About a few weeks ago, I decided to take an evening jog to Punggol East and indulge myself in some Popeye’s chicken after the run.…

Tag: risk averse

Variations of this piece of news flooded my Facebook Feed last night. Coincidentally, I am halfway through Taleb’s latest book: Skin In The Game and…

Raising Of Premiums When I heard this piece of news that meant all insurers were effectively raising the premiums of their Integrated Shield Plans (IPs), I…

It’s been some time (close to 3 years) since I last reviewed our insurance policies. Truth be told, I was going to review it only…

I first got to know about the idea of crowdfunding a few years ago after stumbling on this article at Mr Money Mustache (MMM). Looking…

If you have not read Part I, please do so for a more complete understanding of what this post on my guiding principles is all…

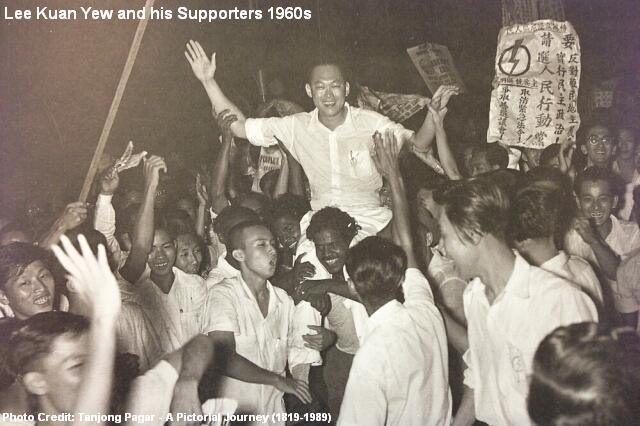

Since a few months back, I have been quietly revealing to some friends that I actually anticipated a 70% popular vote share for the ruling…

So the details of the 1st tranche of the Singapore Savings Bonds were announced yesterday. Basically, if you hold the bonds for the full duration of…

This week’s articles and my reflections on them are detailed below. And as usual, any feedback would be warmly welcomed. (To understand the genesis behind this weekly…

To understand the genesis behind this weekly series, click here. ==================== The Market Is Crashing! What Should You Do? As I am writing this article, the Straits Times Index has dipped below the critical 3,000 mark. The market has dropped close to 20% even though a high of 3540 was achieved as recent as April 2015. Honestly, I feel the pain. With a $200,000 portfolio, it does hurt to see the value decrease by $1-$2k almost on a daily basis for the past couple of weeks. But it really doesn’t make sense to “Buy High, Sell Low” right? In these times, instead of allowing ourselves to become emotional and sell everything to stop the pain, one should try to access his/her rational mind. Yes, I am…