Ok, so BTC has breached its all-time high (ATH) yesterday and the whole crypto market is approaching $3 trillion in value.

If you have no crypto exposure, hopefully the feeling of FOMO is not running amok. But if you are, and keen to onboard, there’s really no better time than now.

Yes, even at an ATH. Why?

Because when the bear market creeps in and crypto dumps, you will be back to thinking this whole industry is a scam. You will forget that BTC/ETH or the whole crypto market is making higher lows through the cycles and the months and years.

Unless you have skin in the game.

How do I know?

Yours truly ignored crypto for a couple of years and only FOMOed a year ago at ATHs. Obviously, there were alot of uncertainties and doubts initially but overall, it’s been a fruitful year.

Anyway, to minimise volatility which is important to onboard beginners, I will only be discussing about Bitcoin (BTC), Ether (ETH) and Stablecoins (USDT, USDC, UST, MIM etc) for the below strategies.

1. Buy and HODL BTC/ETH

This is probably the simplest strategy.

Buy BTC/ETH on a centralised exchange (CEX). There are many options like FTX, Crypto.com, Coinbase or Coinhako. I have used a few and I believe the simplest one to on-ramp and off-ramp SGD is Gemini Exchange to buy the majors like BTC/ETH.

Using the referral link above, deposit and buy US$100 or more crypto on Gemini and you will earn US$10 in BTC. A headstart always helps.

After that, transfer the BTC/ETH to a hard wallet from Trezor or Ledger. To be absolutely safe, buy direct from the website instead of relying on 3rd party agents, even if there is a discount. I have used both the Trezor T and Ledger Nano X and very much prefer the former.

And that’s it, hold on for dear life until till the price moons.

2. Buy and Lend BTC/ETH on CEXes

Hodling is not a satisfactory strategy for some. It’s comparable to buying commodities like gold and silver which does not generate any income.

If you are not prepared to spend on a hardware wallet (a few hundred dollars ) and only entering crypto with a small capital (<5 digits), lending out your BTC/ETH on a CEX or a centralised lending platform could be the most suitable strategy.

If you are not prepared to spend on a hardware wallet (a few hundred dollars ) and only entering crypto with a small capital (<5 digits), lending out your BTC/ETH on a CEX or a centralised lending platform could be the most suitable strategy.

Especially if you are not affected by “Not your keys, not your coins”.

You could even consider stablecoins (no point hodling stablecoins) if you are more interested in the yields.

I shill Hodlnaut (articles here and here) quite a lot, especially earlier on in my crypto journey since the yields can go up to 14%. There are other alternatives, but they tend to offer lower returns.

Using the referral link above, receive a US$20 signup bonus after making an initial deposit equivalent of US$1000.

3a. Lend BTC/ETH on Defi, Borrow Stablecoins, Stake Stablecoins

Defi stands for Decentralised Finance. There is no handholding from organisations here and you hold all the keys to your coins, either through an online wallet (quite risky) or a hardware wallet. There is no customer service to talk to if you send your coins to a wrong address or if a coin you just bought turned out to be a rug or goes to zero.

Going down the rabbit hole also means moving out the risk curve to pursue higher and higher yields (in the range of 4, 5 or even 6 digits APY). Which is not the purpose of this article targeted at people starting out.

Personally, I think Defi’s best use case is collaterising big cap coins like BTC/ETH to borrow stablecoins. This is probably something that best differentiates crypto coins from precious metals like gold. Unless you count pawnshops, eh?

