I enjoyed RPG games when I was in my teens and actually, if I care to admit, even till my late twenties. Final Fantasy, Kingdom Hearts and Dragon Quest are some of the series I have spent an unhealthy amount of time on.

Not sure if I am an anomaly, but I do think that I was a very cowardly RPG player. I tend to manually make a save every 20 minutes or less, to ensure that if something unlucky happens to my character in the game, all my efforts are not “wasted”. I also hate to “lose” or “die”. To press home this point, as a young kid playing Super Mario on the basic Nintendo console, I would often pass the controller to my older cousin when the stage becomes a wee bit too difficult.

Such a mentality means I do take longer than most people to complete a game but this ability to respawn at a checkpoint is useful when you apply to money and personal finance. Not too dissimilar to achieving financial security and making sure you never fall below that level but this respawn analogy is probably much more relatable.

Basically, it is to ensure that you can respawn with an equipment list that enables you to continue the game or in this instance, having enough money to ensure a basic lifestyle if some of my higher-risk gambles blow up.

Basic Expenses (In Order Of Priority)

This is what I believe we require for a small nuclear family of three to more than survive. And in case it is not obvious, there is no room to include expenses for a helper or a car.

Food and Groceries ($1050)

- $25 budget per day for food, with at least one cooked meal

- Two meals a day should be enough for the Mrs and me. More Singaporeans need to adopt intermittent fasting than not. Some cai peng is also very worth the money, like the one at Punggol Hawker Centre that we have recently made a staple

- $10 per day for other household items like detergent, toilet paper, toothpaste, cleansers and shampoo

Mortgage ($0)

- Currently we have about $500k of housing equity (resale value – outstanding loan)

- A combination of the downpayment, mortgage payments, grants and capital gains

- That should allow us to purchase a decent 3-room resale flat in today’s market without taking on any housing loan. Currently, we require much bigger space since we have lessons at home and also have a helper

- In the very long run, one bedroom for us and another bedroom for Baby 15HWW is ok, especially if we are no longer tutors

