How time flies. It’s been 5 years since I started this blog and wrote my first ever post.

I would say I have proven to be one with pretty good foresight (more obvious example is marrying the Mrs). Instead of targeting a full-fledged retirement, I had aimed for a 15 hours work week and semi-retirement then.

But what I had gotten wrong was the timing.

I thought I would only be doing self-employment after accumulating a sizable stash of at least $500k in my mid-thirties. But I pulled the plug on my first job before I even turned 30. And the Mrs followed soon a couple of years later.

So of course, since I found semi-retirement so irresistible, the answer to the title of this post is a resounding yes! This is the main premise of this blog. Otherwise, I might as well shut down this blog on this timely milestone.

If you’re still not convinced, here’s four huge reasons why a 15 Hour Work Week is more relevant than ever in your financial journey.

1. FIRE Takes A Significant Amount Of Money

FIRE is finally catching on, with the idea slowly diffusing into mainstream consciousness. But first, I shall share my own definition of FIRE.

Becoming Financially Independent and then having the OPTION to Retire Early.

There’s really not much debate around Financial Independence. It’s generally a good financial goal/target to have. What’s more controversial is Retiring Early. Some look forward to a life with no work obligations while others feel it’s a waste not to continue contributing to the economy when one is still in his/her thirties or forties.

So positioning RE as an Option should placate everyone.

However, achieving Financial Independence and then having the OPTION to Retire Early is neither simple nor easy. If not, everyone will be doing it already.

Don’t believe me? Here’s a simple illustration for emphasis.

Assuming a frugal couple or a small household that spends $40k in a year. Using the relatively conservative 4% withdrawal rule as a reference, they would require a cool $1 million before reaching FI.

And personally, it would take at least $1.5 million for us to be comfortable with the thought of no longer having to work for an income.

2. So… FIRE Takes A Significant Amount Of Time

If $1 million is the golden number, it should take most people at least the best part of two decades to accumulate that amount.

I know, I know, I know. Famous financial bloggers like Mr Money Mustache were able to achieve it within a decade. But seriously, they are unicorns among this group of financial optimisers.

To achieve what they have done, you need an extremely high income relative to expenses and maintain it for the decade.

That means if you’re making $50k annually, you need to be spending <$20k a year. If your annual renumeration is $100k, you spend <$35k a year. Or if you bring home more than $200k a year, you still keep expenses within a reasonable $60k a year.

Keeping lifestyle inflation at bay for a FULL decade is not easy.

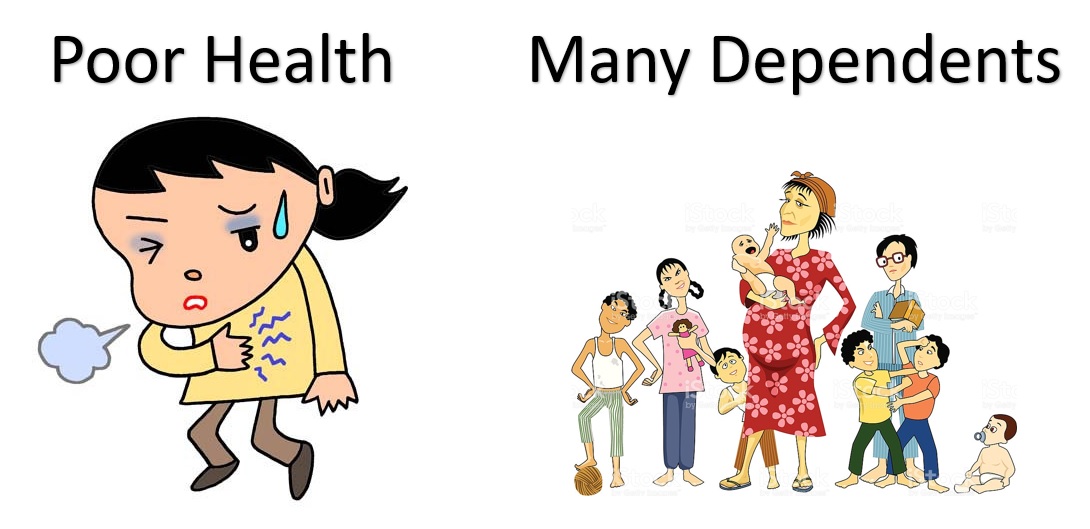

And even if you’re able to do the above, you still have to keep the below at bay.

What’s even worse is many dependents with poor health…

Before I am labelled anti-elderly or anti-children, let me reiterate that I am just being objective and pragmatic here. Long-time readers would know how much I am willing to give up for my mother to be around and to have a child soon.

3. A 15HWW Reduces The Full-Time Work Journey

So for most, it would take two decades or even longer to accumulate the entire stash to achieve FI.

Financially, I had a favorable set of circumstances. I was in relatively good health with few or even no dependents. If I were to project my earnings at my first job and maintain my expenses, I might just have been able to accumulate $750,000 within a dozen working years.

However, even a decade is too long for me, especially stuck in a job which I vehemently detested at that point in time.

Honestly I have no idea if I would live to regret my decision in the future. But, at the very least, it’s quite reassuring to know that as long as we are willing to earn some part-time income going into our fifties, we should be alright with the current modest stash we have now.

