This Sunday Times Invest article “Do younger S’poreans have lower confidence in CPF?” by Invest Editor Mr Tan Ooi Boon was published on 30 May 2021. However, I only read it recently after Kyith’s rant on Investment Moats.

Why?

Because with (heavily-subsidised) free CNA, there is no need to pay and subscribe to The Straits Times anymore. So if you can’t read the article behind a paywall, there is a picture of the original article on Kyith’s blogpost.

Once upon a time, I used to gobble up Sunday Times Invest commentary. There were plenty of good stuff a decade ago. For example, this $100k by 30 article that inspired youths like me to save more.

But how times have changed.

Mr Tan’s Narrow Perspective

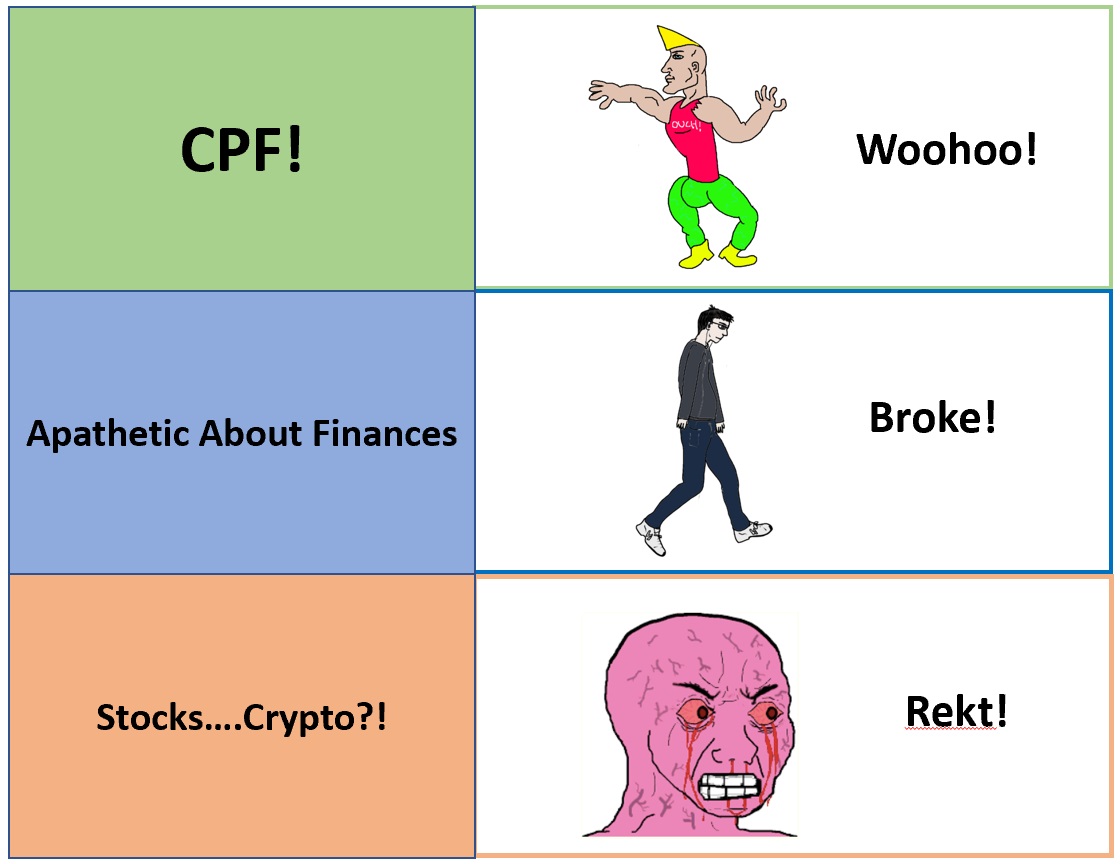

A picture…. or a MEME speaks a thousand words

Luckily Mr Tan Ooi Boon is not a relative of mine. Otherwise, it would be really hard to impress him during CNY meet-ups, especially when the conversation veers towards personal finance and investments.

If I portray myself as apathetic towards my personal finances (blue zone), he would be thinking that I am broke.

If I start pontificating about some meme stocks or *horror* cryptocurrencies (orange zone), he would be anticipating me to get rekt sooner or later.

The only way to get a nod of approval from Mr Tan?

Topping up your CPF! (green zone) when you are in your twenties/thirties.

Trading Apps Compete For Users (Free Money)

The article chastises a 19-year old who opened a share trading account. However, I would like to point out how woke this teenager is.

Low-cost online brokerages have recently descended onto Singapore and companies like Futu is offering attractive welcome bundle to entice investors and traders to come onboard and test out their Moomoo platform.

I have written an article detailing 9 reasons to sign up for a Moomoo account.