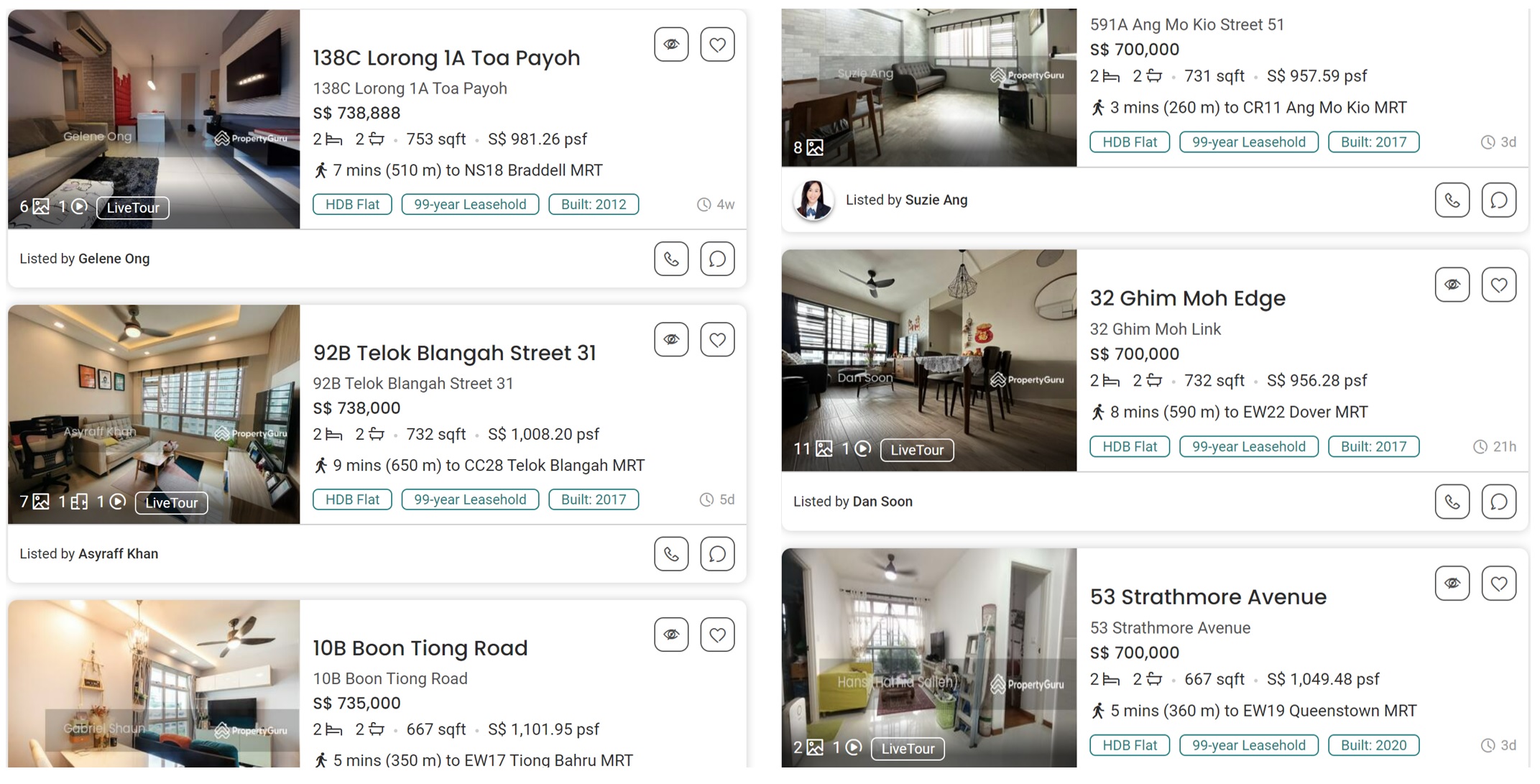

- Don’t look down on 3-room flats. SMOL will scold you! Actually, a quick search on propertyguru shows that some of these 3-room flats in central locations are asking for more than $700,000

Utilities ($200)

- With the smaller living space of a 3-room flat and more generous subsidies provided by the government, I am confident my electricity and water bills will be within $100 per month. Yes, very environmentally friendly

- $100 for a basic broadband and three phone plans is also very feasible. This is an area where deflation has set in as the costs are much lower compared to when I was a teenager

Education ($100)

