15 June 2022 Update: Due to the lack of transparency of most centralised custodians and the risk of contagion in a crypto bear market, I no longer recommend anyone to park more than 10% of their crypto assets with a single custodian. I have personally withdrawn >95% of my funds out of Hodlnaut and into a cold wallet for self custody.

There is no typo here.

I know that on the Hodlnaut website, the return you can earn on stablecoins is stated as 10.5%. And in case you do not know what stablecoins are, they are mostly cryptocurrencies pegged to US dollars.

So if you deposit stablecoins with Hodlnaut, you are getting relatively high returns coupled with almost zero low volatility.

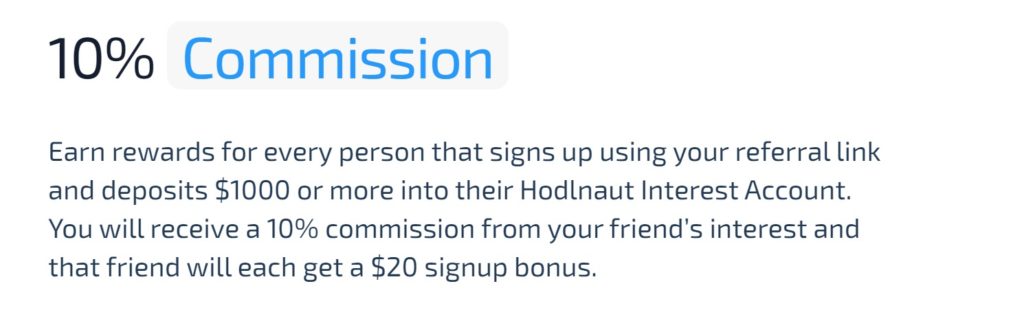

At the same time, Hodlnaut has a very powerful referral program designed to reward both the referrer and referee. In their words:

