So the STI ETF has fallen from a peak of 3,600 in early May to around 3,200 right now, a more than 10% drop that puts us at correction territory. Honestly, it’s not much for now, although we cannot rule out a repeat of 2015 (a more significant 25% plunge).

From what I have observed, some people are getting uneasy with the developments. It’s funny how one is always more affected by stock price dips as compared to property price dips. If a potential buyer of your house offers 10% lower than than two months ago, you will just ask him to f*** off. When stock prices decline by 10%, self confidence disappears and plenty wallow in pity.

In the event that things get worse before better, I feel the below measures could help me cope somewhat. So why not share them?

1. Do Not Check Stock Prices Frequently

It’s quite hard to ignore the stock market on a daily basis for me due to the number of Whatsapp and FB groups that I am involved in. I try to keep up with them because I genuinely do find the topics and people interesting.

But does it improve my investing results? I highly doubt it.

In fact, for most people who are relatively new to the market (which includes me), checking stock prices every day or every hour can be quite hazardous to your financial health.

When you check stock prices very often, you will more likely:

- Sell in a panic when stock prices decline (thinking the sky is falling)

- Deplete cash too fast when the drop is still quite mild (this really applies to me)

So you could really do yourself a favour by checking in less frequently.

2. Frame Your Stock Investments As A % Of Total Assets

If you are mostly invested in the local index, your stocks should have dropped about 10% from its peak this year.

And if your asset breakdown is similar to the one below and have less than 10% in equities, it just means that your total assets dropped by………1%!

Which is really a pin drop in the ocean.

In terms of equities, the Mrs and I are much more aggressive than the typical household. Broadly speaking, 40% of total assets is in our home equity, 30% is in cash/bonds and another 30% is in stocks.

Even in a quite worst case scenario where stocks drop another 30% from this point, to put things in greater perspective, it’s still a <10% drop in terms of total assets.

When we frame poor equities performance this way, it’s much easier to embrace it and soldier on.

3. Corrections Are Very Normal

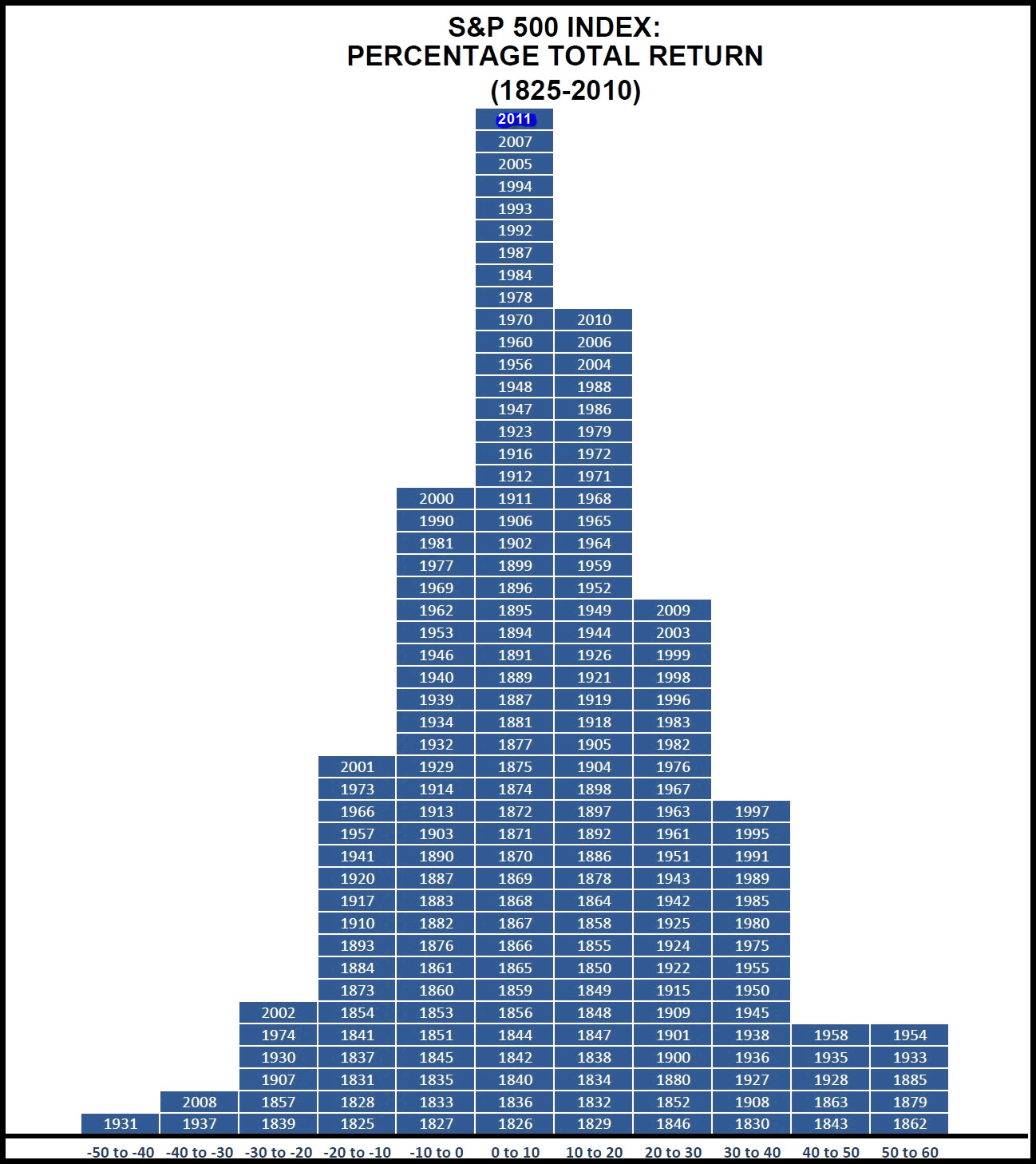

A picture speaks a thousand words.

If we take reference from the US stock market, a correction of up to 20% happens about 20% of the time during the past two centuries. Basically once out of every 5 years, which is pretty common.

So don’t be surprised when such corrections happen. And when a bigger bear comes like in 2002 and 2008, you should know what you need to do to take advantage of these rare opportunities!

It’s hard for most to see and feel this. But corrections are just an opportunity for you to buy more stocks at lower prices. And even more importantly, it’s ok to miss it if you are not comfortable with investing more.

The two pictures above are “koped” with pride from Dr Wealth and STE Investing Journey respectively.

Hi Mr 15hww,

Can I check how do you calculate the life insurance in your pie chart? Is it the payout amount?

Thanks

The Su

Hi,

I think insurance would likely refer to the surrender value of the policies.

ok. thanks

Fully agreed with on point 2

Hi CW8888,

Yes, property and CPF more important.

‘If a potential buyer of your house offers 10% lower than than two months ago, you will just ask him to f*** off. When stock prices decline by 10%, self confidence disappears and plenty wallow in pity.’

I love this phrase. Its really something I cant comprehend up till today, when I am still seeing many cries at a 10% market correction.

Hi CS Jacky,

Glad you appreciate it. It’s really a very small adjustment in the grand scheme of things.

Seems Singapore is the hub for investment as I can see various investment opportunities. Thanks for sharing.