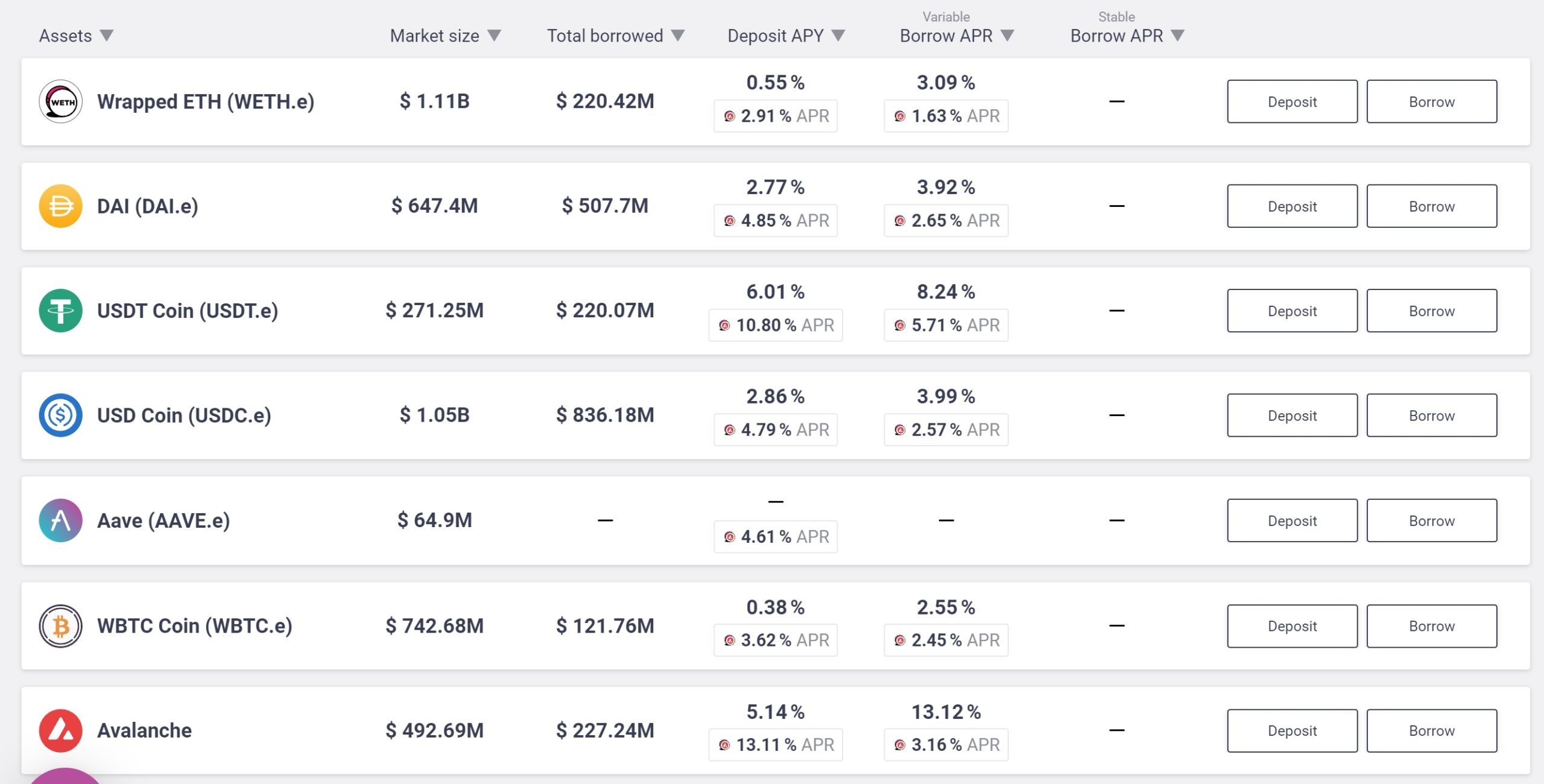

Rates as at 21 Oct 2021

I shall attempt to explain the rates above.

Basically, if you deposit WBTC, you will earn 0.38% + 3.62% = 4% and if you use the deposited WBTC as collateral to borrow USDC, your net borrowing rate is 3.99% – 2.57% = 1.42%.

For example, maybe you deposit 1 WBTC (~$65,000) and then proceed to use it as collateral to borrow USD $25,000 worth of USDC.

