Crypto has been a rewarding journey for me thus far, both intellectually and monetary wise. Although it’s nowhere near generational wealth, I am sitting on healthy paper profits. %-wise, it’s easily 5 or even 10 years of typical stock market returns. Of course, I have my fair share of embarrassments like participating in “LTC fake Walmart pump news.” It’s not all rosy.

But still, the paper profits are pretty mind-blowing since I considered myself “late”, only buying BTC and ETH in the hundreds at the start of the year, before increasing my risk appetite and turning into a degen. Of course, everything could turn again in the blink of an eye.

It’s really dog years in the space. One year of crypto experience probably equals 7 years in the traditional markets. There’s developments every single day. If you totally check out for a few months, you could even find yourself illiterate in the arena when you come back. I am approaching burnout, honestly and will take a step back very soon.

It’s been a slow grind learning and levelling up. That said, I still consider myself a beginner and here are some mantras I realised would be useful to constantly keep in mind.

1. Diversify Your CEXes

Even if you are not native to crypto, you would have heard of the regulatory measures taken by MAS against Binance, the largest crypto exchange in the world.

I expect such regulatory FUDs to recur consistently, since it’s the most effective retaliation from the lobbyists of the status quo. It could happen to FTX, Crypto.com or Gemini even if Singapore authorities have proven to be one of the most “enlightened” in the world.

Personally, I have to consistently make sure I have three viable on-ramp and off-ramp options.

2. Diversify Away From CEXes

Most beginners find Defi (Decentralised Finance) more risky and stick to CEX (centralised exchanges). I used to think this way too. Until I started buying some tokens on CEX that people were farming on DEXes and dumping. I was the exit liquidity.

But now? I think safe cex is a meme (pun intended). As mentioned earlier, it’s easier for governments and authorities to apply pressure on centralised organisations. Defi, at the very least, helps to mitigate that set of risk.

Obviously, with Defi, there are other risks but the risk/reward spectrum is still pretty favorable. In fact, most of my returns have come from moving out on the risk curve, participating in defi farms and exploring new chains.

I know I have shilled Hodlnaut time to time but I have not gone overboard with CEX, especially going all-in on one. Doing that is especially risky in my opinion.

