The volatility that I talked about last month has appeared to be a non-event on hindsight. The STI has since climbed back to above 3,500 and is just a few percentage points away from this year’s high.

Perhaps just like this recent article (which tells us to pay less attention to news and yet be more informed), we should also pay less attention to the market and just continue to save and invest for a better future. Most likely, after a decade or two, you would have built up some serious wealth by then.

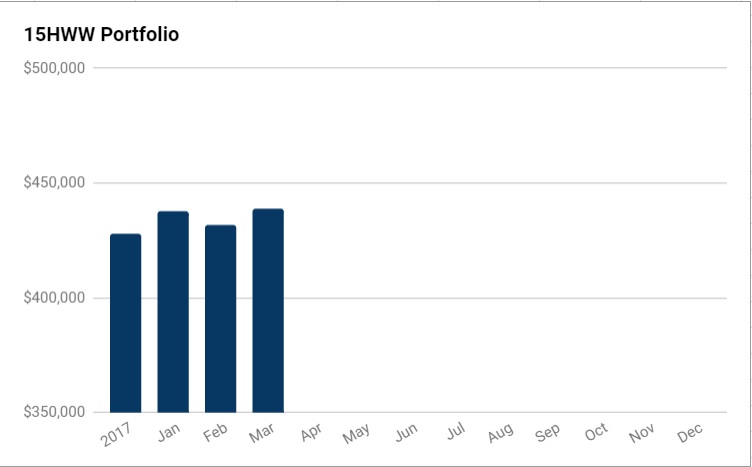

And yes, with the injection of savings, the portfolio is at a new high yet again.

Overall Portfolio (Value: $439,000)

Monthly Change: +$7,000 (+1.6%)

Yearly Change: +$46,000 (+11.7%)

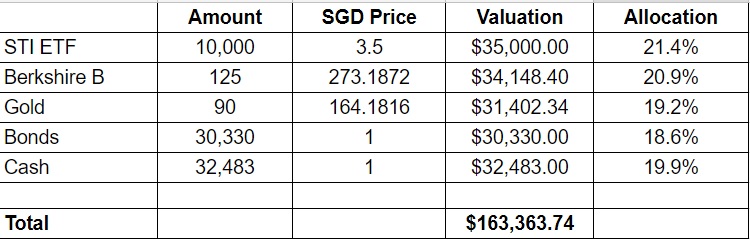

1. 15HWW Permanent Portfolio

There was not much movement in the prices of the assets and the increase was mainly due to the $500+ dividends we received from the STI ETF.

USD-SGD Rate: 1.32

UOB 50 Gram PAMP Gold Price: $2,771 x 6 = $16,626

Annualised Return: 7.3% p.a. (Jan 2017 to Mar 2018)

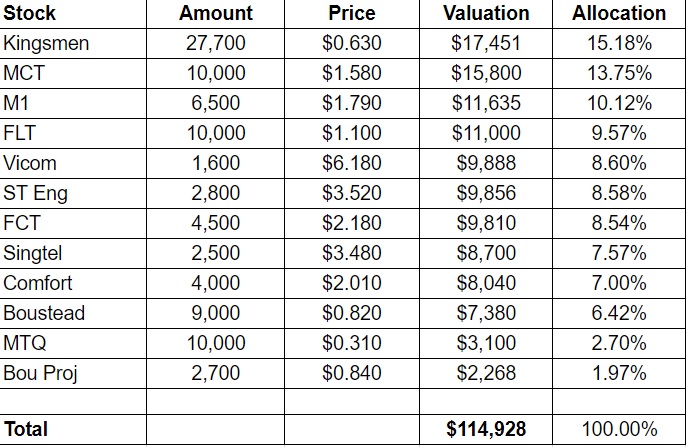

2. Personal Picks

No transactions this month.

The gains from ST Eng, Vicom and Singtel managed to offset the losses of the smaller positions such as Boustead and MTQ.

Annualised Return: 6.7% p.a. (Nov 2010 to Mar 2018)

Annualised Return: 6.7% p.a. (Nov 2010 to Mar 2018)

3. DWI Picks

I subscribe to Dr Wealth Insiders (DWI) as a form of diversification. Only time can tell if I had made a good choice. And for obvious reasons, I will not be revealing the make-up of this portfolio. However, I can probably still document it by noting down a few comments and indicators below.

No transactions this month.

The portfolio is still struggling to stay above water. But I have confidence that in the near future, one of the stocks is going to have a big gain to pull up the returns significantly.

Sub-portfolio Value: $80,476

Number of local stocks: 6

Number of international stocks: 5

Annualised Return: 0.3% p.a. (Sep 2016 to Mar 2018)

4. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

Warchest Value: $80,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.

Does any of the cash in your portfolio consist of emergency fund or the latter is kept separate (savings account?) ?

Hi LH,

Yes, curious_moo is right. I have another batch of cash and CPF kept separately as emergency funds.

War chest will never include emergency/survival funds. This are purely investment funds waiting to be deployed anytime i guess.

Hello, do you think it is a bad time to start investing in STI ETF? Given that price is at all time high…

Hi Xue,

If you are doing a monthly regular saving, I think anytime is a good time to get started.

If it’s lump sum investing, now is not a bad time since the STI ETF has already come down slightly from the high a couple of months back.

Why are you continuing with Dr.Wealth which gives you 0.3% p.a. when your own portfolio gives you ard 7%?

Hi Curious 123,

I started the Dr Wealth portfolio with the hope and expectation that it will do well than my own portfolio. To be honest, now that the Dr Wealth sub-portfolio is performing comparatively weaker, there is a stronger likelihood that future returns would be better if one believes in “reversion to the mean”.