Recently, they have even improved their offering.

You will receive a free Apple share worth ~SGD 170 when you:

- Open an account from now till 30 June 2021

- Deposit SGD 2700 or equivalent within 30 days of account opening

Receive an additional free NIO share worth ~SGD 60 when you:

- Complete 5 trades OR

- Unlock LV 1 trading badge

That’s SGD 230 worth of goodies! I wonder how long the 19 year old would have to work in a part-time job to earn this amount of money.

So if you still have not signed up for a Moomoo account, you can sign up using this link!

CPF Top-Up Is An Unattractive Proposition For Freelancers

Mr Tan was worried that without compulsory CPF contributions, the young freelancers and self-employed like me would lose out “on a state-guaranteed fund that can deliver a stable return for life”. #FOMO

Other than the mandatory Medisave contribution, I have not voluntarily topped up my CPF accounts and am unlikely to do so in the near future. The reason for not doing so is not because I do not understand how CPF could benefit me in the distant future. Nor is it because I do not trust the CPF system.

It’s just that as a self-employed, my income is considered unstable and I need more liquidity than a full-time employee to tide through a rainy patch.

Many other freelancers share the same concern as me. CPF is not a safety net that you can rely on in your twenties and thirties.

Yes, topping up your Special Account with $20,000 guarantees $800 of CPF interest a year. But I reckon having it accessible as a fund to tide through half a year of expenses is more valuable.

Moreover, if one is willing to withstand slightly more volatility, a permanent portfolio will provide similar, if not better returns than CPF without compromising on liquidity. That has been my approach so far and my returns have outpaced CPF interest rates.

CPF’s Goal And Use Cases

From my humble understanding, CPF’s goal has always been to provide for a basic level of retirement. It will ensure that you have enough to put food on the table during your silver years. For those who yearn for a more comfortable retirement, investments would have to be made to complement the lifelong annuity provided by CPF LIFE.

And nothing better than to start investing early, right?

CPF – A successful scheme for employees

CPF has been a successful scheme for a generation of Singaporeans.

For the median Gen Xer who benefited from the CPF scheme, my guess is it’s most likely due to three or even four decades of steady employment and compulsory CPF contributions. I seriously doubt that there are many Gen Xers (especially those hovering around median income) who actively topped up their CPF accounts when they were in their youth.

So for those with a steady job with monthly CPF contribution, CPF is and will still be doing a good job in ensuring a basic retirement for you.

Evolving job economy, changing relevance

However, the workplace is changing and the gig economy will likely take up a bigger proportion of jobs in the future. The pool contributing to CPF will shrink over the next few decades. If some of these freelancers and self-employed are not able to squirrel away a nest egg on their own, would it be left to future taxpayers to fund their retirement?

From a macro point of view, Mr Tan is probably advocating in the interest of the current majority to encourage freelancers to top up their CPF.

But humans typically act on self-interest and a voluntary CPF top-up is not an attractive idea for most freelancers/self-employed.

As for me, what would it take for me to fill up my CPF coffers?

When I am old or rich. But more likely, both.

Thanks for reading!

Futu has improved their offering if you sign up for a Moomoo account using this link!

Receive a free Apple share worth ~SGD 170 when you:

- Open an account from now till 30 June 2021

- Deposit SGD 2700 or equivalent within 30 days of account opening

Receive an additional free NIO share worth ~SGD 60 when you:

- Complete 5 trades OR

- Unlock LV 1 trading badge

Disclaimer: This article contains affiliate/referral links and contributes to the sustainability of this blog

Related Articles:

Why I Have Never Topped Up My CPF (Yet) – Jan 2018

CPF, Oh CPF! – Sep 2016

What’s Best For Me? Employee, Self-Employed, Entrepreneur or Retirement – May 2016

One point to consider – the article is targeted for the man on the street who are less financially savvy compared to you.

Initially when I started my career, I was ambivalent about CPF (beating the 3.5-4.5% SA rates is not a big feat), but over time I’ve seen multiple friends get burned on speculative and “safe” investments e.g. Blumont or Hyflux.

I am now pro-CPF as I believe it works much better for the avg. man on the street who is constantly on the lookout to make a quick buck – those focusing on meme stocks, alt-coins, etc. or those who can’t be bothered to do their own research and buy on hearsay.

Re freelancers – there is always a middle ground, you don’t have to pour all your monthly savings into CPF, but some wouldn’t hurt.

Hi JW,

I appreciate your views and agree with it wholeheartedly!

I do agree that there is a middle ground for most people and CPF is one of many useful tools for most people.

Can we just treat CPF as our bond allocation so that we don’t keep thinking of beating it with equities?

Hi Uncle CW,

I guess the next question then is should youths or freelancers be actively buying “bonds” then?

