It’s been a couple of horrible months for the stock market. Our portfolio was not spared as it went down by more than 1% even after a few thousand dollars of capital injection. So kudos to those who manage to grind out a positive return during this period.

But was May and June really bad for ALL investors?

For investors with lots of cash on the sideline, this could actually represent an opportunity to plow some funds back into the market.

I am not sure about the US market, but the index feels reasonably priced for the Singapore and HK market. I know there are some who are still expecting STI to go back to 2,000 level. Not impossible, but that would look ridiculously cheap.

Since I am allocating heavier towards indexing, I expect to continue buying quite actively if the SG and HK indexes continue to go lower.

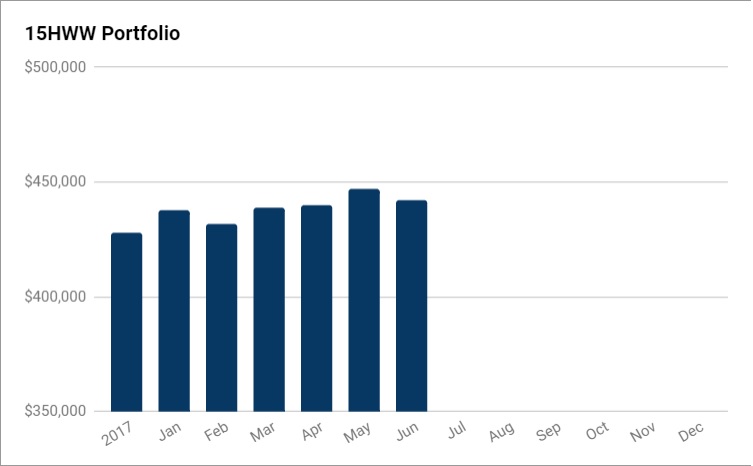

Overall Portfolio (Value: $442,000)

Monthly Change: -$5,000 (-1.1%)

Yearly Change: +$30,000 (+7.3%)

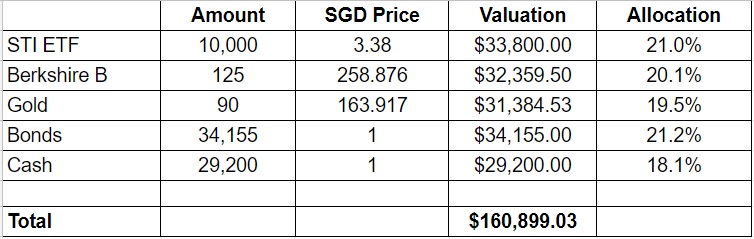

1. 15HWW Permanent Portfolio

The sub-portfolio declined by more than $3,000 with the STI ETF declining by more than 5% as compared to the previous update.

I also took $4,000 of cash and parked it in the Astrea Bonds for the slightly higher yield. Cash is still close to $30,000 with the coupons from the FCL bonds helping to replenish the cash balances.

USD-SGD Rate: 1.35

UOB 50 Gram PAMP Gold Price: $2,772 x 6 = $16,632

Annualised Return: 4.9% p.a. (Jan 2017 to Jun 2018)

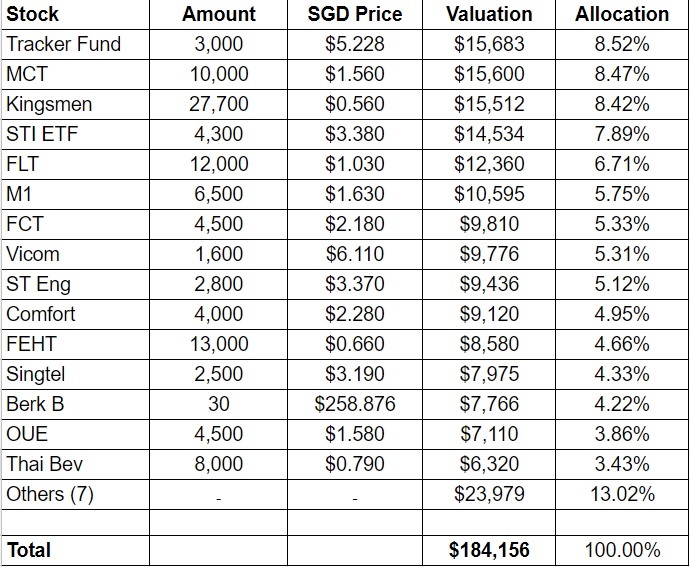

2. Personal Picks

Quite a few buys this month as I took advantage of the market weakness amidst the rate hike. Most of them centered around index plays like Berkshire B, the Tracker Fund of Hong Kong and STI ETF.

I have also grouped the smaller counters together. They include counters that have dipped below $5,000 in value, odd lots, IPO punts and a few stocks from a previous sub-portfolio.

Annualised Return: 5.9% p.a. (Nov 2010 to June 2018)

3. Warchest

This is the amount of cash or cash equivalents we have that is ready to be deployed.

Warchest Value: $97,000

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas” – Paul Samuelson

Thanks for reading.

Don’t look at index, some of the stock indeed quite cheap eg singtel, semb Corp and ST engineering.