There’s probably no need for a fan today, not to mention the air-con. It’s been pouring non-stop throughout Singapore and temperatures have dipped below 23 degrees celsius.

Brrr….. Achoo!

If I had a bowl of piping oyster mee sua or lu rou fan in front of me, I could easily imagine myself in Taipei right now. The temperature is just about comparable to Spring or Autumn Taipei. Well, one can only daydream…… Yes, make lemonade out of lemons! (A shift from my somewhat downbeat post yesterday)

Besides feeling a little chilly, the downpour also made for a challenging drive to and from the Breadtalk HQ, where we had lunch.

The first thing I noticed on the road was the absence of delivery food riders. Honestly, delivering food in this kind of weather condition is an occupational hazard.

Source: The Straits Times

So to my privileged readers out there (who are deciding not to step out of their homes and risk being drenched or just wet) ordering in, do spare a thought for these essential workers. Grumble a little less about the waiting time and if you can afford it, offer a tip.

One man’s boon another’s bane.

If not for the weather, today could have been a golden opportunity to rake in a good day’s income for these delivery riders. Those who choose to take a break today might have to work doubly hard in the next few days to make up the income and to hit the incentives.

Maybe, just maybe, their mood could be cheered up if they decide to log in to their CPF accounts. And then marvel at the sizeable interest that has just been credited.

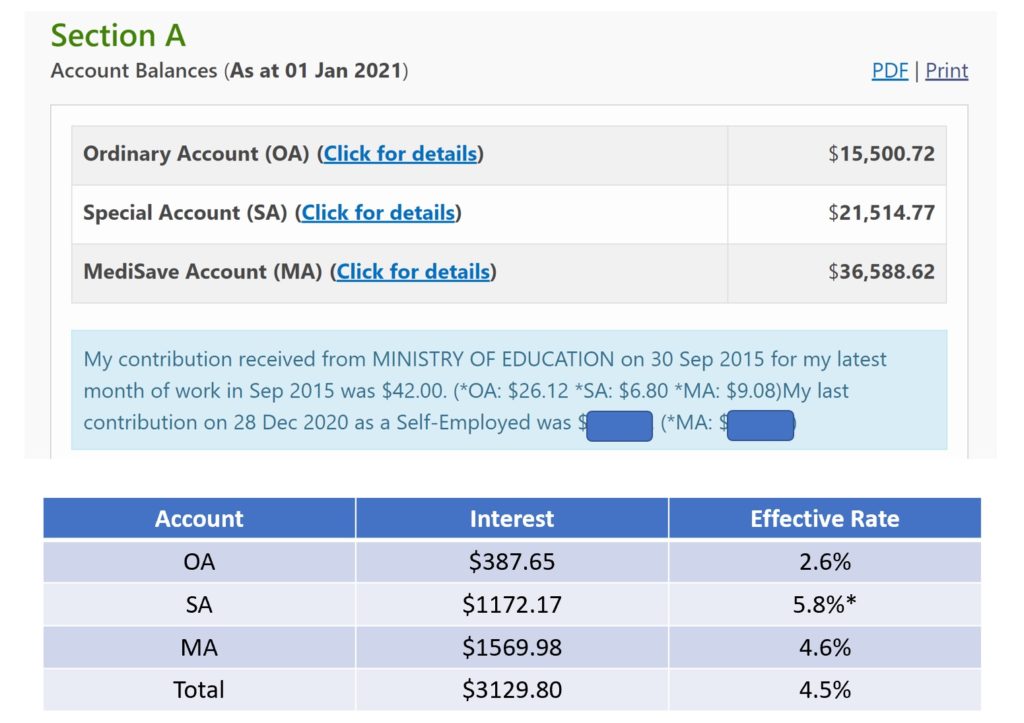

I can’t be certain, but for some of them, their balances could be similar to mine below.

$3k interest and a blended rate of 4.5% is also not to be sniffed at

Unlike others, this is not a flex post or…… a post to thank their past selves for the enlightened decision to top up their CPF accounts.

Well, because for someone in his mid-thirties, my total CPF balance is considered pretty low. My last working contribution was way back in September 2015 and it was a paltry $42.

I am definitely not on track to hit 1M50, 4M65 or (maybe let me coin a new and more impressive term) 10M100. Hmm…Maybe I really should trademark 10M100.

But I feel it’s ok and there’s ample time for me to catch up before I turn 50. More on this in a future post.

Because I know for most food delivery riders (more mature ones) who are still working today, they did not look at the few thousand dollars of CPF interest credited today and then use that to justify taking a day off.

Why?

I leave you to make the conclusion.

Thanks for reading.

* The Mrs sharply pointed out the high effective rate of 5.8%! It seems incredulous since the base rate for SA is only 4% and Extra Interest (EI) only contributed an extra 1%. If you face a similar phenomenon, it’s not because you are favored by CPFB or they have made a mistake. That’s wishful thinking and you would have better odds at the 2021 $5million TOTO draw.

If you are below 55 and earn a higher rate of 5% on your SA account, that’s because “extra interest earned on your OA balances will go into your SA to enhance your retirement savings” . In case you were not entertained by this post, there, you have learnt something useful today!

Wow ok! there is a little difference in that SA rate. To be fair, i check through the phone and did not see the table. I would guess that the delivery workers are too busy doing the job then to have time to check?

More like they don’t have any CPF contribution to begin with especially the young ones who can’t find employment.

Hi basedboy,

You are right about those young delivery riders. Most of them are not old enough to have any prior employment.

But I do notice there are a few “uncles” and “aunties” who are doing this either as a full-time gig or a side hustle.

How could you miss the table?! The blended rate is the only thing I can “flex”.

Lower balances, higher yield. Uniquely CPF.

Ok la, I am sure the food delivery riders have breaks. It only takes 1 min to check the CPF balances?

Ahahaha! I also thought of Ay Chung Mee Sua today.

Your post made me go look at my CPF balances, and it’s even lower than yours. My SA’s only, like, $17K.

Hi Daniel,

Low balances but imagine if you could take out the interest. I have a feeling the amount can last you a few months.

Haha! Actually, I’ve written off CPF for retirement, since I’m already retired and it will be another 15 years before i can touch my CPF.

Some people want to have 1M in their CPF by 65, but those strategies don’t really apply to those who want to be retired by 40. We have to adopt strategies that fit our goals.

You are right! Just different strategies. I have not topped up my CPF before but who knows, I might start doing so in 5 years or more when it becomes the right thing to do for my situation.

Oh hi Thomas,

Indeed. During raining days, I tried to tip in cash, although I know grab does not keep tip. But I thought it brings a bit of encouragement and personal touch too.

Everything so digital

Hi Mike,

That’s a nice touch! I rarely, if ever, order delivery but if I do, I am sure I will tip the same way as you.