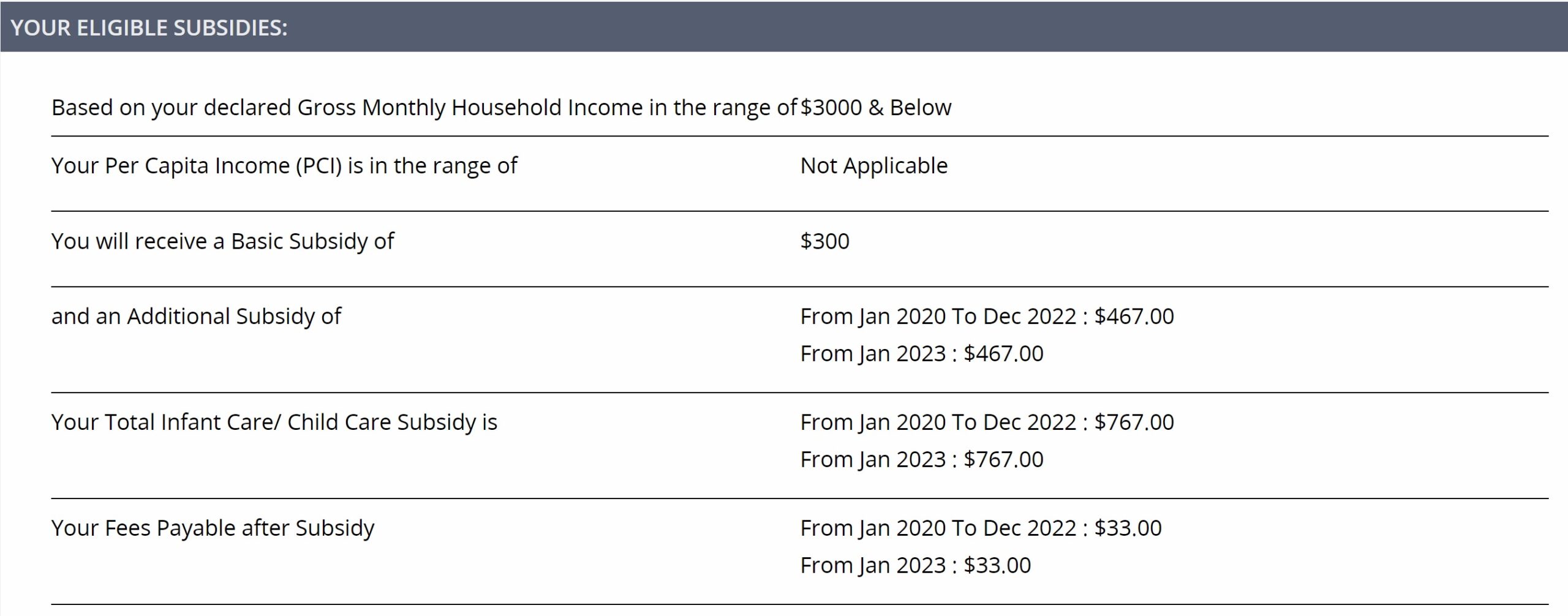

- Even for childcare, after accounting for subsidies, there is very little out-of-pocket expenses for a low-income family. A picture speaks a thousand words

- As for primary school, miscellaneous fees are also below $10 a month for a Singapore citizen. $100 a month should be enough to cover stationery, books and uniform expenses easily.

Based on the subsidy calculator found on Early Childhood Development Agency website

Transport ($200)

- Assuming each public transport round-trip is around $4, we would be able to take a combined 50 trips in a month. Our child could also get a train concession pass for just $26.50 in secondary school

- Otherwise, just walk. For example, just yesterday evening, I walked about 20 minutes to the Punggol Hawker Centre to takeaway a few packets of mixed veg rice. Very pleasant walk in the chilly weather

Insurance ($200)

- $200 is should cover basic Medishield premiums and some term plans. Beyond hospitalisation insurance, I believe in self-insuring whenever feasible

Travel ($300)

- This budget would probably restrict the three of us to cheaper flights and trips within Southeast Asia. Maybe a road trip to Malaysia and two other vacations to other neighbouring countries

- Yes, you definitely miss out on some experiences but even within SEA, I doubt I can ever finish travelling meaningfully throughout the entire region

- Isn’t it odd that North Americans like to come to SEA while some of us over here dream of going to the Caribbean region? Exoticness appeals, but often at the expense of wallets

Parents Allowance ($200)

- As long as my in-laws have more wealth than us, we are ok with contributing 10% of our income as an allowance, no matter how low the income is

Miscellaneous ($250)

- For anything else I might have missed out on. Maybe some shopping and gifting

- Otherwise, any balance can go towards food, travel or just become pure savings

Total expenses in a month: $2500

This translates nicely into $30,000 as annual expenses for the household.

Funding The Expenses

Active Annual Income ($18,000)

- Either one person works and earns $1,500 a month or just $750 each. If we can command at least $30 an hour, that is a maximum of 50 hours of labour in a month

- As a self-employed, we can either continue being tutors but take way fewer lessons than now, or if a car is needed, work as a part-time Grab driver

- Otherwise, industries like retail, sales, hospitality and education could interest us. Becoming a tour guide, staffing an NTUC supermarket or working in the library all have its own appeal

- Basically, unless our health does not hold up, I am confident we can still command a decent wage working minimal hours till our sixties at the very least.

