This is a theoretical exercise, since I do not have $1m in liquid assets right now and I am also not looking to retire anytime soon.

However, by the time I turn 50, it would be good to have $1m or even $2m to supplement whatever active income the household is still making. So these two portfolios that I built below will also be a good dry run to see if the Dividends or ETF way is more suitable when the time comes to actually implement them.

Here are some of the assumptions/parameters that I have used:

- 80/20 portfolio built for someone who just turned 50

- 3.5% initial withdrawal rate. $35k in May each year set aside for expenses.

- Withdrawal amount will increase by 10% every 3 years to account for inflation

- $200k in CPF accounts that will be partially liquid at 55/65 years old respectively

- Fully paid-off home

Personally, I do believe age 50 is still a relatively young age to retire. One could possibly still look like Chuando Tan! At this juncture, I also do not think markets are overvalued, especially the Chinese market. So I am prepared to be more aggressive and settle on a 80/20 portfolio.

Intuitively, 3% withdrawal rate seems too low while 4% appears risky, so I have taken the middle ground here. $35k a year also translates to $3k a month. If there is a partner who also has a $1m portfolio, $6k for a couple should enable a comfortable middle-class lifestyle. If it’s just $3k, still doable but maybe need to be abit more frugal.

Maybe playing cheat here but I have assumed that $35k has already been set aside for expenses till May 2024. Well, it’s just simpler to title this post $1m instead of $1.035m? Also, to account for inflation, every 3 years, the withdrawal amount will increase by 10%. So for the May 2026 update, $38,500 will be withdrawn and on the May 2029 update, $42,350 will be set aside annually for expenses.

If you think a 80/20 portfolio is very aggressive, take note that I have assumed that at age 50, I should have $200k in CPF balances. If this amount is included for a $1.2m portfolio (playing cheat again), the allocation would be a much more balanced 65/35. CPF Life is also the “safety net” in case this $1m portfolio runs out before I die.

And of course, the last safety net would be to sell the home that I own or participate in the Lease Buyback Scheme. That is if all else fails. And well, there is always the option of performing more work to earn an active income.

With the preamble out of the way, let’s take a look at the two portfolios.

