Being perfectly honest here.

Before 2022, I had never heard of Fullerton SGD Cash Fund, even though the fund was incorporated in 2009, more than a decade ago.

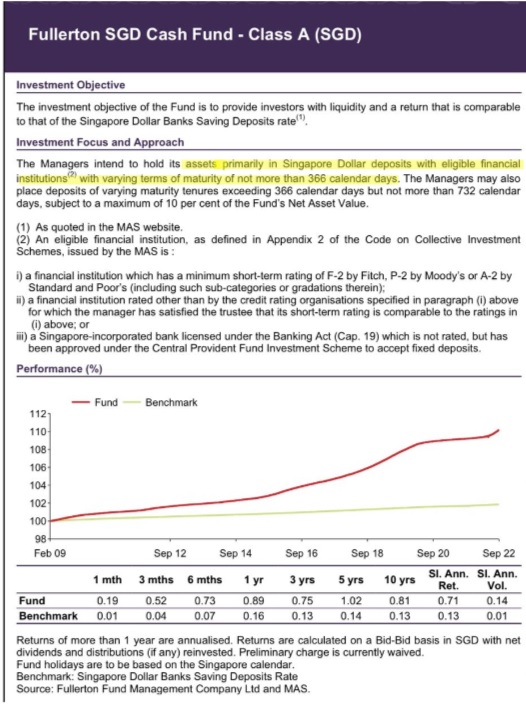

And with good reason, since we have been in a low interest rate environment since 2009 and parking money in such a fund would have yielded 1% annually at best.

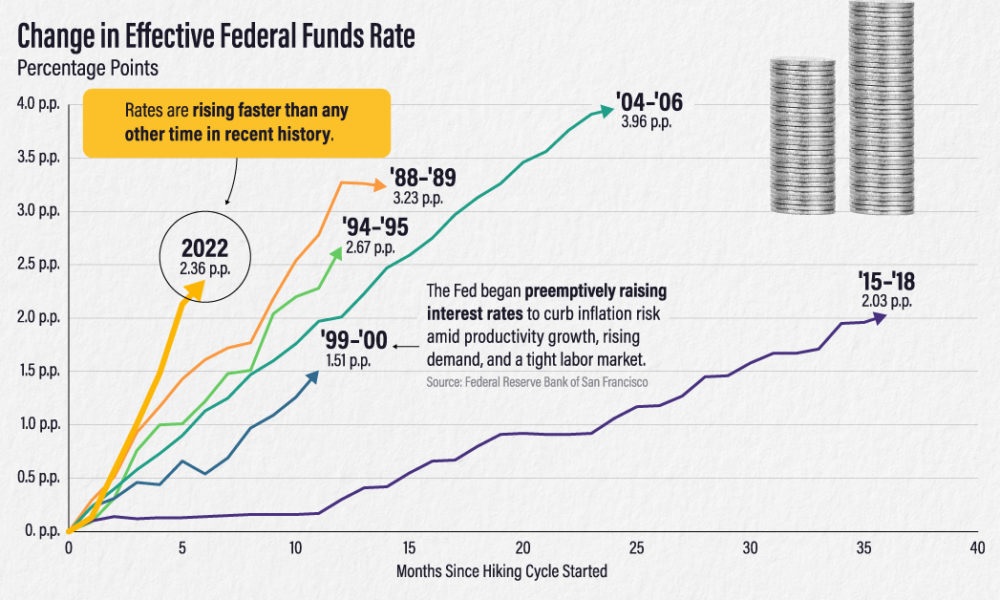

2022 though, is probably a special year that I will remember for a long time. As they say, sometimes, a picture speaks a thousand words.

So here are 6 more reasons why I am considering the Fullerton SGD Cash Fund.

1. Unable To Get Good Allocation For Singapore Saving Bonds

I still believe Singapore Saving Bonds (SSBs) is the closest you can get to a free lunch. Capital-guaranteed, relatively liquid, an option to roll over to the next issue (with higher interest) at almost zero cost and finally, the opportunity to lock in a high interest rate for up to 10 years.

Therefore, no surprise that in the latest November 2022 issue (highest yield ever to date), the allocation was capped at S$10,000 for each applicant.

Thus, the Fullerton SGD Cash Fund offers a compelling alternative for those who are setting aside substantial cash. At the very least, one could park it there at ~3% yield while waiting for the subsequent issues of SSBs.

2. Higher Returns Than Bank Deposits

Not pointing fingers but many bank accounts are still offering disappointing rates that are below 0.5%. Quite absurd to be parking large sums of cash in those accounts in this rising interest rate environment.

A ~3% yield that Fullerton SGD Cash Fund offers is many times higher than these bank rates.