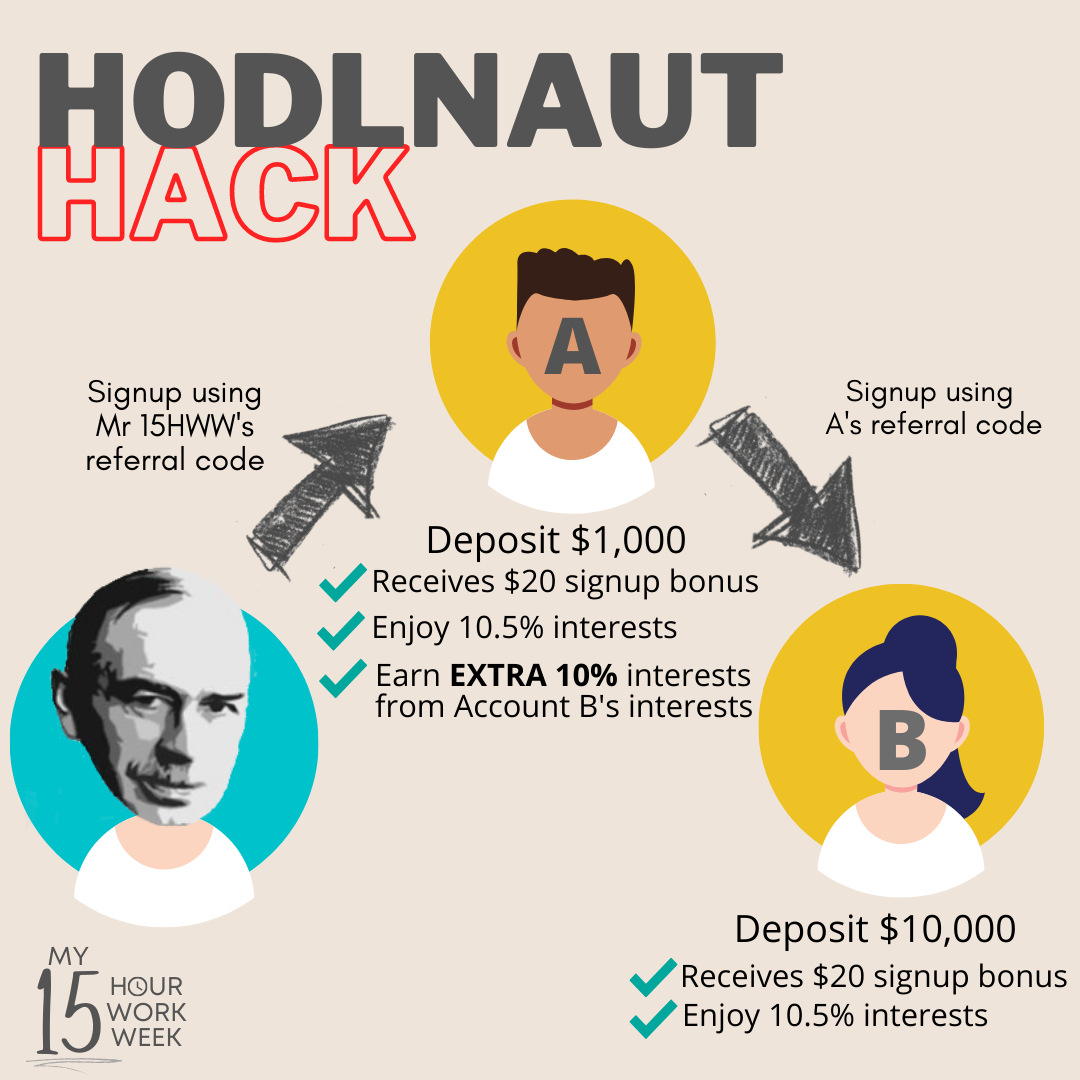

So for example, if you are keen on depositing ~$10,000 into Hodlnaut to earn a 11.5% return, this is what I think you should do:

- Open a Hodlnaut account under your name (using my referral link) and deposit $1,000 to enjoy the $20 signup bonus

- Open a Hodlnaut account for a loved one (spouse, partner, parent, child etc) using the referral link of your own account and deposit $10,000 in stablecoins.

To keep things simple, let’s call them Account A and Account B respectively.

If there are no changes in the interest rates and the $10,000 is held in Account B for a year, Account B will earn $1,050 in interest.

Account A will then earn an additional 10% of that interest by being the referral. So that’s $105 in interest.

Total interest earned from the $10,000 deposit in Account B: $105 + $1050 = $1155

That is a 11.55% interest return. Ta-dah~

Why Hodlnaut and How Safe Is Hodlnaut?

Now that the sharing of the above “lobang/hack” is out of the way, let’s address the elephant in the room.

Or why the Mrs and I started with Hodlnaut for centralised crypto lending:

Importance of Centralisation: “Not your keys, not your coins” is one of the core principles behind the crypto space. Also why I started going down the rabbit hole of Decentralised Finance (Defi) two months ago. I am still no expert, but I feel more at ease navigating the space and am starting to enjoy crypto-focused podcasts.

A few days ago, I used a couple of hours to explain and demonstrate liquidity pooling in the Defi to the Mrs. Sadly, she could catch no ball. Even though the odds of me suddenly passing away is very low (touch wood), it is sadly not zero. This experience also reiterated the importance of having an allocation to centralised crypto lending, especially parking some crypto under your loved ones’ names.

Highest Rates: Hodlnaut just raised the rates for their stablecoins one month ago, which also makes it unlikely to reduce its rates anytime soon. The interest rates for other coins like Bitcoin and Ethereum are also higher compared to competitors.

If you are the type that likes to do more research, do check out Seedly’s recent guide for a comparison with competitors like BlockFi, Celsius and Nexo.

Singapore Company With Strong Backing: Singapore is punching way above its weight, especially in the crypto arena. There is strong Singaporean representation in Crypto Twitter and even Vitalik was based in Singapore just half a year ago.

I personally think there is a good chance Hodlnaut becomes a jugglenaut in the space, leveraging on Singapore’s brand name and attractive proposition. It will then be able to hold its own against other centralised lending platforms that helm from the US or UK.

I am also reassured that some of the notable partners and investors of Hodlnaut include Antler, The Singapore Management University

According to the team, Hodlnaut is also currently undergoing license application under the PS Act 2019 (by the MAS) and is looking to become the first regulated entity in Singapore within the Crypto Borrowing and Lending Space.

PSA: Even when the risks appear low, the risk of an outright scam is still multiples times higher compared to let’s say a Singapore bank. So, in the crypto space, NEVER EVER go all-in on one coin or on one platform.

Downsides Of Hodlnaut

Obviously, Hodlnaut is not perfect.