Especially in this environment of unlimited QE.

CPF is not designed for retirement. It was started as a way for the British to avoid having pensions for the colonies (yes, there’s CPF in former colonies like India, Pakistan, M’sia, Brunei — they call it different names but operate similarly). The original 2.5% interest means that colonials will need to work much longer than those having proper retirement plans, as the accumulated amounts will not be enough to last more than 15%-20% of a person’s lifespan at the end.

Along the way, CPF in Singapore became a nationalist fund, to get people to buy public housing & tie them down to the city. The liberalisation of CPF for private properties & resale HDB in the late-1980s contributed to a massive inflation of residential prices from 1988-1997. Basically 40 years of home price increase occurred within 10 years. We can’t put this genie back into its bottle.

For anyone to feel that CPF really helps in his/her retirement, more often than not, it means that person had a good-paying job & a longish career, with so much cash savings that he doesn’t mind dumping tens of thousands into CPF every year. Majority of lower-wage won’t have the same feeling for CPF as solving their retirement funding.

For CPF to be a more robust retirement plan in today’s world, govt will need to (1) restrict its use for housing, education etc, and (2) investing the monies using low-cost globally diversified techniques, in order to generate better long-run returns.

This is one thing that Malaysia’s EPF has done quite successfully over the past 58 years, and has helped to mitigate both inflation as well as the ringgit’s depreciation.

So basically CPF can perform the lifecycle investing during a person’s working years, say till 60. And then transition into annuity (CPF Life) for pension-like lifetime payouts.

Hi Sinkie,

Thanks for sharing the background! Very interesting and widens my perspective.

As you mentioned, CPF returns currently do not help much against inflation. I guess that is a reason why more people are trying to make their CPF OA money work harder by investing with Endowus.

Hi Sinkie,

CPF rates have been adjusted over time, it was higher in the 70s and 80s due to higher inflation. (https://www.cpf.gov.sg/askjamie/user/uploads/Historical%20interest%20rates%20Q1%202021.pdf)

My 2 cents – CPF is still great for it to be a cornerstone of a person’s retirement planning, the annuity payments are what you describe a defined benefit plan (pension plan)

Quick check over the last 10 years of SG inflation rate (https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?end=2020&locations=SG&start=2008), and assuming CPF split of 60/40 between OA and SA/Medisave, returns beat inflation at a 1.7% CAGR. $100,000 will provide a nominal return of $135K (real return of $119K)

Now having grew up in Msia, I do have some authority to speak about EPF – yes, its great that the returns are higher but:

– no government guarantee – expose to volatility in the market

– Msia have higher inflation

– a depreciation currency

Side note, Some of my friends are worried that due to the current economic situation in Msia, they won’t be able to withdraw their EPF at retirement age (refer to the Tabung Haji scandal)

Hi JW,

Thanks for your input.

CPF interest rates are based off SGS bills & bond yields, which have become suppressed since early 2000s.

Not sure if SGS yields will respond appropriately to higher inflation in the future. For e.g. in 2008 when inflation hit 6% for the whole year, SGS yields remained depressed.

As I said, usually the higher salary will say CPF is good i.e. those that actually don’t really need CPF lol.

For CPF Life or any DB pension plan to be adequate, you need to be able to grow the portfolio meaningfully for 30 years. 4% isn’t going to cut it.

The problem for local CPF is that majority, especially lower-middle & low income, will use up their OA for property. And the SA allocation is too damn low: 6% for those below 36, 7% for those below 46, and still just 8% for those below 51.

Not enough principal in SA for the 4% compounding to build sufficient amount for lower- middle & lower income.

At the end, the CPF Life payout is insufficient & the govt solution is to work until 70++.

Regarding EPF, I used it as example of how a providend fund can be invested & operated to generate higher returns over long run. This is how insurance companies & Ivy League university endowments do it. If cannot, then all insurance companies & Uni endowments will have collapsed by now.

As for the doubts & policies surrounding EPF, that’s more of politics & how the country is running their econ policies. Not so much as how the EPF is being invested & run.

Basically CPF all along has not bothered to put in the hard work to make the monies work harder, leaving people to work harder & smarter to increase their salary to solve retirement. This is still workable during initial high growth stage & then for past 20 years during relatively low inflation stage.

But if we enter 10 or 20 years of high inflation + average salary increments? People like us who are into investment & personal finance will do OK. As for the bottom 50%?

Hi

Do you think there’s anyway CPF can change so that it works for freelancers as well?

I assume not all freelancers are into finance so they need some help from a centralised, low risk method of saving for retirement?

Hi Robert,

Honestly, it would be hard to mandate freelancers to contribute more of their salaries, unless there is a matched contribution from the government to incentivise long term savings.