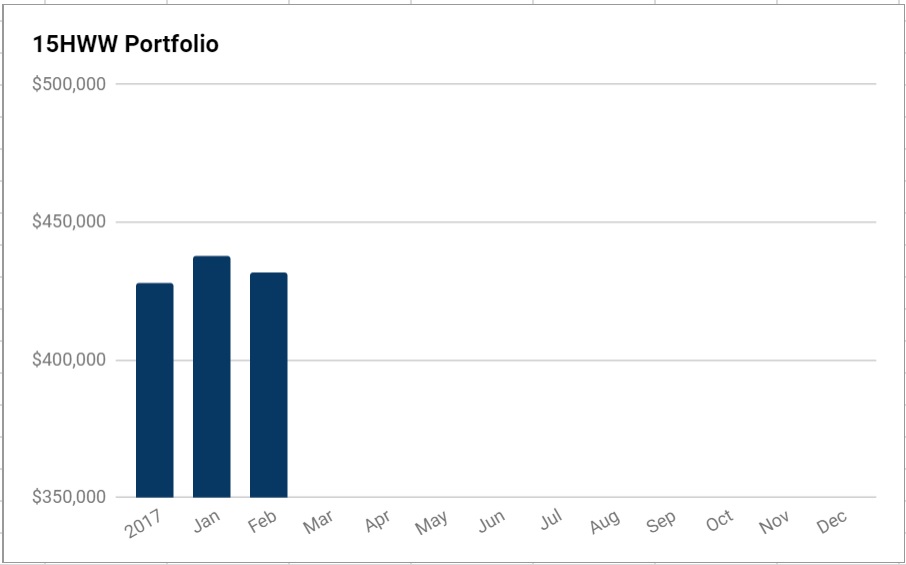

Overall Portfolio (Value: $432,000)

Monthly Change: -$6,000 (-1.4%)

Yearly Change: +$42,000 (+10.8%)

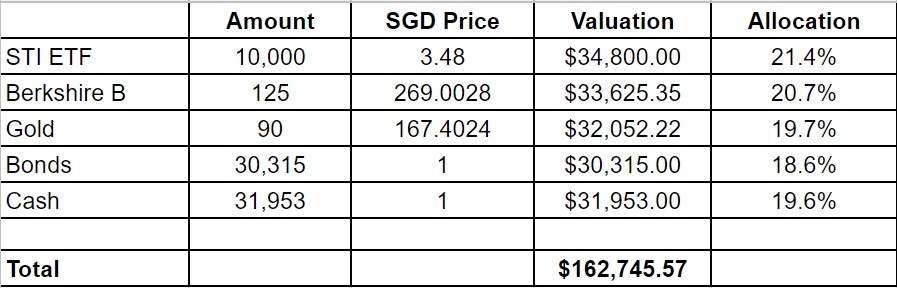

1. 15HWW Permanent Portfolio

Both the STI ETF and Berk B came down from their lofty highs last month but this sub-portfolio is still seeing respectable returns at 7.4% p.a.

USD-SGD Rate: 1.32

UOB 50 Gram PAMP Gold Price: $2,831 x 6 = $16,986

Annualised Return: 7.4% p.a. (Jan 2017 to Feb 2018)