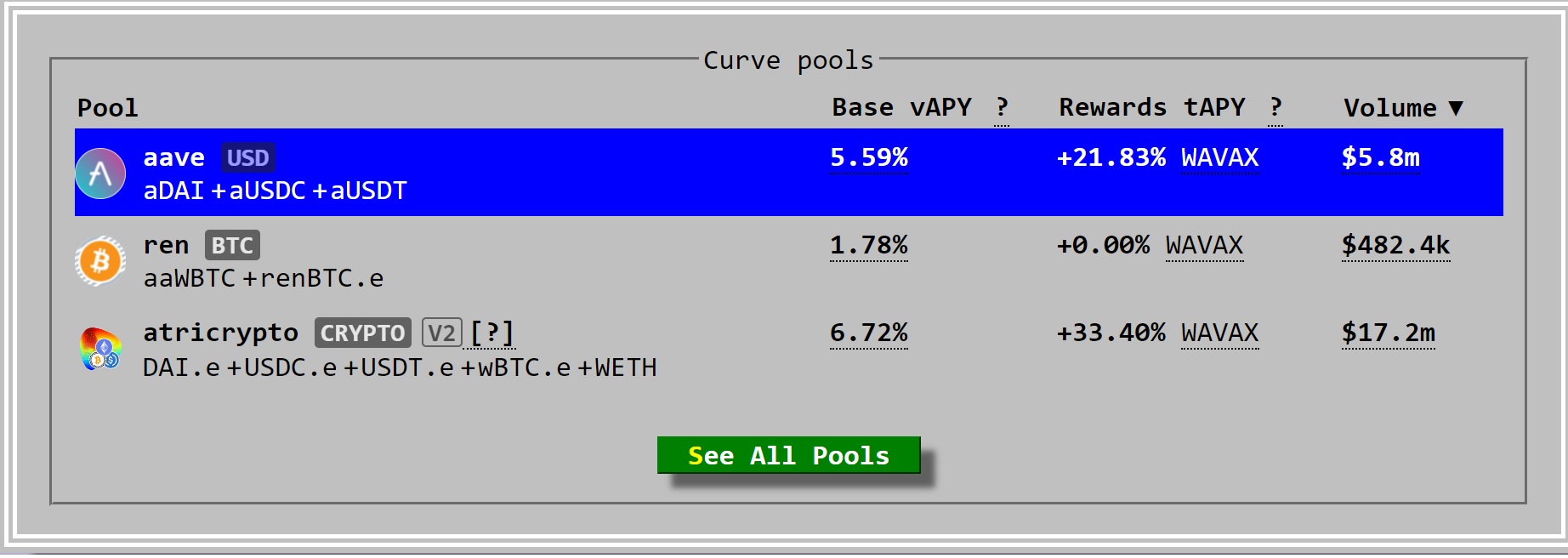

What can you do with that USDC? Well, you can deposit it into a liquidity pool of stablecoins to earn ~25% p.a. interest.

Warning:

Do note that the rates above will fluctuate and likely reduce over time. That’s why this is not a passive strategy. At the same time, if your collateral value falls below a certain value (BTC price dumps), your collateral will be liquidated to pay back the loan to prevent the protocol from shouldering bad debts.

That said, the example I have used is relatively conservative since one would only be liquidated if prices drop 50% overnight, which is unlikely. One will also have the opportunity to withdraw the USDC from the pool to pay back the loan almost any time since Defi is 24/7.

The net yield for your deposit is likely to be between 11% to 13% and there would be no impermanent losses and you will still enjoy any upside of the WBTC deposited.

