Genesis

The 15HWW Permanent Portfolio was built during late 2016 with a capital of around $140,000 and I started tracking it from Jan 2017.

The aim of a permanent portfolio is to create a liquid portfolio with low volatility and a respectable return. A comparative benchmark is the CPF SA return of 4%.

To keep the portfolio as simple as possible, there is neither rebalancing nor injection of funds.

Purpose

Personally, I view many components of this portfolio as a form of emergency fund. For example, the cash and bonds are invested in very liquid and safe instruments and can be sold and cashed out within a matter of days.

Another reason is that by showcasing and regularly updating this humble portfolio, I hope it will inspire confidence in some readers to take some risk, invest and build wealth steadily with a low-effort portfolio.

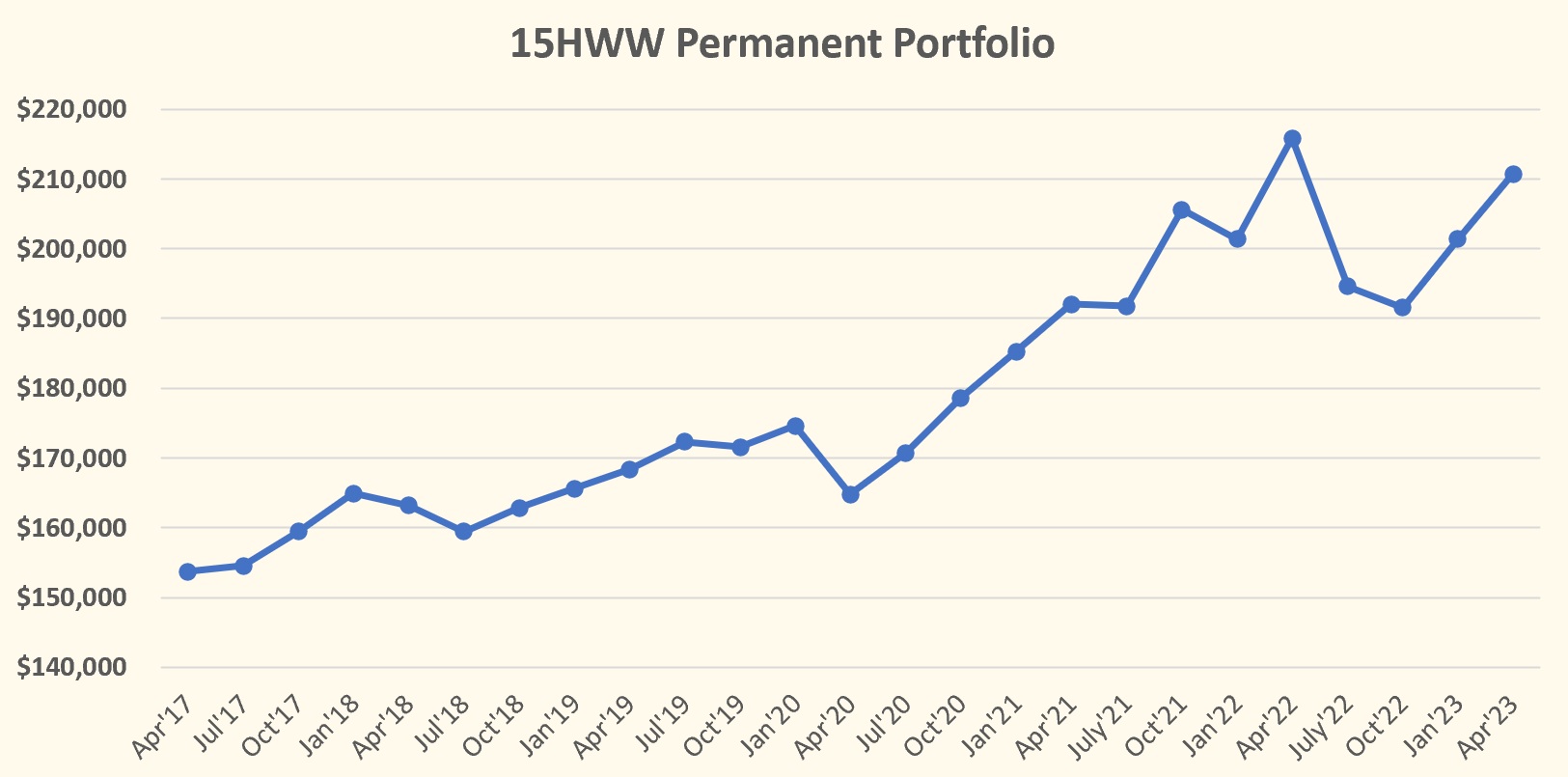

Portfolio Value From Jan 2017 To Apr 2023

April 2023 Update

Annualised Return: 5.5% p.a. (Jan 2017 to Apr 2023)

