This is going to be a short post.

I will be sharing a simple and efficient credit card strategy (in terms of cashback).

10 or even 5 years ago, I would have gone to painstaking lengths to move from the 90th percentile to the 99th percentile in terms of optimising my cashback from credit card usage.

What I describe below will never be the “best” strategy (if there is such a thing) but I am sure it is going to put you in the top quintile comfortably.

UOB One (Primary Card)

This card only works if you have a consistent spending pattern as the cashback is disbursed on a quarterly basis.

Whether it’s spending $500, $1,000 or $2,000 every month.

The respective cashback is $50 (3.33%), $100 (3.33%) and $300 (5%) if you meet the spending requirement every month. Not too difficult for most people with the increasing shift to online payments.

This is also not promo rates since I have used the card for about 5 years. So based on the Lindy Effect, the these cashback rates are likely to continue for a long time. #fingerscrossed

For the first 3 years, I was hitting $500 consistently. But for the past two years, I have been clocking $2,000 a month without fail. My mother-in-law’s monthly medical bill is easily $1,000+ and the other $1,000+ consist of dining, supermarket and petrol expenses (largely for two pax).

This is the power of pooling expenses and my mother-in-law is always quite delighted when I pass her an additional $150 every quarter. A win-win situation.

Here is my workflow for your consideration:

- Call and align the billing cycle with the calendar month and quarter (one-time effort)

- Log in on Day 10 and 20 of the month to tally expenses

- Switch to another card once I exceed the spending target by a hundred dollar

UOB Absolute Cashback (Secondary Card)

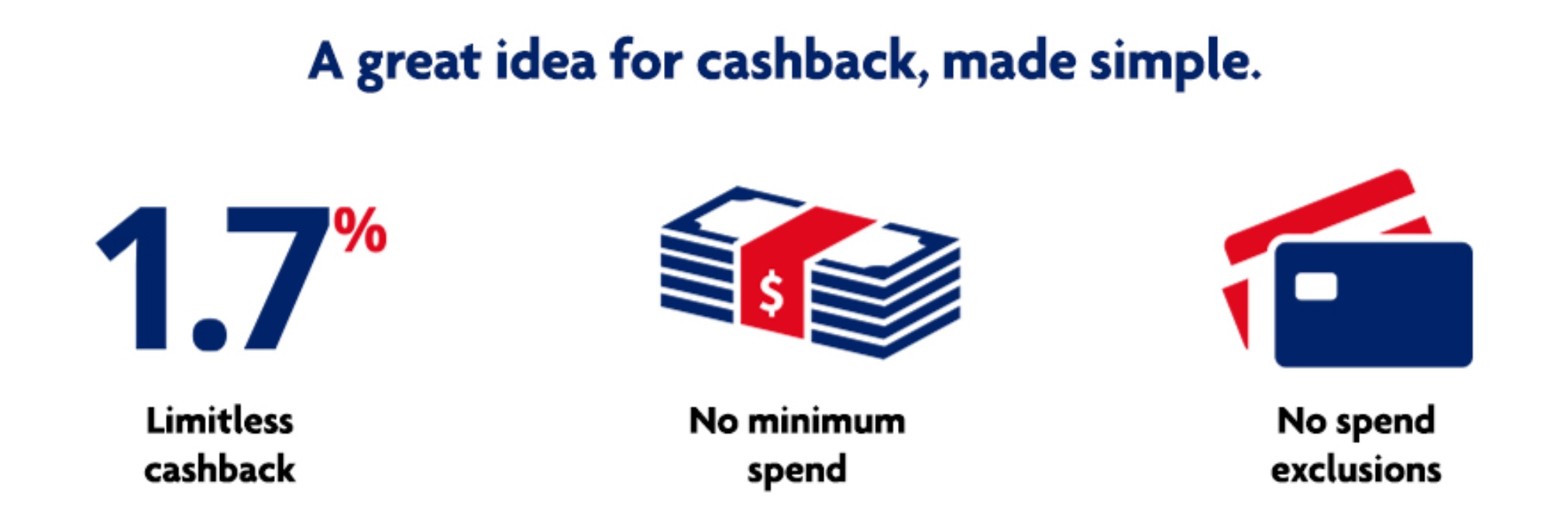

This is a newly launched card and unlike the UOB One card, everything can be explained with a simple diagram.

The tagline is great. It’s simple and fuss-free. But not great as a primary card since it’s an AMEX card (some merchants do not accept AMEX).

Currently, I am using the AMEX True Cashback Card (1.5% cashback) for expenses beyond $2,000 or big-ticket items. It is going to be replaced by this new UOB Absolute Cashback card.

If I am spending another $1,000, I can now get $17 rebate, instead of the current $15.

An extra $2 every month? It’s small but for a one-time effort, why not?

“Sedikit-sedikit lama-lama jadi bukit.” – Mrs 15HWW

According to her, this is how we have built our wealth and who am I to argue with her?

Thank you for reading!

In case you are wondering, there are no affiliate links and this is also definitely not a sponsored post.

If you intend to sign up for UOB Absolute Cashback Card, do pop by these two other financial blogs who wrote comprehensive guides:

I am likely signing up through one of them!

They have some good cards but I absolutely can’t stand their CSOs and policies when it comes to fee waivers. I think I’m blacklisted by them.

Hi kevin,

Somehow, I have no contact with their customer service for the past (many) years. But I am not surprised to hear of your experience. OCBC and UOB seems equally bad. Maybe cos I spend more than 2k a month, they have no qualms waiving my annual fees.

In terms of customer service, hard to beat AMEX.

to get pass the amex restriction. top up your grabpay with either the TCB or the Abs. then spend with grabpay (provided you have it in the first place)

this route is especially useful for insurance and hospital spend as grab top up are currently still eligible for cash back. for miles junkies, you can do the same with the amex highflyer card as they award hf miles for grab top ups.

Hi FC,

Thanks for the suggestion, will explore it when the need arises!

Based on the use cases of dining (6%), groceries (8%), petrol (8%), Citibank Cash Back card has a lower spending requirement of $800 to earn the various cashback tiers and you don’t need to wait for the billing quarter to receive it.

Hi Carl,

Thanks for the suggestion, will definitely consider it when our spending behaviour changes since the cashback for the Citibank card appears higher.

Thanks for sharing 15HWW! Our strategy is slightly different! We love the maybank friends and family card. 8% on dining/food delivery grocery, telecom charges and petrol/transport. Right up our alley in terms of spend category. Min spend $800 is quite easily achievable for us too and for all excess, we put into UOB one at $500/mth with 3.33%. Covers whichever category not covered by maybank such as online shopping, medical etc

and for all excess, we put into UOB one at $500/mth with 3.33%. Covers whichever category not covered by maybank such as online shopping, medical etc

Hi Anon,

Your strategy seems to work quite well for about $1,300 of spending in a month. Kudos!

Yes.. amex customer service is good. I am also contemplating if I should switch fr amex cashback to this uob one. The customer service at Amex does make my day when I call in.

Hi Lynn,

I still have my AMEX Platinum for its dining perks so the great customer service will still be occasionally patronised.