With falling stock prices (1% drop almost on a daily basis) and rising interest rates, T-bills and SGS bonds are the rage these days. Since they are backed by the Singapore Government, they have the same exact risk profile as CPF savings, which are invested in Singapore Government Securities (SGS).

For my cash, I still prefer Singapore Saving Bonds (SSBs) since they are much more liquid. Do note that it is not possible to invest your CPF savings in SSBs.

However, I do think there is a great arbitrage opportunity to utiliseT-bills and SGS bonds to increase the interest rate of your CPF savings.

Especially if you tend to be more conservative in your risk appetite and have accrued substantial CPF OA savings.

*Enter my parent-in-laws*

I have done some research to produce this article so as to help my in-laws benefit from the rising T-bill and SGS bond yields. Hopefully you will find it useful too.

It is interesting to note that almost no organization has a vested interest in this since the banks will not earn anything and CPFB will also not stand to benefit from the fund outflows.

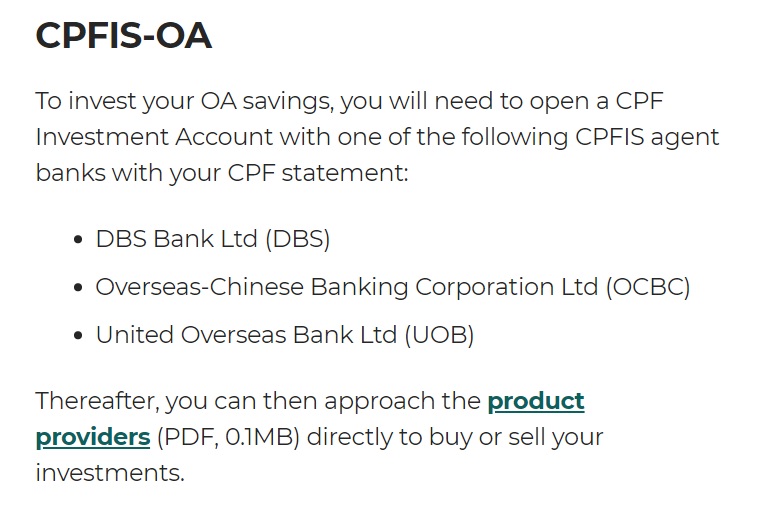

1. You Need To Open A CPFIS Account First For OA Funds

Below is a screenshot taken from the CPFB website:

You should have no issue opening a CPFIS-OA account online.

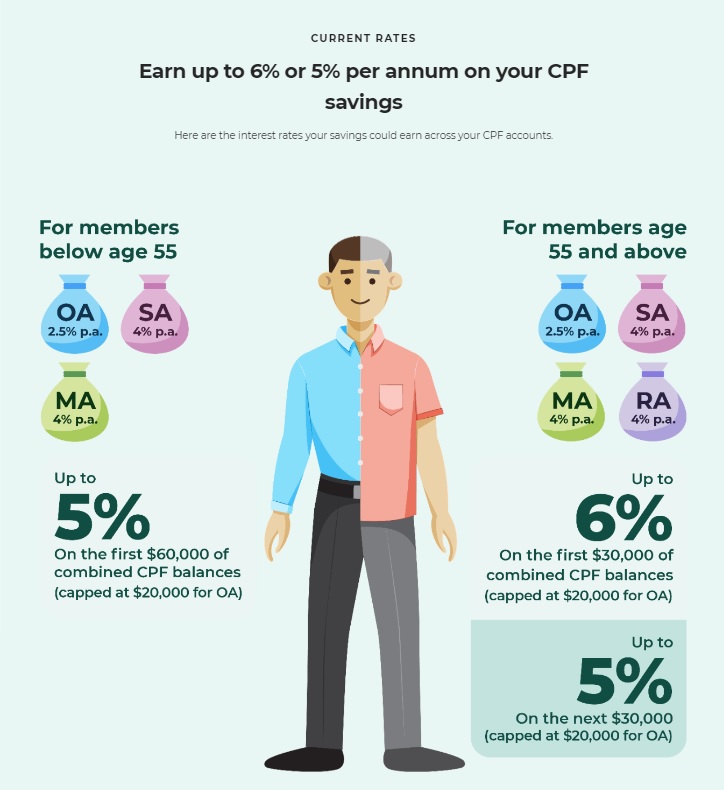

2. Do Not Use The First $60,000 of Your CPF Savings

Firstly, under CPF regulations, you can only invest your Ordinary Account (OA) savings after setting aside $20,000 in your OA and you can invest your Special Account (SA) savings after setting aside $40,000 in your SA.

Even if there were no such restrictions, you need to be aware that the Government pays an Extra Interest of 1-2% on the first $60,000 of your combined CPF savings.

If your CPF OA savings are yielding 3.5%, it is not worth the hassle to invest the savings in a T-bill or SGS bond at current rates.

3. Do Not Use Savings From The Special Account

Below is another screenshot from the CPF website, accessed on 17 October 22.

OA interest rates are pegged to banks’ default interest rates which have shown no signs of increasing in the past year. Therefore, I reckon that the CPF OA interest rate has a very remote chance of going above 2.5% in the foreseeable future.