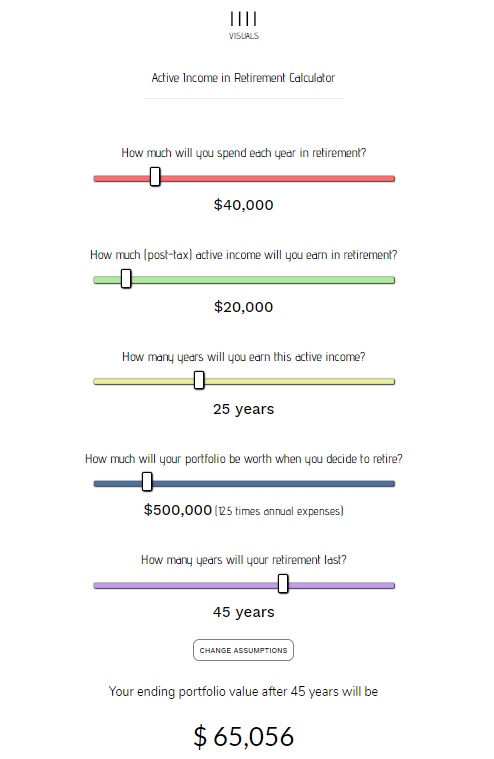

How do I know that? See the graphic below.

You can access this visual/calculator and have fun tweaking here. Besides his awesome coding work, I am also quite a big fan of this young lad’s writing and philosophy and pop by once a week to catch up on his daily posts.

I honestly think it should not be difficult to find a palatable part-time job that pays $10k a year. If one were to work 3 days a week for 5 hours each (15HWW!) and paid $15/hour, that would already add up to $11k a year.

So instead of needing to accumulate $1 million before you quit that soul-sucking job, it’s reassuring to know that all you need might be half the amount before you seek fresher and greener pastures.

4. A 15HWW Might Also Be Sweeter

Many stuck employees believe that their world will be perfect when they are able to leave their jobs. So they either actively plan for FIRE or buy TOTO. =p

And then without a doubt, exercise the OPTION to Retire Early once they manage to secure it. I know because I have been there before.

I am not saying that you will not enjoy a carefree life of leisure without work, but going by evidence and my own experience, that’s quite unlikely.

Life will never be perfect and there’s likely some things you will miss about work besides the monthly salary. There are some invisible perks to work besides the income, especially part-time or self-employed work, where the upsides could likely outweigh the downsides.

Let’s use myself as an example.

Introversion is being bandied around so often that I believe the word “reclusive” is more suitable to describe myself. Yes, by default, I prefer to stay at home.

So what would I be doing if I didn’t have to work? I could imagine spending more time than desired/expected watching movies or playing games. Basically consuming alot of digital media. The lack of a structure could potentially cause most days to descend into chaos, which happened during my sabbatical.

But the fact that I need to work, go for lessons forces me to go against this default reclusive nature of mine and meet people. Besides instilling some structure and discipline into my life, I also have to acknowledge that the social interaction with students and parents helps keep me sane at times.

Afterall, no man is an island and humans require social interaction, especially “to belong” in a community.

At the same time, there’s alot of pleasure or short-term gratification from just watching movies or playing games, but such activities lack meaning in the long run. Going for lessons can often be a sharp contrast. It takes considerable effort, but there’s alot more meaning to that activity. It can be oddly reassuring to know that I have made a meaningful contribution to improving their understanding, results and future prospects.

It’s just like writing this post. The opportunity cost could be sleep, FB scrolling, Youtube bingeing or (worse) watching France vs Denmark. There’s a little bit of dread when I begin writing, noticing the pull towards other more “pleasurable” alternatives.

But it’s all worth it when I have completed this last sentence.

I’ll be sad if you decide to close shop and will miss your sharings. 🙂

Hi ting,

Thanks for your super kind words! Very honoured and don’t worry! It’s likely that I enjoy writing and personal finance too much that I would never stop sharing on this blog.

Hi Mr 15HWW,

You and I have similar mindset about quitting rat race and I am also “reclusive” in nature.

I envy you that you managed to find such a supportive wife who is willing to go as far as you in achieving financial independence.

Can you share your “secret” on how to find such girl?

Hi TheIpohInvestor,

I really don’t know how to answer your question. Maybe make sure you are “deserving” of the woman?

I only know you just made Mrs 15HWW smile. =p

Thanks for the shout out! Glad you found value in the Active Income Calculator 🙂

Hi Zach,

No problem. All the best with your writing and financial journey. I am most impressed by your tenacity, publishing a post every single day. Wow!

Why are some people so concerned about contributing to the economy?

I’m only concerned about having not to work and just retire.

Working after a while becomes quite meaningless. You’d become a robot doing the same thing every day.

Hi Wanna to retire,

I honestly think most people hate work mainly because of the ridiculous amount of hours it takes and the inflexibilty

If the job’s workload and working hours are halved, and annual leaves are doubled, (of course with an accompanying 50% pay cut), I think most people who reach FI could be willing to continue in their job.

Main because there’s perks to contributing and creating rather than just consuming.

Great post!

I am on sabbatical now and am totally enjoying it so far. It’s both the tangible and intangible parts of work that I do not miss.

But since I have a stay-at-home-mum role to fulfil right now, things appear to have a little bit of “structure”, since my life revolves round my two kids.

Hi Kate,

I think for most parents, it might actually make alot of sense to take a 10-15 year break to spend more time with the kids.

And then after that return back to some form of part-time work since there is a high chance your kid won’t be home for most of the day too =p