During the family gathering on Xmas day at a cousin’s place, I was surprised to find myself in the middle of a conversation about CPF top-ups. Yes, as we approach the end of the year, CPF top-ups are back in vogue again.

I tried to bring up T-bills as an alternative and all I received were blank stares. When I explained a little further about T-bills and the process to apply for it, I was literally waved off.

Nowadays, with age slowly but surely mellowing me, I simply do not double down on my position. Instead, I reflect and explore the different angles on why the others’ position are more justified. So here’s what I realised:

1. Tax Relief

Taken from the CPF website:

You can enjoy tax relief for cash top-ups made in each calendar year of up to:

- $8,000 if you make a top-up to yourself; and

- an additional $8,000 if you make a cash top-up to your loved ones.

Only cash top-ups up to the current Full Retirement Sum (FRS) are eligible for tax relief.

Personally, I think for high-earners, this is a very valid option to legally reduce your tax liabilities for FY 2022. Since the deadline is 31 Dec, I can understand why many are rushing to perform CPF top-ups over the next few days.

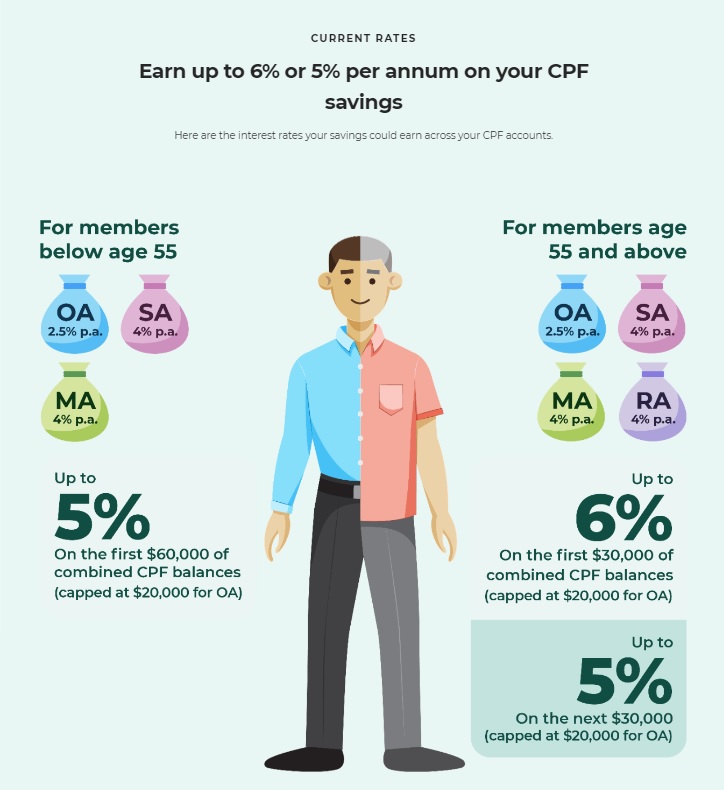

2. CPF Extra Interest

This is applicable to those who have low balances in their CPF accounts. Either just starting out with their career or they are self-employed like me.

If the top-ups attract extra interest, the returns will then likely be comparable or even higher than that of T-bills.

3. High Interest Rate Environment Could Be Temporary

I do not believe that the floor rate of 2.5% for OA funds and 4% floor rate for SA/MA/RA funds will be lowered during this decade.

However, I do not hold such strong conviction for T-bills, even for the next two years. There is no guarantee that one can roll over a 6-month T-bill at similar rates or higher than 3% in 2024.

Therefore, for those that are relatively risk-averse and are happy with rates between 3 to 4%, CPF remains a good avenue to park extra funds for the long-term.

4. Option To Use CPF OA To Buy T-Bills

For those who are using the Voluntary Contribution (VC) scheme and are making cash top-ups to their CPF OA account, there is always the option of using the OA funds to earn higher interest rates by buying T-bills.

That way, the floor interest will be 2.5% even if interest rates suddenly take a nosedive. Meanwhile, there is the opportunity to top up and also enjoy the higher returns currently offered by T-bills.

5. Age 55 Or Beyond

I personally think the main downside to parking funds in CPF is the long wait before the funds turn liquid, whether it is 55 or 65. I am still decades away from those milestones.

