I shared my theoretical SGD1m retirement portfolio a month ago and whether it was the dividend stocks portfolio or the ETF version, I decided to set aside an equal SGD200,000 as cash.

Having received some emails asking me how I would allocate this amount of money among deposits, SSBs or T-bills, I thought it might be useful to provide a quarterly update on where I would park SGD200,000 on this blog.

So here are some quick thoughts on where I would deposit the cash.

SGD100,000 in UOB One Account (~5% p.a)

There is a SGD100,000 cap for the UOB One Account, otherwise I would be tempted to just dump the entire SGD200,000 inside. The first SGD75,000 is also guaranteed by the government although counterparty risk for UOB deposits should not keep anyone awake at night.

Only two requirements, credit >$1599 salary and spend $500 on a UOB credit card, which are really easy to fulfil. There are also ways to get around it (google online?) if you find the above criteria hard.

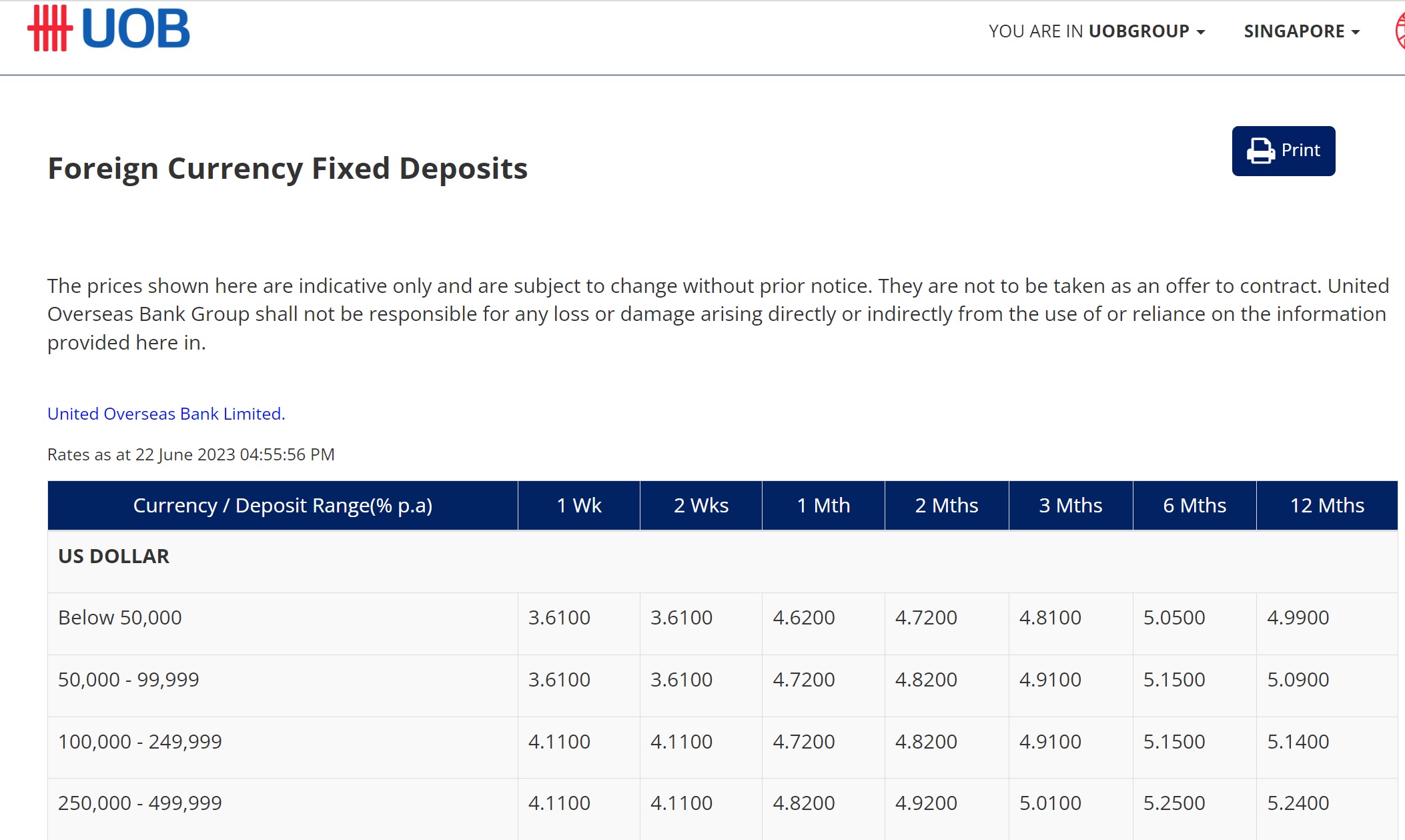

USD 50,000 in UOB 6-Month Fixed Deposit (~5.15% p.a)

If you are a bullish on USD being the reserve currency for both the short and medium term, USD fixed deposits with a SG bank might be appealing. USD 50,000 is not really that big an amount, so I really do not think it is worth it to attempt to buy the US T-bills directly.

As mentioned above, holding extra counterparty risk with UOB does not raise alarms for me.

SGD33,000 in Money Owl WiseSaver (~4% p.a)

MoneyOwl is an NTUC Social Enterprise so the risk of them folding and running away with your funds should be negligible. When you open a WiseSaver account with MoneyOwl, your deposits are invested in the Fullerton SGD Cash Fund. I see it as similar to a money market fund that holds most of its assets in Singapore deposits. This fund is also managed by Fullerton Fund Management, a subsidiary of Temasek.

The yield has hovered at around 4% for the past 6 months and there is the flexibility to withdraw anytime unlike a T-bill or fixed deposit.

If you need more information before signing up, you can also check out these two articles from Investment Moats and Turtle Investor.

Other Worthy Options

Singapore Saving Bonds (SSBs) come to mind and issues are worth a look if the 10 year yield is above 3.2%. Great hedge when you think rates are coming down and you still want to keep that certain amount in cash.

Otherwise there is always the option of both SGD and USD T-bills in this high interest rate environment.

Conclusion

In case it is not obvious, I would never claim that this is the “best” way for anyone. Firstly, some people will claim that one should not have so much spare cash on the side, while others will think 200k is peanuts (Fixed Deposits and T-bills have no cap). And then for instance, some might think it is a hassle to have three separate accounts while others might think I am not diversifying enough.

Nonetheless, what I have suggested above is very similar to what I am doing in real life too, in case you are wondering.

If there is any compelling alternative or long-term promotions that are worth making an effort to further optimise my cash, do drop a comment! Will really appreciate it.

Thank you for reading.

One Reply to “Where To Park $200,000 Of Cash? June 2023 Update”