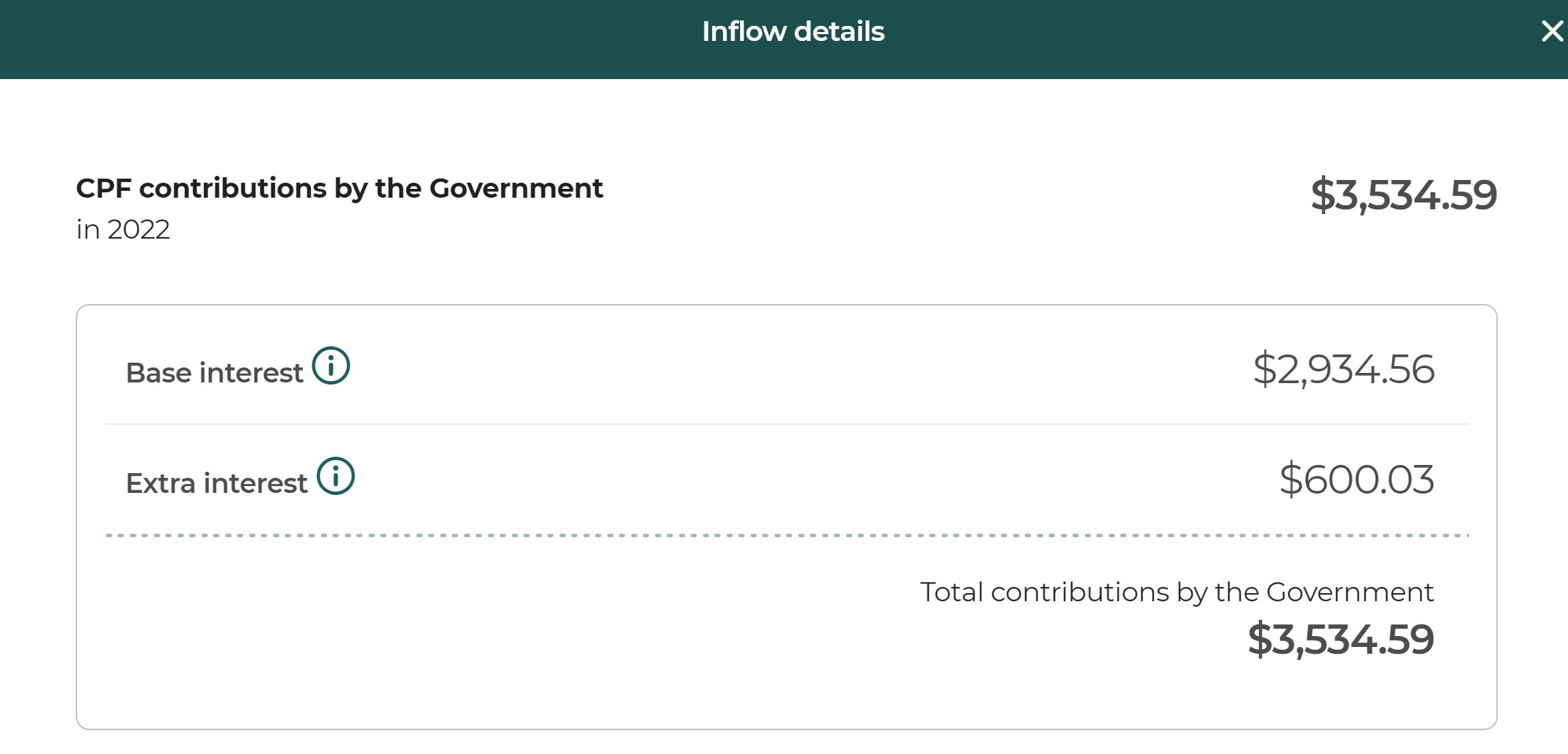

I can understand why most Singaporeans like to log in to their CPF accounts on 1st Jan every year. That’s when the yearly interest for the previous year is being credited. Even though mine is a very modest number of $3534, I still got a positive kick out of it. Not to mention those people who are getting >10x the amount of interest I received.