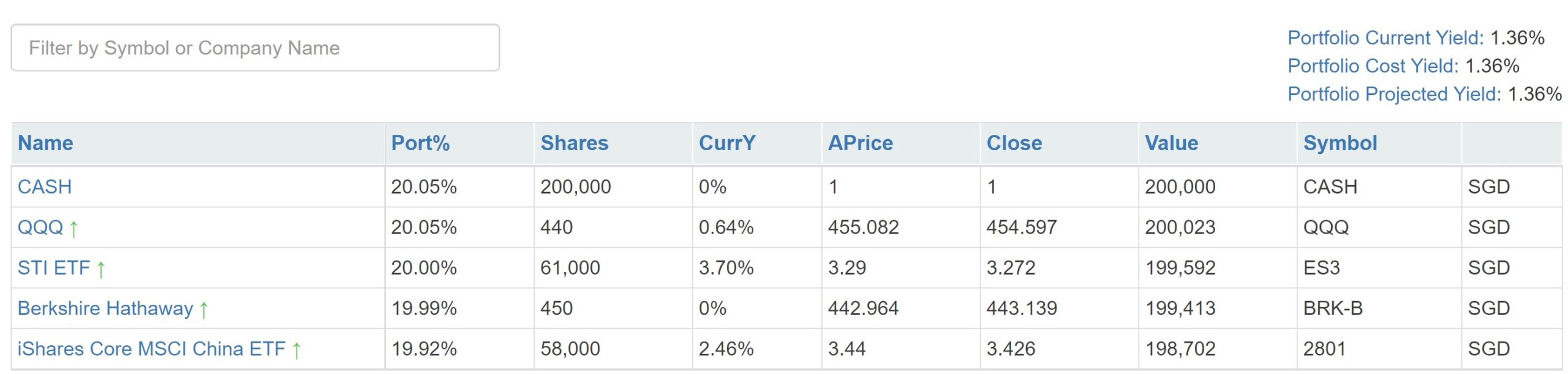

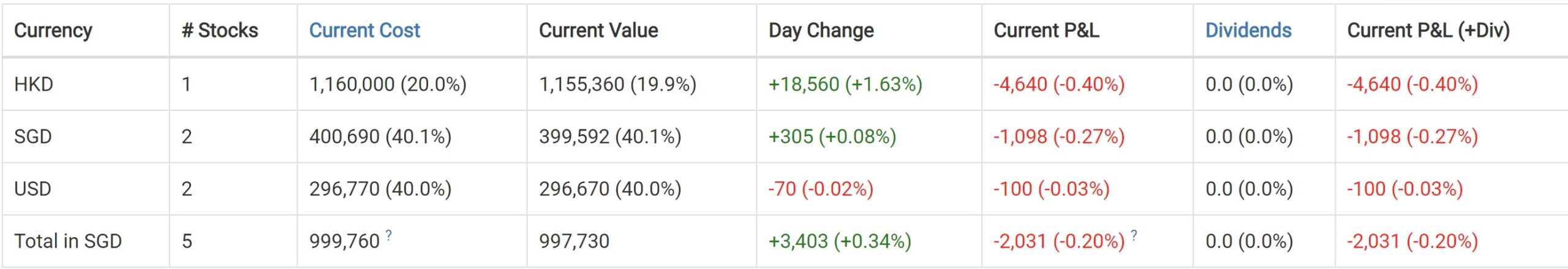

$1 Million ETF Portfolio

Broadly, you can see it as 20% SGD Cash, 40% to US Equities, 25% to Singapore equities and 25% to China equities. 5 positions so it is simple to monitor and keep track of every quarter.

Not touching European or other emerging markets as long-term, I am very bearish on them.

A note on Berk B. I think it is more than reasonable to replace it with a S&P 500 index. The advantage of Berk B is no dividend withdrawal tax (whether it is 30% or 15%) but Berk B is increasingly becoming just a bet on Apple these days. Even if we include Berkshire’s cash holdings, they are 1/3 invested in Apple.

Quite sure the dividends every year will not add up to $35k so during May every year, some of these counters will have to be sold to generate the funds for annual expenses. That is also when we might perform a little bit of rebalancing.