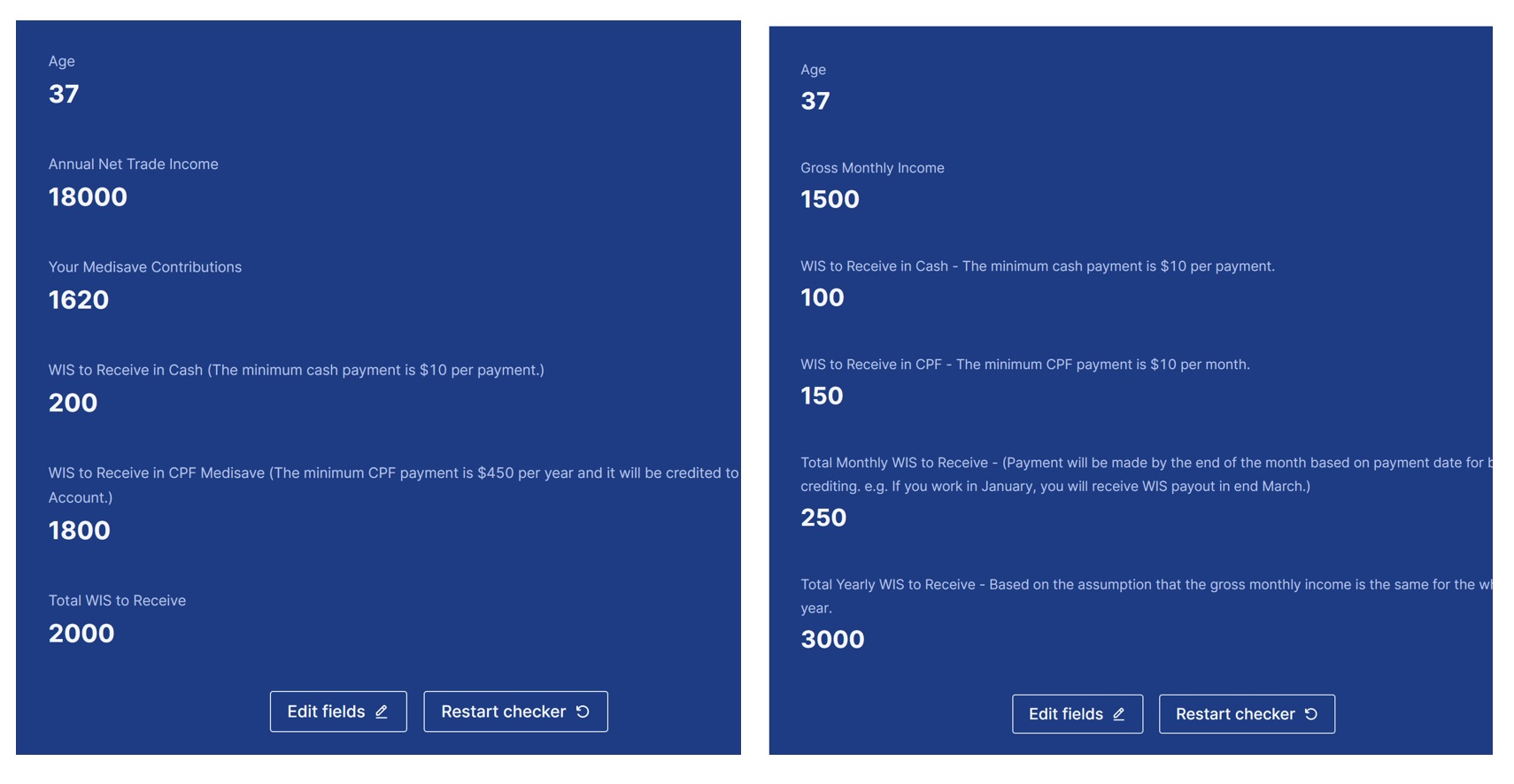

- In Singapore, it is important to earn. Even earning $1,500 each a month is great since the SG government has a slew schemes and incentives to encourage people to work. For instance, Workfare and Childcare subsidy for working mothers are two of the major polices that come to mind

Workfare payouts for self-employed vs employee. Numbers are computed using the WIS calculator. WIS received could be up to an additional 20% of total annual income.