However, there are many folks who have crossed those milestones and additional contributions or top-ups to their CPF accounts become liquid almost immediately, if the need arise to withdraw them.

For this group of people, even in this high-interest rate environment, CPF top-ups could make more sense than T-bills or fixed deposits.

Conclusion

You would think the main reason would be the tax benefits, a rational conclusion. But I think the truth is likely to be far more instinctive and also based on fear and habits.

There are many folks who believe CPF money is sacred and it will be the last thing that the ruling party would give up on. Everything else, even T-bills, just sounds more risky. And who would like to dispute that?

Furthermore, I believe with 2022 proving to be a bad year for risk assets, more money would pour back into CPF. How do I know? Because my mother-in-law, who is retired, continues to perform voluntary contributions to her CPF account. I am quite sure she is doubling down on her risk-averse position after hearing even more about my paper losses recently.

Thanks for reading.

If you enjoyed this article or found it useful, do subscribe to my blog via email to receive notifications of new posts.

Do follow me on social media for updates too!

- Instagram (Featuring Baby 15HWW! Updates are dependent on Mrs 15HWW)

- Twitter (Still finding my feet)

Thanks for the support!

Personally, I am irritated by ads and pop-ups so I do not use any of them on this blog too.

Thank you, Mr 15HWW for all the insightful and very relatable posts. I’ve been a long-time reader but a first (or second) time commenter.

I’m with you when it comes to the choice between t-bills vs CPF for reasons not very dissimilar to yours, the chief of which being accessibility. Like you, I’m still a few decades away from 55, so I prioritise the freedom of moving my money from one favourable place to another over most things.

The most important thing that I’ve learnt from this post is, ironically, something non-financial. That we should not insist on our views, but instead analyse why others are doing what they do. No point doubling down on one’s own views, especially when chatting with those alpha-know-it-alls. This has been something that I’ve been working on for a while and have yet to reach your level of self-control.

By the way, is there any chance that you’d have the time to pen a post regarding your goals/resolutions for 2023? Would love to know more!

Hi Tee,

Thanks for the comment and with regards to your praise about my self-control, I guess the stuff I write acts as a reminder to myself? =p

Even though I did not reply to your comment in a timely manner, I hope my most recent post was a better response on your request for goals/resolutions. With age and with the many accumulated years of “failed” goals and resolutions, I guess “hopes” become more apt.

Happy New Year to you and your family and may all your goals/resolutions come to fruition in 2023.

Thank you for sharing your insights. With regards to your question on which is safer (T bill or CPF saving), please allow me to provide my 2 cents worth. Technically, both are eventually guaranteed by the Government of Singapore. However, T bills are issued directly by the Government while CPF monies are managed by CPF board that will invest the monies in Special Singapore Government bonds. Hence, CPF monies carry one more layer of counterparty risks (i.e. the credit worthiness of CPF board). Nonetheless, both are equally safe and guaranteed by the Government.

Hi Robert,

I have similar sentiments to you. Quite sure that at the end of the day, the Govt will back both CPF and T-bills.

But actually as I have pondered, I realise CPF has less risk as there is counterparty risk for T-bills since one is buying from a bank?

But the increase is probably negligible. Maybe 0.0001% increase? lol

Hi There,

I am one of those who would not think twice about topping up my CPF accounts in the current elevated yield climate. And the two main reasons are :

1. I am above and the money in my OA & SA are liquid to me should I need to draw on them

2. I could use the OA & SA funds to purchase T-bills and even place them in FDs in our three local banks should the rates become compelling enough.

And should the current elevated interest rates revert to low interest rates, at least my funds in the CPF will be ensured of the floor interest rates of 2.5% (OA) & 4% (SA, MA & RA). It is not so easy to pump in money into one’s CPF accounts.

Incidentally, I have used $1.24M of my OA funds to purchase a series of T-bills with yields from 4% to 4.4%. In the rare event that the T-bill yield climbs beyond 5%, I may even deploy my SA funds for it.

Hi Nick,

Thanks for sharing your situation and you are right, my mother-in-law is quite fixated about the annual limits for CPF top-ups and would like to maximise it every year in order to ensure the “max” pump into her CPF accounts.

I would recommend most people with ample CPF funds to buy some T-bills. However, as for SA funds, my view is that if T-bills climb above 5%, the floor rate of SA funds will likely rise above 4% too.