The market has been a big giant scam during the past decade, especially to value investors primarily focused on the Singapore or Hong Kong/China markets.

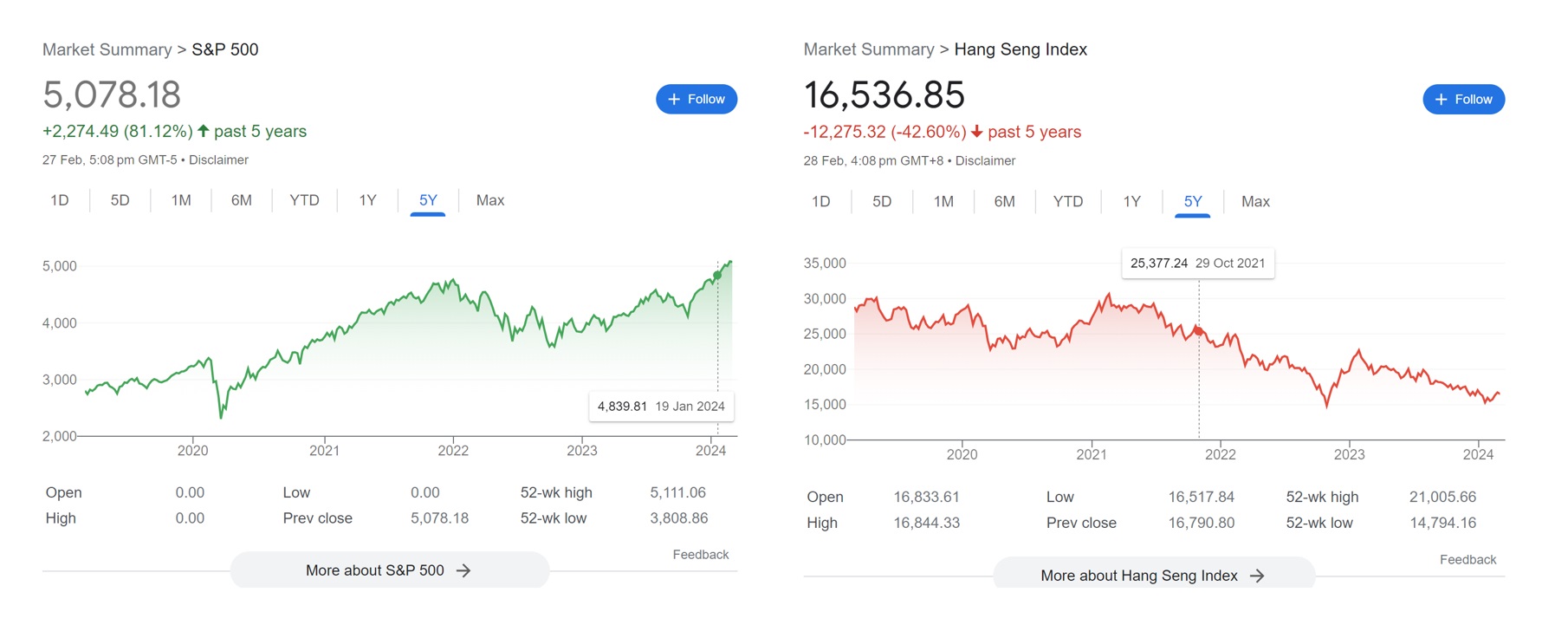

I mean, how can the overvalued S&P 500 be up 80% while the Hang Seng with an already low P/E continues to tank by another 40% during the past 5 years?!

The market is wrong and it is only a matter of time before the market reverses, proving that US index investors have no idea what they are doing.