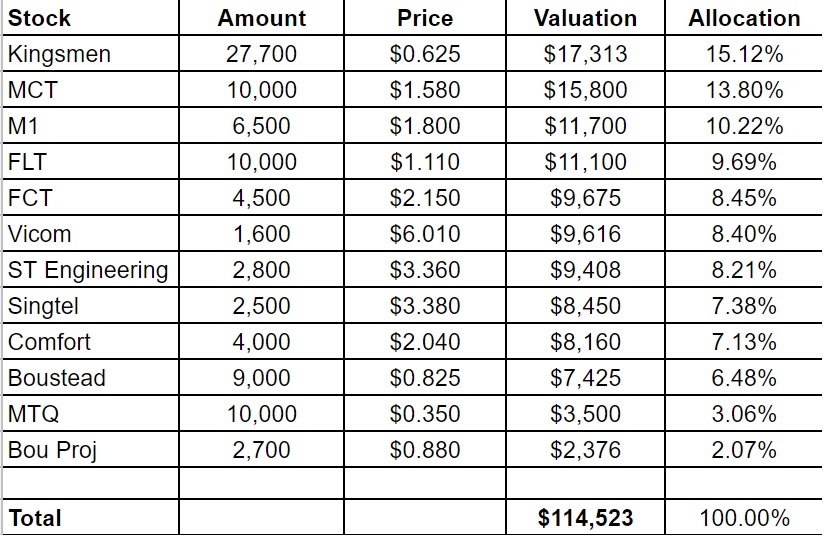

2. Personal Picks

With the looming fear over interest rate hikes and higher inflation in the US, it’s not surprising to see the REITs retreating.

I also managed to add 2800 shares of ST Engineering @$3.22 a week back.

Annualised Return: 6.7% p.a. (Nov 2010 to Feb 2018)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few comments and indicators below.

This month, one of the stocks in the sub-portfolio tanked by 25% in a single day. That’s a new experience for me and that literally wiped out all the gains I have had so far in this sub-portfolio.

It also drove home the importance of having enough diversification. Before the big drop, the stock comprised less than 2% of the entire portfolio. So even if the stock was to correct by 50%, it’s only a 1% drop overall. Something I can live with or easily recover from.

A few weeks ago, I also made my first foray into Bursa and added a stalwart of the KLCI.

Sub-portfolio Value: $80,822

Number of local stocks: 6

Number of international stocks: 5

Annualised Return: 0.7% p.a. (Sep 2016 to Feb 2018)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

Warchest Value: $74,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.

Hi 15hww

Are you applying for excess rights on MTQ?

Hi B,

Do you have MTQ? I remembered you sold it some time ago.

I am definitely going to get what I am allocated. It’s not alot of money since I only have about 10,000 shares.

But whether I can make back the losses would depend on the amount of excess rights I apply for and how much I get. I have a feeling there could be lots of rights not taken up so I could be cautious and just apply for at most a few thousand shares.

What’s your plan?

I don’t have the mother share right now but the exercise rights price at $0.20 is indeed in my opinion quite a steal.

I am still pondering if I should get mother share like you and then apply for crazy lots of excess (i also think there will be lots of excess) or then buy the rights at a later stage.

I think on a risk reward level MTQ could be worth a decent bet.

Hi what is ur expectation on the ROI of dr wealth picks and the time horizon? 25%? 50%?

Hi,

I hope to achieve above 8% in the long run. A good point to evaluate if the strategy is working would be the 5 year mark.

8% isnt exactly a lot for Value investing.

It’s like market/index return. In fact, index return may be slightly more than this.

so what’s the pt of following dr wealth?

Hi anon,

I think it really depends on the index we are comparing to. Even if it is the same, I would prefer the additional diversification.

International stocks then compare to s &p or total world index.. index is already diversified..

Dont compare to sti… it’s crappy and sure can beat the index as a consolation prize

what’s your take on those companies who have lost value such as MTQ, Boustead, Singtel, etc. ? their share prices have bottomed out over the past several years… are you going to wait for a rise again?

Hi Alfred,

Yes, I do believe in the power of “reversion to the mean” for some companies.

Arent their means on downward or sideway trend as well given they have been behaving like this for at least a couple of years

Curiously why DWI roi so low? Coz I used their strategy to get many double returns, like the recent p…, and earlier e… m…

But I didn’t join the club. Thinking to join.

Hi Tony,

I also wish the ROI is higher. Their portfolio consists of more than 30 stocks, while mine is just about 10. So it’s only a part of theirs and perhaps I have been a little “unlucky” and missed out on some of the two baggers.

Whats their track record and how much to join

Hi Henry,

I am not sure what is their current rates as it has been some time since I joined.

Best is to email Dr Wealth directly.