Maybe 10x the amount of kick? =p

Especially since the interest is positioned as “Total contributions by the Government”, instead of something that you should “rightfully receive” in exchange for giving up decades of liquidity? Some intensive psyops there but kudos to the officer who thought of this. Because my immediate reaction when I saw the above screenshot was to be thankful to the G before I caught myself! So it did work……

Anyway, enough digression. This post is a reminder to myself to count my blessings even though my CPF amount is probably way below the median for my age group.

No Active Contributions To OA And SA Accounts

In case you are new to this blog (low odds), I am a self-employed tutor who only makes mandatory CPF MA contributions. Yes, no VCs or CPF top-ups ever and likely to remain so for at least the remainder of this decade.

All the balances I have in my OA and SA came from the 3-4 years I spent as an employee almost a decade ago.

I Prefer Other Investments

Whether it is stocks, REITs, SSBs or crypto (yes, still buying), I rank them higher than CPF at this point in my life. If you managed to buy some of these risky stuff a month or two ago, you could be up by multiples of the CPF interest rate in a matter of weeks.

It does not make sense to be more defensive in your asset allocation during a bear market. #justsaying

Things could change in the future, of course, if I value the stability and certainty of an annual 3-4% interest. But right now, I am simply not that interested in ramping up my CPF contributions to see a 5-digit interest every year.

$3534 Is Higher Than A Year Ago

The last time I wrote about CPF interest was two years ago. Since I do not use CPF funds for mortgage payments, the typical withdrawals tend to be deductions for insurance premiums, which are quite negligible in the grand scheme of things.

So I guess higher interest is still cause for a mini-celebration since it means that there were no major medical expenses that would result in the draining of MA funds. Whether it’s for yourself or your family members.

That’s great news, if you think about it seriously.

$3534 Is Still Significant

Expenses have crept up over the past years. Besides inflation for essential items like food and electricity, there are car-related expenses, milk and diaper for the baby and the additional costs of hiring a helper.

Therefore, even though I have not tracked expenses granularly for some time, a simple estimate of $7,000 every month should not be too far off.

So theoretically, if CPF interest can be withdrawn for me, it should help cover my half of expenses for about one month. Almost 10% of annual expenses, so still not too bad.

Decent Effective Rate Of 4.5% For Entire CPF Balances

Since my entire CPF balance was still below $80k on 31 Dec 2022, the blended or effective interest rate is still approximately 4.5%, not too different from previous years.

This is because the Extra Interest of 1% for the first $60,000 of balances helps to pull up the returns on all funds and the fact that OA funds account for only about 20% of my entire CPF balance.

4.5% guaranteed was great a couple of years ago but even in the current high interest rate environment, it is still fairly decent.

Conclusion

Not sure if I have enough unique perspectives to make this a yearly post, but otherwise, an article on my CPF interest once every two years should help reiterate and update my stance. And probably offer some solace to those like me with low CPF balances.

This is definitely not a diss to those with high CPF balances. After all, I like to check and remind my mother-in-law at the start of every year on her CPF interest. It is indeed hard for her to hide her smile when she vaguely plays down the amount of interest she receives, ahem.

Thanks for reading.

If you enjoyed this article or found it useful, do subscribe to my blog via email to receive notifications of new posts.

Do follow me on social media for updates too!

Thanks for the support!

Personally, I am irritated by ads and pop-ups so I do not use any of them on this blog too.

Hi 15HWW,

When we were younger, right up to when we were in our 40s, we werent fans of the CPF. We saw it as savings we couldnt touch for our daily expenses. So we practically emptied our OA savings into property. I still remember in my mid 40s, I had all of $7K in my OA.