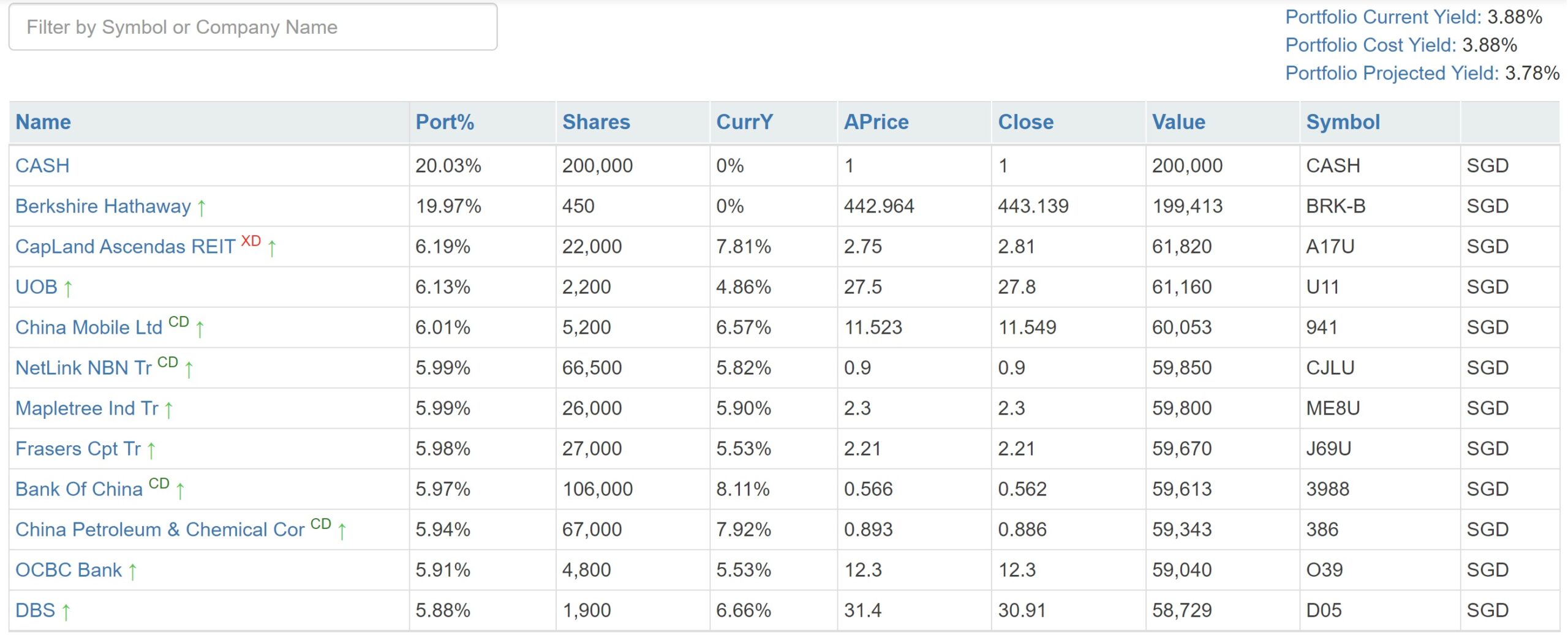

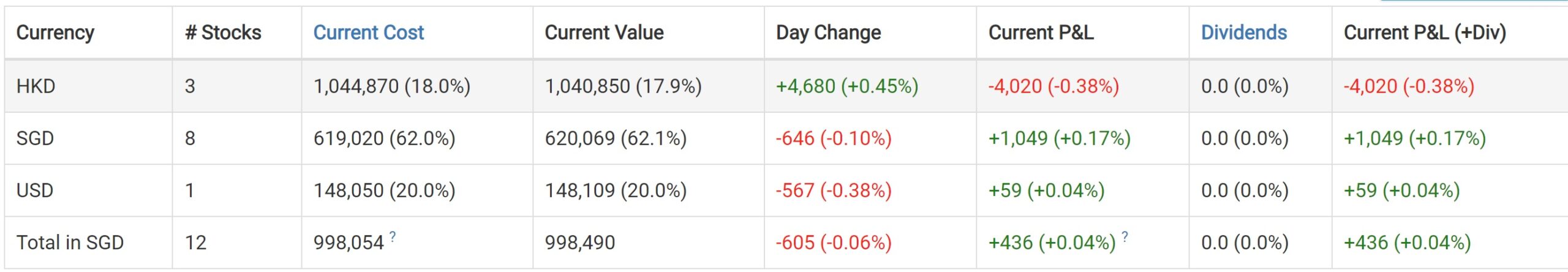

$1 Million Dividend Portfolio

Even though Berk B does not give dividends, the sage of Omaha loves investing in companies that generate lots of cash flow. To realise the “dividends”, you just have to sell some of the stocks every year.

However, that might not be necessary as I believe that the interest from the 20% allocated to cash and the other 60% allocated to dividend stocks should generate enough moolah to fund annual expenses.

Here, we included 7 SG dividend stocks and 3 China ones that are listed on HKEX. The Chinese ones come with a 10% dividend tax. Not great, but still tolerable. For a local dividend investor, SG stocks remain attractive due to tax policies.

Vested heavily in banks and REITs and this portfolio will definitely require closer monitoring than the ETF one. To be fairer, any decision to divest will be made at the point of each update. Especially since all these are theoretical.

Conclusion

If you find the above useful, do use it as a reference but do not blindly copy everything! After all, it’s all theoretical even though I do hold a majority of the counters that are mentioned above.

And definitely welcome any feedback, especially if you think I made major errors or blindspots in the portfolios.

I aim to update these portfolios once a quarter. The next update will be on Aug 2023. Till then. We shall see if these portfolios can thrive for the next 3 to 4 decades.

Hi 15HWW,

Dividend income is one of our income source (or tap) that we built up and is still a work in progress. After monitoring the dividends received for over 12 years, these are the observations or lessons learnt if you will:

1. Dividend income is directly dependent on your invested capital. If you have $1M capital and the ROI is 5%, then your dividend income would be $50K a year.

2. Both dividends and the underlying stock are at risks to market condition and performance of the business. You can expect to see the dividends get reduce / stopped and the stock value decimated in a crisis or when the business fails. And sometimes they dont recover.

3. Timing the stock purchase is as important if not more, as time in holding the stocks. We were “lucky” we bought the banks stocks when they were “unloved”. Conversely we had also bought duds.

4. Diversification thins out your capital, lowers the returns from good stocks but reduces volatility in your stocks value and dividends received.

5. Dividends received can vary widely year to year so it is difficult to plan a lifestyle based on dividends alone unless you have a big buffer (eg., like AK71 whose dividend income is above $200K yearly while expenses are below $60K?). Or have other sources of income.

6. Dividend payout by S’pore listed stocks are mainly in May & August, while some do pay in other months and at various frequency (eg., quarterly, twice yearly or annually)

7. High dividend yield can be a red flag. So study the business sustainability properly before buying those stocks.

8. Dividend investing in not entirely passive and needs monitoring to weed out rotten performers.

We have learnt not to depend on dividend income to fund our lifestyle primarily due to its unstable and unreliable nature. We are still keeping this source of income as part of our diversified portfolio and treated as a bonus income tap. Good to have but can do without.

We have also taken steps to address the volatility of the income and to make sure we can always receive some income from this tap.

I have shared the steps here : https://t.me/CPF_Tree/1854

Hi, for starter age 44, what is the best approached as starter late and losses in 2022 period due to USA equity on growth stock after attended course from growth stock investor -GIM or super stock. Should I consider except loses and move on with dividends stock? Getting pissed and really don’t know what is the better approache now.

1 point to note, Apple is not 1/3 of Berkshire. Its only 1/3 of the investment portfolio of Berkshire. BRK of course owns many private operating businesses including a huge insurance company (geico), railroad (bnsf) and utilities (berkshire energy). However, wont disagree with your opinion of s&p indexing, i would suggest 100% to s&p instead of your split of sg, china etc.