Although they are younger, they are also comparably smaller compared to their competitors:

- BlockFI – USD 15 Billion in assets

- Celsius – USD 10 Billion in assets

- Nexo – USD 4 Billion in assets

- Hodlnaut – USD 0.25 Billion in assets

Let’s see if this post helps to get them closer to USD 1 Billion. =p

High Withdrawal Fees:

There are no free withdrawals and a withdrawal fee of between USD 14 to USD 18 makes it less attractive compared to its competitors.

But in my opinion, it is not a deal-breaker.

The higher interest should help to offset this downside and instead of withdrawing the interest monthly, do it quarterly or even yearly.

Limited Coins:

There are only 5 coins to choose from right now. As Hodlnaut is still relatively new and growing, I fully expect them to increase their range of products in the future.

That said, I think these 5 coins more than satisfy 90% of my needs when using a centralised lending platform.

Two Simple Strategies To Apply

Strategy 1:

- 1/3 Bitcoin

- 1/3 Ether

- 1/3 USDC

Pros: Participate in the potential upside of crypto majors like Bitcoin and Ether

Cons: Lower blended interest of ~8%, more volatility

Strategy 2:

- 1/2 Dai

- 1/2 USDC

Pros: Higher interest of ~10.5% (or 11.5% if you use the earlier hack that I shared), low or even zero volatility

Cons: No upside if crypto moons

How To Buy Coins:

Currently, Hodlnaut does not support the buying and selling of any crypto on their platform. You will need to buy coins from other platforms and transfer them to Hodlnaut.

There are many methods out there but I feel the simplest for beginners would be:

- Buy Bitcoin and Ether through Gemini using SGD direct deposits

- Wire USD to BlockFi, convert the GUSD to Dai/USDC (Guide to DBS Remit from SuzMoneyLife)

Gemini offers 10 free transfers in a calendar month and BlockFi offers one free stablecoin withdrawal in a calendar month.