It was only when we got nearer to 50 yo that we felt maybe it was time to return the money into our CPF. By 50, the CPF savings looked more like a 5 year fixed deposit then. And we continue to pump money into it as we got nearer to 55, as by 55, the CPF savings could become our ATM. An important point to note here is the yearly contribution / deduction from our salaries into the CPF. If you miss contributing yearly, you will not be able to put in money later on to make up for the lost years of non-contribution. So where you can, you should try and contribute yearly.

To cut the story short, with our CPF savings fattened up at this current time, we realised that we could create two robust passive income streams from it:

Total combined for both of us

1. Interest from our OA&SA = $68,000 (interests obtained in 2022 = $64,000)

2. CPF Life payout at 70 = $62,000 pa (or $50,000 pa if start payout at 65)

The two streams will thus provide a stable floor income for us in our retirement and without drawing down the OA&SA principal sums. Any other income from dividends, rental and SRS savings draw down will only add to the income.

In my view, do not neglect the humble CPF. We will appreciate its benefits as we get older and when we do get older, we would want to have passive income coming in monthly like clockwork without any effort on our part. Besides we should be focussing on the more important things in life in retirement.

Hi Nick,

Thanks for the detailed sharing on your successful CPF story. Being an ex-employee of the stat board, I am pleased that you are singing praises of the system and of course, highlighting the fact that there is an annual cap to contributions that I probably have “missed” for about a decade.

I guess a key takeaway for me is that I can still “catch up” in my mid-40s just like you? =p

Totally in agreement..

that’s exactly was my thought too when I was young and literally emptied my OA to buy property.

Later, when I realised the benefits of cpf, I voluntary pumped in the cash that I withdrew for property. Also, made SA top ups.

Just turned 55….

managed to hit ERS sum in RA, and have quite a decent sum sitting in OA and SA.

Do give a serious thought to maximize cpf benefits.

Hi SJ,

Thanks for corroborating Nick’s experience and encouraging me not to be “too dismissive” of CPF. Will definitely update if I change my mind, especially when I grow older. Appreciate thoughts and perspectives from those who have travelled the path!

Hello 15HWW,

I was tickled pink with your paragraph on “Total contributions by the Government”.

Big daddy got their own snake oils too! I’m sure the official who thought of it got a gold star next to his resume. LOL!

You were with big daddy before, you would know 😉

It’s nice to have a counter-balance post on CPF once in a while – What? You not voluntarily contributing?

It’s simple math:

If we can beat 4.5%, why right?

If we can’t beat 4.5%, big daddy I love you!

Hi Jared,

Long time no see you on my blog post and super envy your “views” in your new SERS replacement flat.

Honestly, I think I have barely beaten 4.5% after slightly more than a decade in the market. But I take the liquidity anytime!

With this total contributions by government, im wondering if i should start labeling the interest im getting from the banks as contributions by banks too. Perhaps i should thank the bank for wanting to loan money from me.

Hi honest_me,

Good catch too! The banks can really take a leaf out of the government’s books…

Big difference between mandatory CPF or voluntarily CPF contributions as cash Savers or cash Investors who are confident of beating 2.5% compound interests over market cycles.

We have our own mind over to save more with capital protection in CPF or take risks and invest more in cash.

Hi Uncle CW,

2.5% is a low hurdle for “investment funds” but a decent rate for liquid short-term needs. I guess that’s one of the perks of growing old in Singapore, have access to CPF as a liquid saving account.

Hi

Kudos on the point about “government contributions”.

I totally get the importance of CPF, but for the uncommon few (like yourself) who have the means and ability to create your own retirement path, deviating from the norm makes sense.

Hi Robert,

I would say I am not obsessed over maximizing my CPF at this point in time. I do think when I turn 55, there is a good chance I will be much closer to the Full Retirement Sum (FRS) thank what most readers will expect.

Being able to guarantee basic needs during retirement is definitely something I will completely dismiss out of hand.