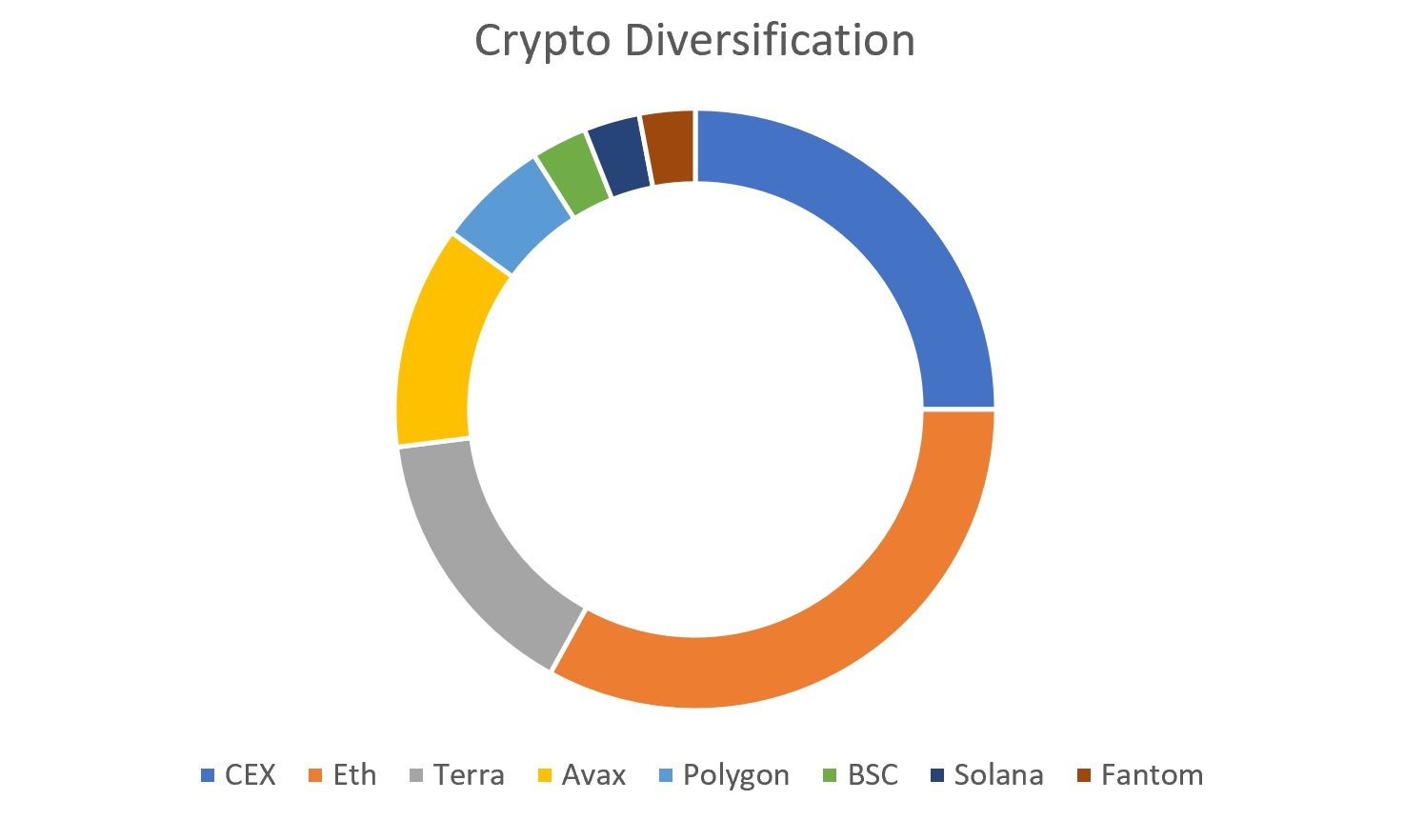

As a point of reference (and definitely not financial advice), here’s a breakdown of my crypto portfolio and the different ecosystems I participate in.

3. Improve Security And Wallet Hygiene

Have at least one hardware wallet, if not two. One Ledger and one Trezor minimum in the long run, especially when you go further down the rabbit hole. I think Trezor is better but it does not support some ecosystems (yet).

I used to store most of my defi coins on Metamask as a warm wallet, thinking that it’s ok if I lost everything. Until the amount grew to be not ok. =p

So don’t be like me and take on such unnecessary risks.

I am also very skeptical of storing coins on mobile apps, especially if your 2FA exists on the same phone.

Imagine you fall asleep on a couch at a friend’s place and your phone slips from your pocket. An acquaintance picks it up and you are auto-logged in onto a CEX app and with easy access to your 2FA, your wallet is drained.

Maybe I have an imaginative mind, but who knows?

4. Have A Base Outside Of Crypto

In this space, you eat 30% drawdowns for breakfast. Volatility is a feature, not a bug. The whole crypto market is still a comparatively small market, vis-a-vis precious metals, not to mention stocks or bonds. It can be quite easily manipulated, and maybe that’s where regulation legitimately comes in.

All it takes is just one crypto god tweet (Elon, Vitalik, SBF, Su Zhu) to move prices, whether up or down.

Even till now, I have barely sold any stocks or bonds to reallocate to crypto. These legacy holdings are my Lean-FI stack and if crypto goes to zero, I still have something substantial to fall back on.

This allows me to go degen in crypto with less anxiety and swallow the volatility.

5. Avoid Being A Maxi

This is hard for most people, especially those who made generational wealth with Bitcoin and then Ethereum and now Solana.

It is psychologically so much easier to be loyal to something that made you 10x or 100x and transformed your life. That’s why there are so many BTC-maxis and ETH-maxis around, whether it is merited or not.

One way out of this is to always diversify out onto new chains and opportunities. Especially if one have the time and capacity. Then you can continue learning and exploring with a more open mind.

6. Do Not Chase Verticals

One or two weeks ago, various friends texted me a picture and told me that a financial blogger was shilling $SOL. That coin had already went vertical for a few days and I interpreted such a signal as “Do not add anymore” or even “Sell”.

Always remember that most people shill when they already have a heavy bag. It’s all about incentives.

Of course if you are a momentum player, that kind of play might suit you. But from my experience thus far, when something is the “in-play” or reached mass consciousness, it is better to avoid it. Psychologically hard as FOMO will be especially strong.

If you pull the trigger, more often than not, if you are a beginner, you will be left holding the bag.

7. Buy “Unloved” Coins

I don’t think I am that good at rotating. But I think I capture some of those alpha when I buy early or buy unloved stuff and just hodl. Two examples below.

A month or two ago, I was lamenting about my paper losses from $Rune and $Ohm. But the narrative has changed drastically since then and I am easily up 2-3x on my cost in a matter of weeks.

And then, during the height of the NFT craze and the more recent alternative L1 hype, Eth defi plays became unloved. I am talking about blue chips like Aave, Sushi and Curve that were lagging behind. Effectively declared dead.

That’s when the r/r for them becomes favorable, when the coins are heavily overlooked. I scooped up some during the latest dip and it’s turning out pretty well thus far.

Almost every coin (with fundamentals) has a season. Wait for the narrative to come back instead of chasing them. Be more contrarian.

And lastly, a bonus tip. Avoid pool 2s in general. I have had some mild successes in them but they are definitely nerve-wrecking. We are talking about either a 5 or 10x or an 80% plunge, depending on whether you are a few days early or late.

WAGMI? I am not so sure since we are not “that early” and most financial games follow Pareto distributions. But the odds could be in your favour if you practise these tips and of course “Buy low, sell high”. Simple in theory, hard in practice.

Thank you for reading and all the best in your financial or crypto journeys.

Related Articles:

Quick Hodlnaut Update: Earn Up To 14% Interest With Stablecoins