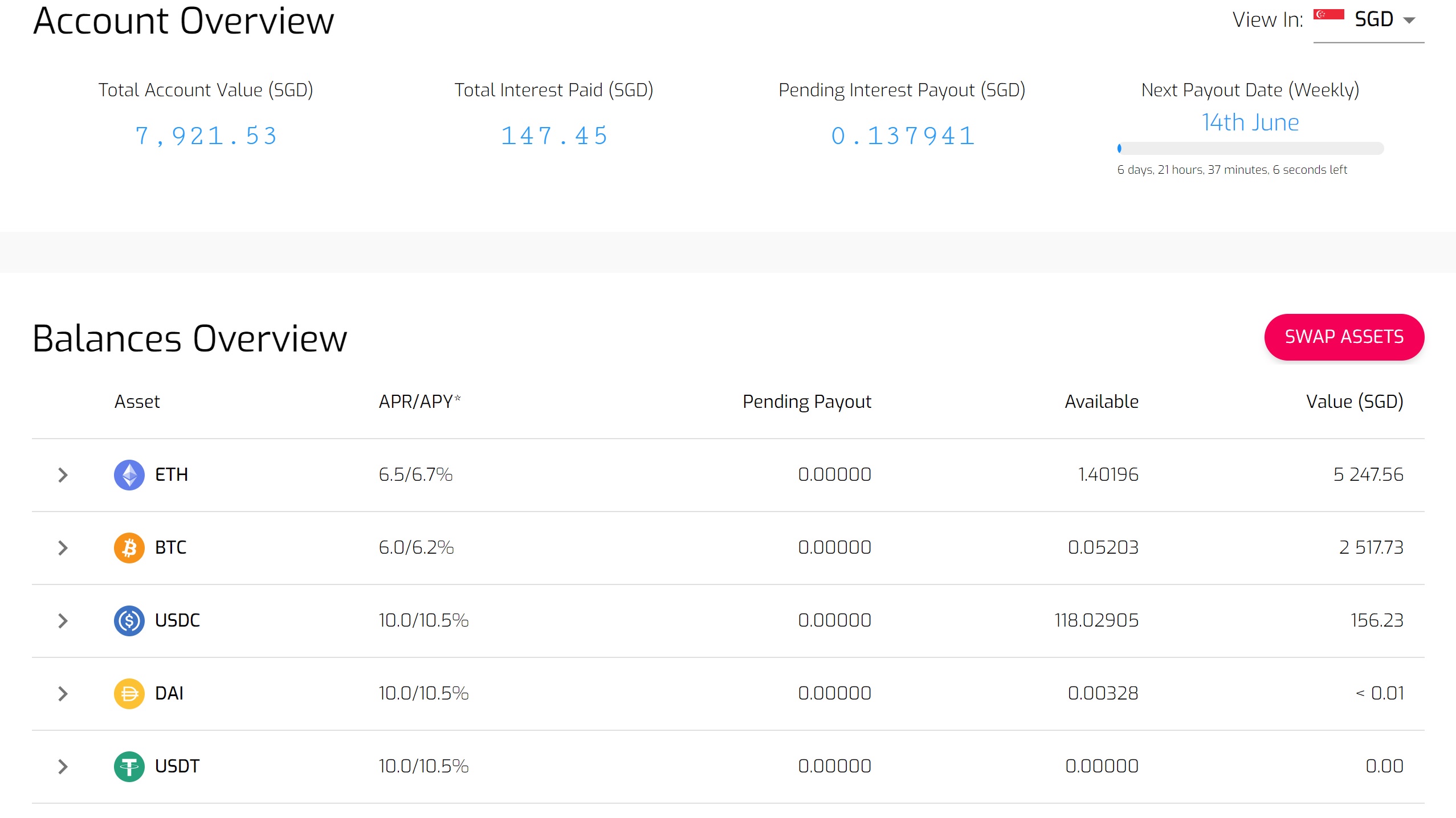

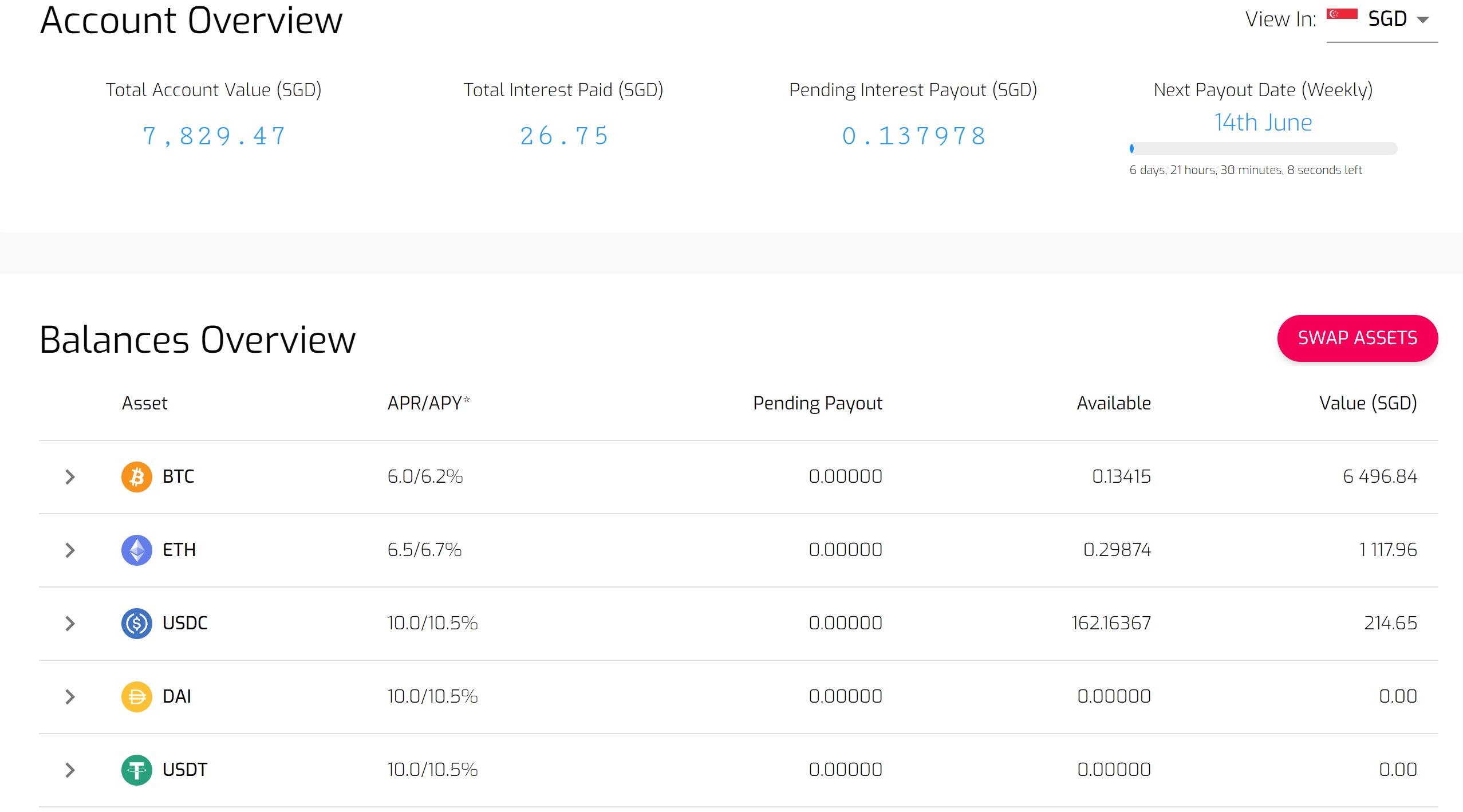

Our Hodlnaut Portfolios

I only recommend stuff that I use and I am also inclined to do a Hodlnaut update every quarter. The next update is likely to be in September.

If there is a rug pull, Mrs 15HWW and I would be the first to feel the pain.

For the rest of the year, the intention is to continue to transfer coins to Hodlnaut until both accounts reach SGD10,000 in capital size. Thereafter, if we still want to allocate more to centralised lending platforms, it is likely that we will use other platforms.

Always diversify.

As my defi portfolio continues to increase, it is also likely that we will hold more stablecoins in our Hodlnaut accounts. Basically, pivot to look more and more like Strategy 1 and then Strategy 2.

Account 1: 7k capital

Account 2: 8.5k capital

And then in 2022 and every year thereafter, on our respective birthdays, we will withdraw SGD1k to enjoy the interest return.

Let’s see if the balances would become zero before 2032.

And if you would like a second opinion or reading, I would recommend TurtleInvestor’s comprehensive review of Hodlnaut!

Thank you for reading!

Disclaimer: This article contains affiliate/referral links and any support is much appreciated! Signing up using referrals ensure that you will benefit too, as seen below.

Hodlnaut: Receive a US$20 signup bonus after making an initial deposit equivalent of US$1000

Gemini Exchange: Deposit and buy US$100 or more crypto on Gemini and you will earn US$10 in BTC.

BlockFi: Receive a US$10 BTC bonus after depositing US$100 or more into your BlockFi Interest Account

Thanks for the plug! Your ‘hack’ is an excellent way to maximize returns haha! Skin in the game, right? Our money is on the line before anyone’s else.

Hi Kevin,

Yes, that’s the core principles behind our affiliate benefits. Otherwise how to face our conscience?