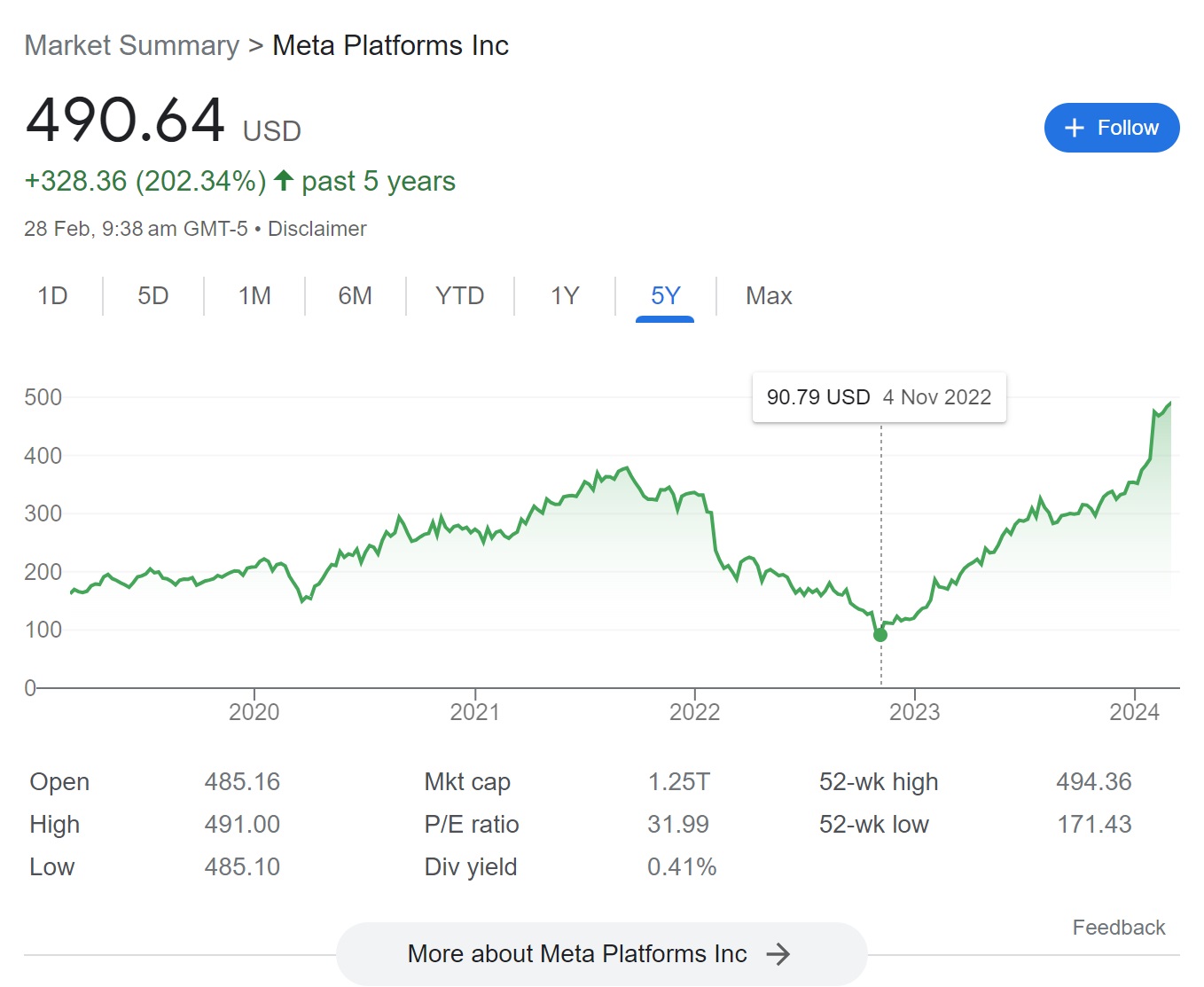

The next chart would probably make people even angrier. Afterall, 1.5 years ago in Nov 2023, wasn’t the consensus that Facebook was “dying”?

Apple dealt them a hammer blow and Facebook was also losing ground to TikTok. Facebook and Meta was so over and if you were a shareholder, you were supposed to be running for the exit. And then…… this happened.

How can a company that held a massive retrenchment exercise be up 5x in such a short space of time?! This is simply not right and setting a very bad precedent for society. Tsk tsk……

What a scam!

