Let’s start off with a short primer on SRS.

The Supplementary Retirement Scheme (SRS) is a voluntary scheme to help us save up for retirement. In case you are unaware, the main selling point of SRS is its tax benefits. Contributions to SRS are eligible for tax relief and the annual SRS contribution cap is $15,300.

Obviously, there are conditions attached to the withdrawals. Early withdrawals before retirement age will incur a 5% penalty and are 100% taxable. Withdrawals after the retirement age are taxable at 50% and can be withdrawn over a period of 10 years.

P.S. If you are unfamiliar with SRS, you can check out this basic guide by SingSaver.

Why I Started Contributing To SRS Recently

Working backwards, it would be optimal to have a $400k SRS portfolio at age 62 and then withdraw $40k each year without incurring any penalties or having to pay any taxes. Of course, I will not complain if the portfolio grows much bigger!

Since I am approaching my late thirties, I guess it starts to make sense to contribute around $10k each year for the next 25 years.

Based on a conservative 5% p.a. return, the portfolio will grow to $480k. If future returns mimic the past and we achieve a more respectable 7% p.a. return, I can look forward to $630k inside my SRS account. I will be rooting for more accommodative tax policies for the bottom rungs when that happens.

Alright, enough day-dreaming and back to tax savings. Since my marginal income tax rate is currently 7%, I get to save$700 for a $10,000 contribution.

More importantly, the money is liquid unlike CPF top-ups. If I am down and out in Year 2023 with no income, I can withdraw my SRS funds at 5% penalty. Even with a $500 penalty for a $10,000 withdrawal, I will still be ahead by $200 after netting out the tax savings for the prior year.

Why Endowus

Most likely (or hopefully), I will only withdraw the funds in my SRS account at 62. This means that the funds have a long time horizon and probably should be invested at least for the first two decades to maximise returns. So yes, I will not be using it to buy SSBs or T-bills.

Of course, I could DIY and invest in individual stocks but I believe it is more natural to want to turn to robo-advisors for a more hands-free approach.

Especially if you are contributing ad investing in chunks of $1,000 like me. It will be cheaper for me to pay Endowus’ 0.40% fee as compared to incurring brokerage charges.

I would also like to think that Endowus is pretty legit since they are the first CPF digital advisor and you can invest your sacred CPF funds with Endowus. I simply cannot imagine Endowus doing a FTX and stealing customer funds outrightly.

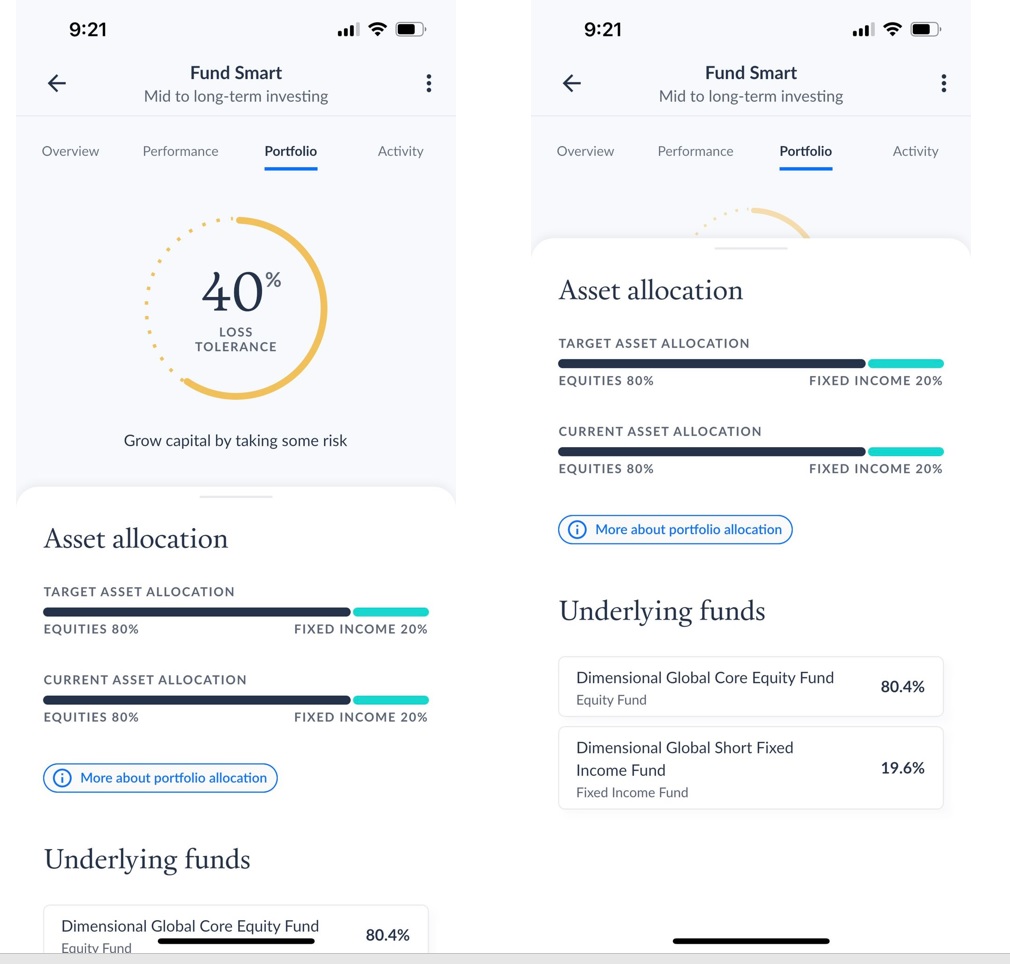

The 15HWW SRS Portfolio

Another plus. Accessing the portfolio is also fuss-free and convenient, especially if you use the app on your smartphone.