Since this is not the main focus of this article, if you are interested in the full details of what schemes you can qualify for if you Barista FIRE and see your income more than halved, do check out this post by Turtle Investor. I believe he is already starting to transition into this lifestyle whereas this post is just a theoretical daydream.

Passive Annual Income ($12,000)

Despite many naysayers, I am still optimistic with regards to the 4% retirement rule so setting aside 25x expenses should suffice. So that is $300,000. But we shall err on the cautious and apply a 3% rule, to make sure we can easily respawn to this point in a worst case scenario.

To be able to drawdown $12,000 annually from a total investment sum of $400,000 indefinitely, a balance would still need to be achieved since the investments have to be obviously safe and stable (obviously no crypto) yet still be able to grow and keep pace with inflation.

Not one to overcomplicate things, the intention would be to implement a 60/40 portfolio, allocating 60% in risk assets like stocks, ETFs and REITs and 40% in low volatility bonds and cash.

Allocating $240,000 in Stocks, ETFs and REITs:

- Stocks: $60,000 split between DBS and UOB (4% yield = $2400)

- ETFs: $90,000 split among CHIS, USMV and VDC (1% yield = $900)

- REITs: $90,000 split among Ascendas, MIT and FCT (5% yield = $4,500)

Allocating $160,000 In Bonds and Cash:

- $100,000 in UOB One (5% yield = $5,000)

- $60,000 in SSBs (3% yield = $1,800)

Total yield = $14,600

8 different counters and just 2 places to park liquid SGD should keep things relatively diversified yet still simple enough for the Mrs to implement it. The odds of 1 of them collapsing is very low and for all of them to go to zero would be a true black swan.

And yes, if I am able to squeeze out a yield of $14,600 out of them, then there is no need to draw down on the principal to fund the $12,000 of expenses. But well, I do acknowledge that we are currently in a high interest rate environment and the rates, especially on cash, will likely drop in the medium term.

Caveat: This is not my portfolio and I do not own all of the stocks, ETFs or REITs mentioned above. It is what I would do if I had to quickly allocated $400,000 today. However, there is an argument that if this is what I truly believe in, it makes sense to disregard sunk costs, liquidate other positions and allocate like the above. Serious point to ponder over.

What Is The Point Of Such A Lifestyle

I can already imagine some of your shaking your head at this point and wondering what is the point of squirreling aside $400,000 to live such a spartan lifestyle, and at the same time “milking” government benefits. To be honest, I am 99% confident that we will be able to spend much more than $2,500 a month eventually when the time comes.

I guess besides trying different jobs and leading a very different kind of life, the main perk is freeing up your calendar and living what I would call a poor aristocrat lifestyle. A lot of time and mental space to pursue whatever hobbies you have, whether it is writing a financial blog like this, shitposting on Twitter, painting, gardening, hiking or reading.

And it should be obvious that I would very much prefer such a life as compared to that of a middle manager, especially when I enter my forties. The very essence of daily life would also be much more similar to that of a retired multimillionaire, of course minus alot of the creature comforts and luxury of modern life.

If some of those upgrades are very desirable to the Mrs or me (like travelling beyond SEA or a bigger flat), then we would have to set aside additional funds for a more advanced respawn point. That will be material for another post.

Thank you for reading through a 2,000 word post. This was a fun post to prepare and write and perhaps it could inspire you to think about where you could respawn too and bring more clarity to your financial goals.

If you enjoyed this article or found it useful, do subscribe to my blog via email to receive notifications of new posts.

Do follow me on social media for updates too!

Thanks for the support!

Personally, I am irritated by ads and pop-ups so I do not use any of them on this blog too.

Hello 15HWW,

I don’t scold people OK?

I just poke them.

Awkward silence.

LOL!

Glad to see you having fun!

Harlow 15HWW,

How much free time you have per week?

Best regards,

J

This is very good sharing

thanks for sharing!