As for SA, notice that they are based on 10Y SGS yields plus 1%. The 12-month average yield is a lagging indicator and if SGS yields remain elevated for the next half a year, it is likely that we will finally see SA interest rates break above 4%.

Therefore, there is little to no incentive with regards to investing SA savings in T-bills or SGS bonds.

4. The Opportunity Cost Of Investing Is Much Higher Than 2.5%

The latest BS22120E 6-Month T-bill issuance and the BY22103A 12-Month T-bill issuance had a cut-off yield of 3.77% and 3.72%, respectively.

However, it is a tad too simplistic to assume that you will earn an extra 1.2% of interest by investing your CPF OA savings in these T-bills.

Firstly, you would incur two types of charges when applying for T-bills using your CPFIS. The first is a transaction charge of $2.50 for the purchase of the issue and a per quarter service charge of $2 per issue. A 6-Month T-bill would incur total charges of $6.50, a 0.65% charge if you are investing the minimum of $1,000. Please do not do that.

Secondly, our CPF interest is computed monthly and compounded annually, based on the lowest balance in the month. Therefore, if you bought a 6-Month T-bill with CPF OA savings, you will forgo 7 months of CPF OA interest.

Based on my rudimentary calculations, for a $5,000 investment into BS22120E (latest 6-Month T-bill)

- Interest earned: $94

- Opportunity cost forgone: $73 + $6.50 = $79.50

The difference is about just $14.50 more by investing in the 6-Month T-bill.

5. Enter With Size To Make It Worth The Effort

Personally, I think $14.50 is not worth the hassle for me to accompany my mother-in-law to go down to a bank to apply for the T-bill. Remember, there is also a trade-off in liquidity, considering how difficult it is to sell T-bills and SGS bonds in the secondary market.

I guess one would have to make a minimum investment of ~$50,000 on each issue to make this a worthwhile endeavour since the arbitrage would increase to about $200.

6. T-Bills Vs SGS Bonds

Based on the illustration above, the benefits for a T-bill or SGS bond should be starker if you invest in a bond with longer duration. For a 6-Month T-bill, you only get 6 months of higher rates while you lose 7 months of 2.5% interest. For a 12-month T-bill, the ratio will be 12:13. For a 2Y SGS bond, it will be 24:25.

I hope you get the idea.

Ceteris paribus (i.e. the rates are the same), I believe a 12-Month T-bill or a 2Y SGS bond could be more ideal for this arbitrage exercise.

However, the problem is the lack of issues for both of these instruments. If you look at the 2022 and 2021 issuance calendar, in a calendar year, there are typically 25-26 issues for 6-Month T-bills, 4 issues for 12-Month T-bills and just 2 issues for 2Y SGS bonds.

The advantage of 6-Month T-bills in a rising interest rate environment is that it is more liquid and you can easily buy another 6-Month T-bill (with higher rates) when the issue you bought matures. Conversely, locking in a longer duration would be favorable if rates start to decrease.

7. Only Invest Savings You Do Not Need In The Short-Term

If you have a sizeable mortgage and your preferential rates (<2%) expires sometime within the next six months to a year, then it will not make sense to invest your CPF OA savings in these T-bills or SGS bonds.

Current mortgage rates will be comparable, if not higher than these yields. It would be more prudent to use the CPF OA savings to reduce the debt in that case.

Therefore, this arbitrage opportunity is more relevant for older folks who have already paid off their mortgages or people who are on the HDB Concessionary Loan (2.6% fixed rates).

Conclusion

With no Fed pivot in sight, one probably does not have to be in a rush to invest in these instruments. There is a good chance rates will stay elevated or even increase in the upcoming issues.

For those looking for a step-by-step guide, I will probably write a follow-up post after I bring my mother-in-law down to a local bank to apply for her T-bill/SGS bonds with her CPF savings.

The 2023 issuance calendar would also be out either this October or next month in November. Do stay tuned!

Thanks for reading.

If you enjoyed this article or found it useful, do subscribe to my blog via email to receive notifications of new posts:

- For mobile users, please scroll to the bottom of this page

- For desktop users, look to your right!

Do follow me on social media too for daily musings and updates too!

Thanks for the support!

Personally, I am irritated by ads and pop-ups when I am reading an article so I do not use any of them on this blog too.

Thanks for this post! Great to have this free arbitrage opportunity. Upon maturity, do the principle + interest flow back into the OA automatically or into the CPFIS account with the bank and you need to refund it back into the OA?

Hi YH,

Thanks for the comment and good question. I have no experience with the process yet, so do monitor for a few days what happens when the T-bill matures. If the funds are not automatically refunded back into the OA, one would have to manually do it.

The fund will flow back into the CPFIS (e.g. with the bank) upon maturity and remain there for up to 3 months before returning back to OA if you don’t do anything. You shall transfer it back immediately to your OA account via ATM to continue to earn the 2.5% from OA.

Please bear in mind that most banks branch managers and staff don’t know anything about T-bills. They are only there to help with the paper work.

Thanks Almur, i also found this in the CPF website:

https://www.cpf.gov.sg/member/faq/growing-your-savings/cpf-investment-schemes/how-do-i-transfer-the-cash-balance-from-my-cpf-investment-accoun