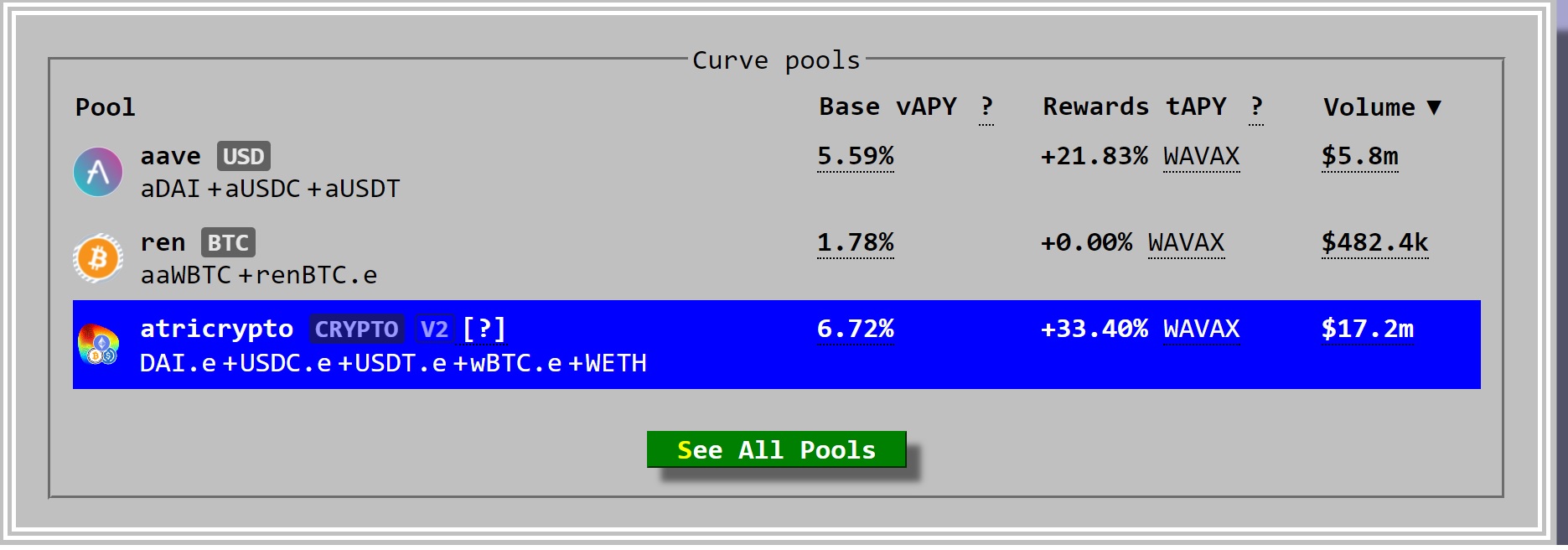

3b. Lend BTC/ETH on Defi, Borrow Stablecoins, Stake Atricrypto

Maybe the numbers above is not exciting enough.

Maybe you are super bullish on BTC/ETH.

So maybe instead of staking the borrowed stablecoins into a stablecoin liquidity pool, put it into an atricrypto pool that is split 1/3 BTC, 1/3 ETH and 1/3 Stablecoins.

This will actually be considered a leveraged play on BTC/ETH so if BTC/ETH goes up, your returns will be juiced up further. If BTC/ETH prices drop and you want to redeem your loan, there might be a shortfall.

Well, it’s a double-edged sword.

The net yield for the deposit will be between 17% to 19% (more respectable) with >100% exposure to the price movement of BTC/ETH.

In fact, this is actually what I have been doing for the past few weeks.

If you are wondering about the large sums ($65k for example) involved in the deposits, my experience is a mid 5-digit sum is needed in the ethereum ecosystem to offset the high gas fees.

Even for chains like Avalanche with much cheaper gas fees, one would have to account for bridging fees as well for the eventual withdrawal, so a small 5 digit figure is necessary to make farming meaningful and mobile.

Try out all the strategies if you are keen, but honestly, I think most people have little business venturing into defi. i.e more likely to chase momentum which leads to losses.

For friends who have approached me, I often recommend Strategy 2 and if they are keen to go down the rabbit hole, I am always happy to share resources to kickstart the journey.

Finally, I hope the above will have helped you. Feel free to dilute my returns in the above pools I have shared.

Thanks for reading!

Related Articles:

7 Crypto Tips For Beginners Like Me

Quick Hodlnaut Update: Earn Up To 14% Interest With Stablecoins