With an infant at home, I have been da-baoing lunch alot more frequently in the past few months. One of my favourite haunts is Tai Seng, where I can do a 12-minute drive, have a cup of Kopi-O Xiu Xiu Dai paired with a salty dao sa pia at ToastBox and then proceed to takeaway soya sauce chicken rice/noodles from Hawker Chan.

I know, I know. The standard has probably dropped quite a bit from 10 or even 5 years ago. But in this inflationary environment, I would reckon $5 for a plate of above-average soya sauce chicken rice is a steal. Furthermore, there’s no surcharge for packaging too.

But well, all good things do come to an end, as I found out just yesterday. The price for a plate of chicken rice has risen to $6.80. I personally thought the price hike was pretty drastic, a >30% increase and it even took the Mrs multiple tries to guess the price hike after I brought the goods back home.

Down Bad

My networth (including cash, bonds and home equity value) is down ~20% over the past half a year. There is no hiding, whether it’s HK, US stocks and of course, crypto. Granted, I am probably comparing to ATHs and there is a perverse sort of anchoring bias there since in dollars term, I am still up compared to 2.5 years ago, pre-pandemic.

But comparing using dollars term isn’t really that useful today. Because in terms of purchasing power, especially if we are counting plates of soya sauce chicken rice, I am definitely down compared to 2.5 years ago.

For example, in early 2020, my net worth could have bought me 100,000 plates of Michelin-star soya sauce chicken rice. Now, even though my net worth has increased in dollar terms, I am down in plates of chicken rice.

Not good, not good.

I came across an interesting recent comment that asked me if I could turn back time, whether I would just shun the crypto sector.

My view is that things do not work that way and in the next boom (if there is a next), I would take more profits and DCA slower since I underestimated the speed of the reflexiveness of crypto.

Feeling Poor Again

It’s interesting that even though I thought I was conservative, right now, it appears that I am almost “fully invested” again. Not too different from March 2020.

With higher fixed expenses (car, helper and an infant) and higher inflation compared to two years ago, I have to set aside more cash for two years of emergency funds.

So even if I wanted to invest aggressively at this stage, my hands are somewhat tied.

Of course, the obvious move in this bear (besides shorting) is to increase income. Raising rates, taking in more students and exploring other avenues have to be on the cards.

Also, belt-tightening measures have subconsciously crept in as we dial down on the number of restaurant visits, start consuming more house-brand items from Fairprice (bread, peanut butter, cheese, chips etc) and travel shorter distances for food options.

To be fairly honest, if not for the fact that I have an infant now, I would sell my car in a heartbeat to raise cash. The high COE and car prices are simply not sustainable in this climate.

Counting My Blessings

Hand to my heart, I know that it’s not all doom and gloom, at least for my side. Indeed, the numbers are down by a few hundred k on my excel sheet, but I still have ample left to tide through a decade or two.

Market cycles are becoming faster and faster and although my bet is that this time would be much worse than anything I have personally experienced, you never know. Unlimited QE could suddenly resume at the turn of the year and the younger generation continues to get f***.

Seriously, I cannot imagine being part of a young couple who are looking to buy a home and start a family. If the income is high or there’s financial help from parents, things obviously will not look so bleak. Otherwise, I wonder how I would look at the fact that the median 4-room resale flat has increased from $450k to $550k in the short span of two years.

This is probably why I am still bullish on crypto. It’s a casino indeed but for some people, to get out of the rut and climb the social ladder, there might be no better alternative than playing the game.

If you are down bad just like me, don’t worry, you are not alone and who knows, we could make it all back slowly but surely?