just signed up with your referral !

newbie to the crypto world. will be using direct USD tx with dbs remit to blockfi.

what is the difference between USDC and USDT?

why 1/3 in the former, and not the latter? (both are same APY)

Hi FC,

You can google “USDT controversies” to see the many FUD (fear, uncertainties and doubts) regarding USDT. If you compare to other exchanges, USDT also gets higher rates compared to other stablecoins,

Generally, the market gives higher rates to offset the higher risks. Since Hodlnaut does not differentiate, better to put it in USDC or Dai.

just set up Hodl accoutn with your referal. awaiting funds deposit into Gemini, then will buy DAI and tx

one thing though, whats your take on DAI?

Gemini doesnt have USDC. so it seems i will have to transfer into Hodll with DAI instead.

is it as safe as USDC?

Hi FC,

I think until 18 June, Hodlnaut will still have a Token swap service. So you can swap Dai to USDC if you prefer.

In my opinion, both are pretty similar since Dai is increasingly collaterised by USDC too.

hey 15HWW,

HODL has been awesome.. now i am trying to do some withdrawals from HODL. whats your strategy to do USDC witthdrawal from HODL to DBS (preferably free and in USD)?

on second thought, since i am using DBS USD debit. can i tx to Gemini instead of blockfi?

since Gemini has a cheaper withdrawal rate than Blockfi. (when decide to withdraw in future. one less hoop to jump)

Hi, I tried signing up with BlockFi but I’m unable to get past the verification process. I have tried taking photos of my driver’s license, IC and passport and none of this works. How did you manage to get past that?

Hi JC,

Hmm, I had no problems with the KYC. Perhaps you can get in touch with the customer service?

An alternative arrangement is to try to sign up a Binance account and get BUSD before converting to the other stablecoins.