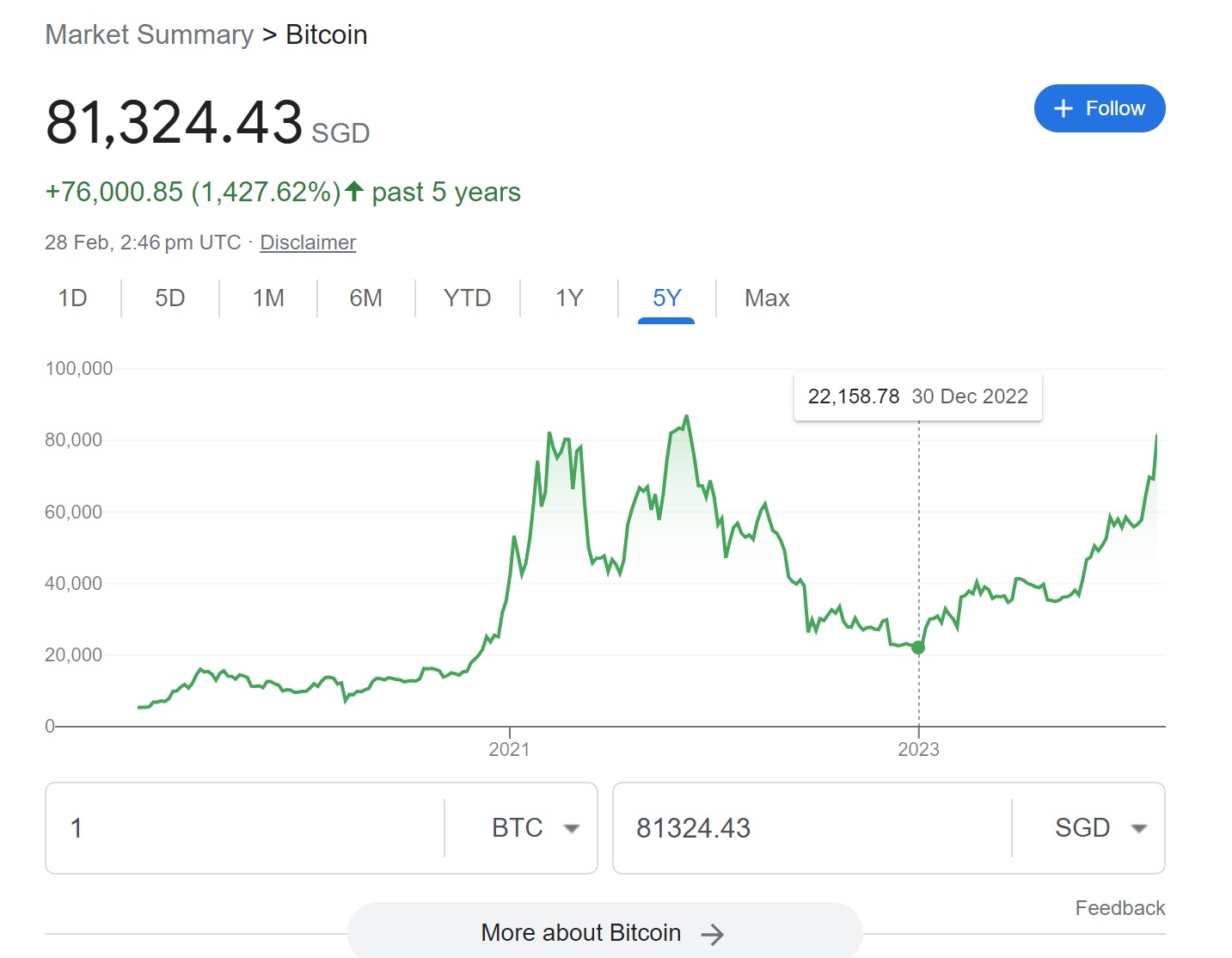

In case you are wondering, I have saved the best for the last, the biggest scam of all, Bitcoin and cryptocurrencies. This should set many people’s blood boiling.

Crypto is supposed to be “dead” after the collapse of Luna and FTX. How can $BTC, this rat poison be near its all-time high again within such a short space of time?

Perhaps we should not let our anger get the better of us. The next crypto crash is just around the corner and we shall see the tears of these crypto bros once again. Gold is already bad enough as an unproductive asset, what more “digital gold”.

The only use cases I can think of for crypto are criminal activities, rich folks who do not want to split all their assets with their estranged ex-spouse. And maybe the degenerates who wanna gamble, which interestingly, could include those that are recently retrenched.

With such a small market fit, surely there is simply not enough demand to sustain the ridiculous price of this rat poison, right?

Thanks for reading!

Hi, I have also wondered many of the same things 🙂

As I have about 15% of my portfolio in HK/Greater China, I also feel the pain. Nevertheless, valuations appear reasonable so I use FSM to RSP a small amount of ETF each month. Prices can be affected by legal/geopolitcal risk so one cannot say that the market is priced wrongly (eg: could be pricing in a war, for example).

However, I also have learnt my lesson not to underestimate the S&P500 so at the start of the year I have already bought about $20k of World and US ETFs because I believe that 2024 will be a green year for S&P500 and MSCI World, but maybe only single digit gain.

If S&P500 continues to climb, I will find it psychologically more difficult to buy more, thats why I’m thinking I should do my buying for US market now, and later on, start looking elsewhere, like certain SG REITs 🙂

I’ve never commented on your posts before.. but you woke up and chose vengeance! Haha! I’m with you on crypto btw. No need post so much about it this time. Let’s just wait for end 2025 to do 1 proper solid post. Cheers.

Hit me up in X if you’re there too. Connecting more regularly with Turtle and SideHustle these days.

You have to tie your charts to a fundamental valuation ratio.

EPS earnings growth has been strong for S & P 500 – with the technology companies leading the way. Likewise with META their share price increase coincided with a huge resurgence in their ad business.

Contrast this to the HSI – earnings have been frankly stagnated over the last few years. Adding in the Chinese tech giants looked like a right move at first… but the tech clampdown (along with other clampdowns) had a major impact on their businesses and earnings.

Not to mention the raging property crisis that has already brought down most of the private property sector.

Even in Singapore, other than the banks, the results of most local GLCs and property firms have pretty much gone nowhere.

I like this post hahahaha.

It sure is testing our patience (since a significant portion of my portfolio is vested in HK stocks). However, have to accept many things in life is out of my control, what I control is how I deal with it. Would I add more solid US stocks now? No. Would I add more solid HK stocks now – more likely.