Accessed through moomoo SG app on 7 Nov 2022

3. At Low Risk

I hear the naysayers here. Yes, the first S$75,000 of bank deposits are guaranteed by the government while no such guarantee applies for Fullerton SGD Cash Fund. Nonetheless, if we take a closer look at the prospectus of the fund, the risk is very low since all the funds are held mainly in Singapore Dollar deposits.

Accessed through moomoo SG app on 7 Nov 2022

For further reassurance, this is also one of Singapore’s largest cash funds, used by notable companies and institutions for their cash management.

4. Liquidity And Flexibility Is Preserved

In order to compete with instruments like Fullerton SGD Cash Fund, fixed deposit rates are also rising and indeed, some offers yields higher than 3%. However, this is not an apple-to-apple comparison.

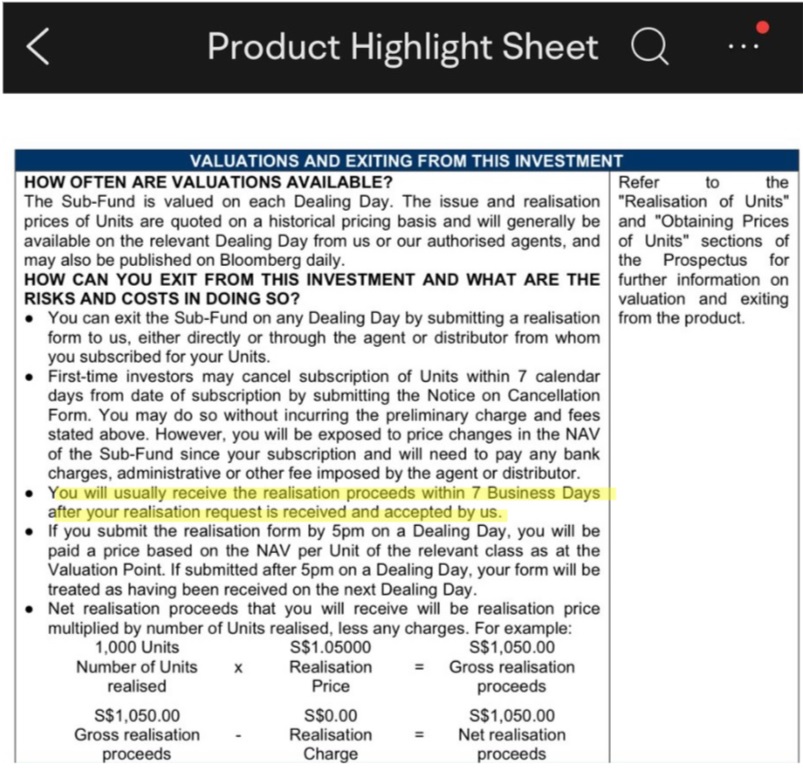

Unlike fixed deposits, with the Fullerton SGD Cash Fund, I still retain the flexibility to withdraw my savings whenever I need them. The units can be redeemed at prevailing prices and proceeds will be returned to my bank account within a few days, with no penalties.

Accessed through moomoo SG app on 7 Nov 2022

So that on short notice, I can use the funds to invest when markets have a sudden sale.

5. Fullerton Fund Management Is Very Reputable

Fullerton Fund Management was incorporated in Singapore in 2003 and is a subsidiary of Temasek. NTUC Income also became a minority shareholder in 2018.

Knowing about the owners of the fund has certainly helped to put my mind more at ease.

6. Anticipating Higher Yields For T-bills

SGS Bonds and T-bills are almost definitely a better deal than fixed deposits of the same tenor. In fact, the latest 6-month T-bill is yielding 4.19%.

If you are anticipating higher yields for T-bills (5% anyone?), it might make sense to park the idle cash in Fullerton SGD Cash Fund while waiting for the “perfect” auction.

Well, unlike SSBs, T-bills are much more illiquid, and you do not have the “free” option to redeem and roll over to the next issue/auction.

Conclusion

If you are interested in the Fullerton SGD Cash Fund, do note that you can gain access to it through moomoo Cash Plus.

I always believe in skin in the game, so I have personally used moomoo Cash Plus and also redeemed some units to test out the liquidity. I was very pleased to find out that I could redeem my funds for instant use to buy stocks on the moomoo SG platform, reiterating point 4 above. Moomoo Cash Plus also do not charge any additional subscription and redemption fees for the funds.

At the same time, for deposits of at least S$100 into your moomoo SG universal account before 17/11/2022, you will unlock guaranteed 5%* p.a. rewards on your Cash Plus for 4 months. Applicable to the first 3000 new moomoo users!

Click the link here to sign up!

*T&Cs apply.

Thank you for reading.

This article is written in collaboration with moomoo Singapore. All views expressed in the article are of my independent opinion. Neither moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.

sorry but where do you get 3% yield ?

Hi Peter,

The fund provides around 3% yield if not higher.

Hi,

Thanks for sharing your whys.

Just curious, where can I find out more on what they invest in? Thanks.