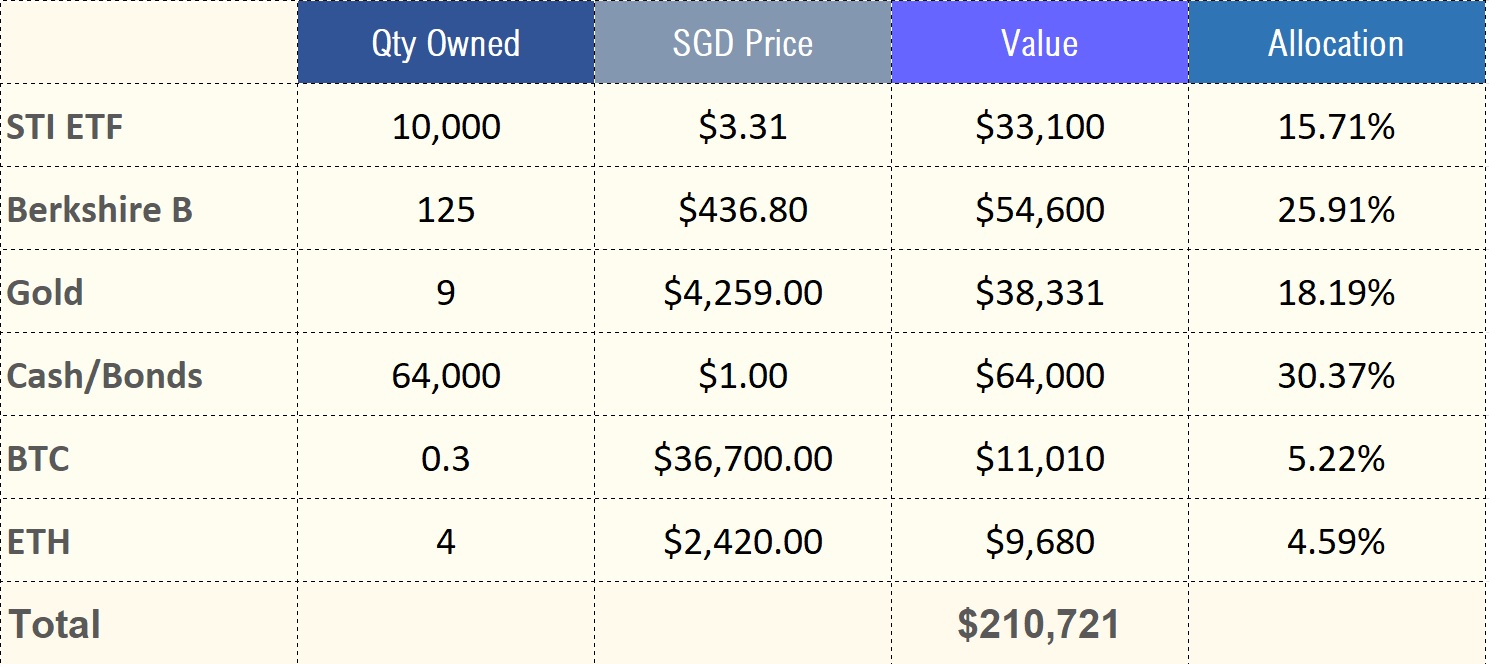

Another great quarter for the 15HWW Permanent Portfolio and at SGD211k, this is the 2nd highest number ever, just falling short of April 2022’s update.

The portfolio is up by SGD9k compared to a quarter ago and more than half of it is contributed by crypto, even though BTC and ETH are such a small and tiny part of the portfolio.

Berkshire B has held fairly well amidst the bearish sentiment and I guess their large cash position in USD treasuries have attracted a fair bit of attention. STI ETF also spit out some dividends to add to the 15HWW Permanent Portfolio’s cash position. Gold has also shown some signs of strength during the US banking crisis about a month ago.

With a good start to the year, the annualised return of 5.5% (since inception) for this portfolio is also back to establishing some gap against the CPF SA risk-free rate of 4%.

It has been exactly 6 years since I first shared this portfolio on the blog and I would say, so far, so good. The performance has slightly exceeded my expectations, considering there is such a large allocation into cash, bonds and gold. Volatility has also been largely muted with only 2 relatively steep declines so far (in early 2020 and early 2022 respectively).

As an investor, if you can stomach some volatility, you stand to be rewarded with higher returns.

Till the next update in three months’ time!

Thank you for reading.

Related Articles:

The 15HWW Permanent Portfolio Update: January 2023

The 15HWW Permanent Portfolio Update: October 2022

Annex: A Brief On The Various Components Of The 15HWW Permanent Portfolio

1. STI ETF (Initial Allocation: 20%)

It comprises the 30 biggest listed companies in Singapore and many of them are dividend-paying. The ETF distributes the dividends semi-annually, in February and August every year.

2. Berkshire B (Initial Allocation: 20%)

The idea is to use Warren Buffett’s holding company to loosely replicate the S&P 500 for US equities exposure. Since foreigners investing in US stocks are taxed on dividends, it is an advantage that Berkshire B does not pay any dividends.

3. Gold (Initial Allocation: 20%)

I used to hold some paper gold but have since converted them to physical gold. The portfolio consists of 9 pieces of 50g PAMP Gold Bar bought from UOB Bank. They are fairly liquid since they can be sold back to UOB Bank at a small spread. You can also check the prices here.

4. Cash/Bonds (Initial Allocation: 30%)

The majority is invested in Astrea Bonds and Singapore Saving Bonds (SSBs) which are very liquid in nature. Astrea Bonds are traded on the market while SSBs can be redeemed at par value, usually in a week or two’s time.

5. Bitcoin (Initial Allocation: 5%)

Added in 2021 to diversify away from cash and gold as a store of value. As many centralised crypto exchanges have abused users’ trust in them, my bitcoin is now stored in a cold wallet.

6.. Ether (Initial Allocation: 5%)

Added in 2022 since I am not a Bitcoin Maxi. As many centralised crypto exchanges have abused users’ trust in them, all my ether is staked on-chain.

You used to give the total value of your other portfolio previously eg:

https://www.my15hourworkweek.com/2018/09/18/portfolio-update-september-2018/

No, you only give the percentage composition. What is the current value of the other portfolio? I’m trying to see how your portfolio has evolved over time in terms of total value.

Thanks 👌🏻

Thanks for sharing, good stuff