Here are the funds and allocation that I have chosen under Fund Smart.

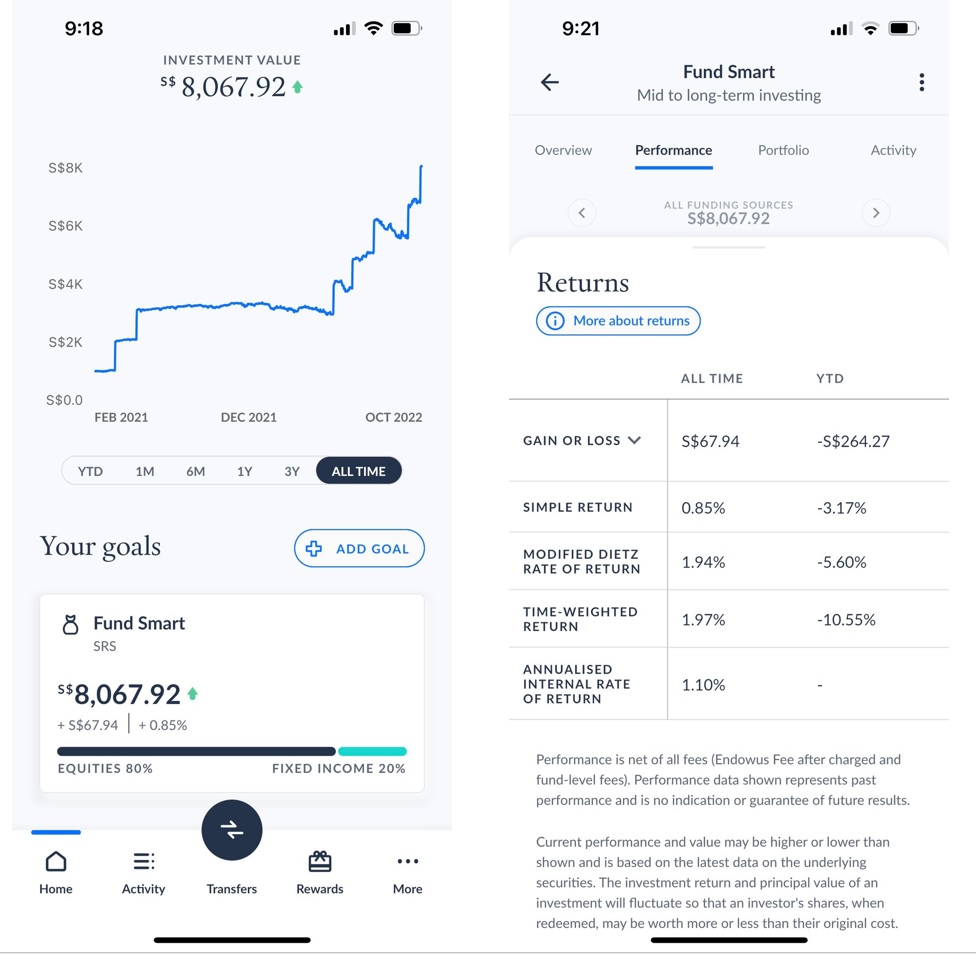

I have also contributed a total of $8,000 across Year 2022 and Year 2023. I am actually pleasantly surprised that I am not in the red, especially since we appear to be at the depth of this bear market.

Why I Am Tracking The SRS Portfolio Every Quarter

Similar to the Permanent Portfolio, I think the SRS portfolio is relatively simple to implement and as shown above, when you start DCA-ing in a bear market, the odds of making losses is really low in the long run.

Going forward, I will aim to invest $1,000 every month into my SRS.

I sincerely hope these quarterly updates will inspire some beginners or those who are relatively conservative to go further out on the risk curve, beyond SSBs and T-bills. At least for a portion of their funds and what better than SRS contributions which should theoretically only be accessed during retirement.