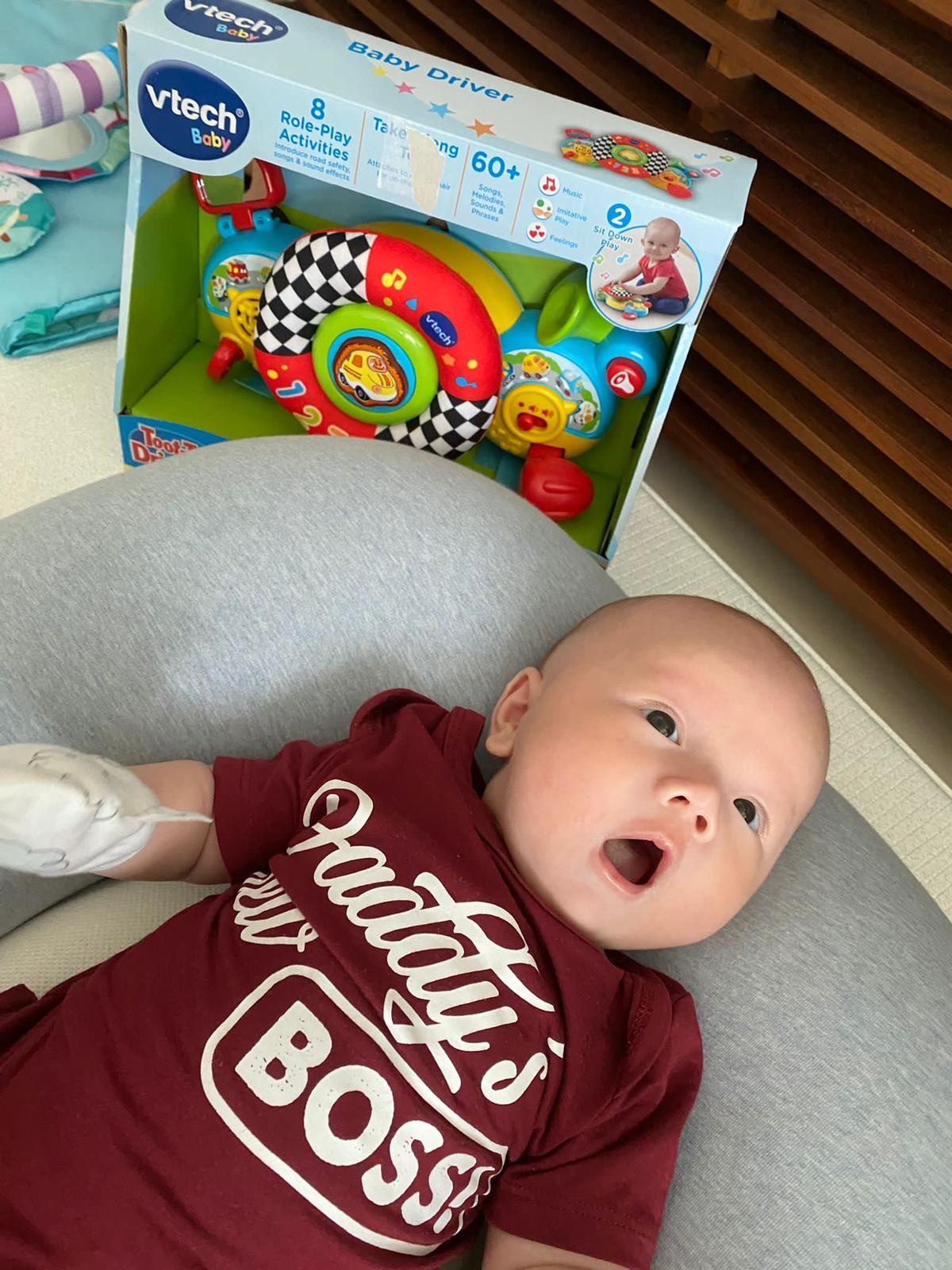

Thanks for reading and not sure whether I would be writing again anytime soon as I am generally busy with this boy below (who is the apple of my eye). If not for the fact that he was napping, I probably wouldn’t even have started this post.

Even you have to admit that objectively, he is cute and adorable, right? Right?!

Very cute and very adorable

We are in very similar situation. I did not take much profit as we go up and reinvested capital too quickly. Almost fully invested too!

Stay invested in the right investments and all will be fine. Good luck!!

Aww. He is cute! You are a tutor?

Kids suck away all your time, but they are so cute! ( if they are not whining). I have 2 myself as well. You will eventually find more time to write again.

Very cute boy. I have 2 of my own and they grow very fast…. so spend more time with him now while he is still cute… haha…

Very cute! I am in the same situation too, we are in this together. 🙂 I just welcomed my newborn in June. Net worth down around 20 – 30%.

Super duper cute little one!