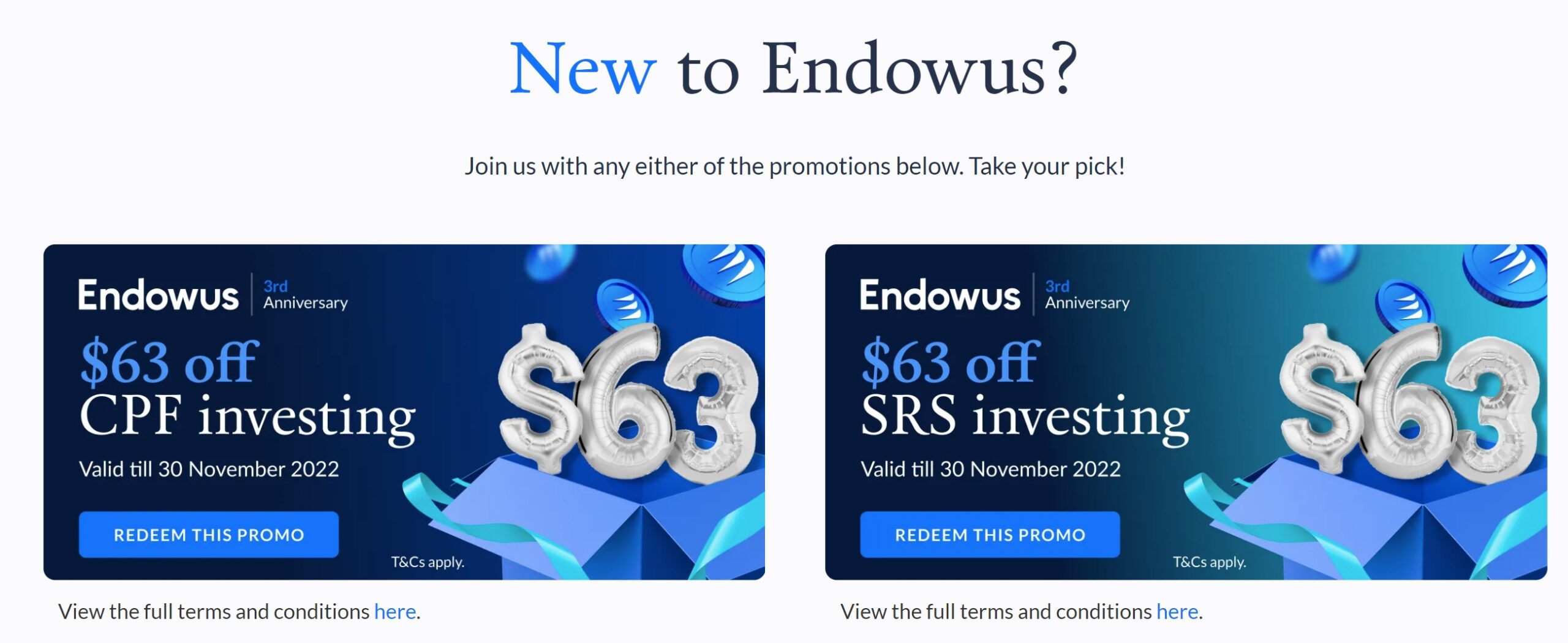

Endowus 3rd Birthday Promotion

Screenshot taken from Endowus website on 17 Nov 2022

If you are new to Endowus and planning to invest using either your CPF or SRS funds, you should not use a friend or influencer’s referral code which only provides you with $20 off your fees. $63 off by using the promo code on the Endowus website is infinitely better and the promotion is valid till 30 November 2022.

Using $10,000 of investment as an example, $63 should be able to cover 1.5 years of Endowus fees.

The above is a great promotion, probably Endowus’ most generous ever for referrals. The promotion started on 5 October 2022 and is limited to 300 sets and interestingly, it is not fully redeemed yet.

However, it will only make sense for you to use my referral code to sign up for an Endowus account if you are funding it with cash.

If somehow I miraculously get the $300 cash bonus and you believe you are a contributor, drop me an email. Upon verification, I will want to share the cash bonus with you.

Otherwise, Iet me reiterate again, you should be using Endowus website’s promotion code. Especially if you are investing your SRS funds.

Conclusion

The next update will be in February 2023 and till then, all the best in your SRS investing journey!

Thanks for reading. In case you are wondering, this article is not sponsored. You should also not be using my affiliate link unless you are investing with Endowus using cash.

If you enjoyed this article or found it useful, do subscribe to my blog via email to receive notifications of new posts.

Do follow me on social media for updates too!

Thanks for the support!

Personally, I am irritated by ads and pop-ups so I do not use any of them on this blog too.

does the promo work for existing SRS users with endowus?

planning to max out the srs contribution for this year

Hi FC,

If you are referring to the $63 off promotion, my understanding is it only applies to new users of Endowus.

Could you share which funds you purchased with SRS and why?

Hi B,

I use Dimensional Global Core Equity Fund and Dimensional Global Short Fixed Income Fund in the ratio 80:20.

The ratio is to have decent returns while hopefully decrease a bit of volatility. I chose Dimensional as they are reputable and these two funds also have relatively low expenses.

Hope the above helps!

Thank you for the reply. Just wondering, did you also consider Amundi’s MSCI World Fund, which has a lower expense ratio of 0.18%?

Hi B,

I think that is a good choice also.

I have a feeling when I started the portfolio in 2021, the Amundi fund was not available for SRS funds?